@Michael_Haas how do I LOL this!

Hi @David_Bagdy according to you and @David_Bagdy this trend of euro lumber demand will continue … @Andrey_Tikhomirov how are the Russian mills adapting the tariffs and sanctions in Europe?

Hello!

To be honest, I was surprised to hear @David_Stallcop said that Europe is running out of wood. According to my good friend from Latvia, they have enough stock of wood until winter due to low demand in France, Germany and the UK. It was also very interesting to find out about schemes for delivering wood to the USA in order to pay less duty. Thank you @David_Bagdy! This reminds me of the emerging way of selling Kazakh and Armenian lumber to Europe. Probably everyone has heard about Kazakhstan and Armenia as states with wild forests where no human has set foot and with a developed timber processing industry.  If you haven’t heard of this, it’s time to pick up textbooks and telephone directories.

If you haven’t heard of this, it’s time to pick up textbooks and telephone directories.

Everyone understands everything, but temporarily turn a blind eye to it.

The Russian sawn timber market is going through hard times now, especially the northwestern region of Russia. The state continues to support exporters. Companies can receive compensation for transportation costs to the Russian border. Compensation can reach up to $50,000. For large companies, this is “a drop in the ocean”, but for small mills, this is a good opportunity to “hold pants”. Also there are other measures to support manufacturers.

With the ban on exports to Europe, logistics and tariff problems in the US, payment problems in Egypt, and persistent requests from the Russian government, manufacturers are forcing manufacturers to turn to the East, and to the South. Of course China is the main market.

As for prices. Prices continue decreasing. For each client there is a struggle, like for the heart of a princess at a jousting tournament. The buyer has become more demanding on the quality of the goods, and if earlier they bought everything they can find even low-quality goods, now they want the best goods at the price of firewood.

Lumber production is down, the price of lumber is down, the price of sawlogs is down. Many companies still cannot sell sawlogs harvested last winter, but the next harvesting season is already visible ahead. Winter Is Coming and this is both a good opportunity and a kind of Russian roulette for companies.

Sorry for the possible confusion in the answer.

@Andrey_Tikhomirov I was talking about the European lumber supply on the ground in the US in my original comments. Not the Russian lumber supply in Europe.

Andrey- Thanks for the information. Keep us posted as to changes on the horizon.

Demand for Euro lumber, boards and dimension, will remain steady as we coast through the dog days of summer. Stronger demand is in sight as September approaches.

@David_Stallcop I am sorry, I missed that you said about the American market.  Sorry again.

Sorry again.

Does this mean that we should expect an increase in demand for European sawnwood in the US and, as a result, an increase in lumber prices in Europe?

Will local mills in the US and Canada be able to supply enough wood to reduce the pressure on the European market?

@David_Bagdy I will!

It seems to me that there will be serious changes in the Russian market soon. Good or bad - time will tell.

Boom! That’s a sharp uptick. Are you seeing strong demand heading into September along the lines of what @David_Bagdy is seeing?

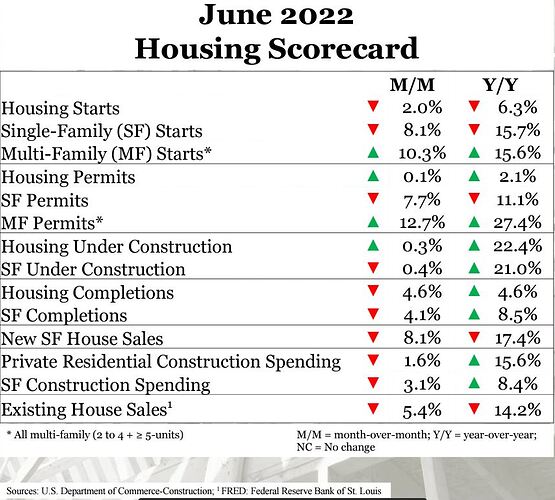

@Andrey_Tikhomirov with interest rates nearly doubling in the US from 2.75% a year ago to close to 5.5% today for a 30 year mortgage, we are seeing a lot of single family home buyers getting priced out of the market. This is causing the single family housing starts to drop and multi family housing starts to increase. More people are going to be renting moving forward until either housing prices start dropping or interest rates lower again. An average size single family house uses roughly 21m3 of lumber whereas a multi family house uses only 7m3 of lumber. So, overall I see construction lumber demand dropping. Canadian mills are curtailing production and that will keep the US market in balance. I don’t see a huge increase in demand for the rest of this year. I do see a seasonal jump in demand in September as we get out of the hot dog days of summer. It is just too hot in most southern states to frame up homes in the summer months.

I just received information that a Russian company is exporting fuel pellets as cat litter to avoid an import ban in Europe.

omg @Andrey_Tikhomirov – ingenious tariff avoiding!!! Obviously necessity is the mother of invention and people are applying it in this case …

Have you heard of anyone getting nailed for this yet? Like we see in @Leo_Spunt’s post? For every tariff and restriction, we hear about some work around. In some cases the legality is a gray tightrope. In other cases, it is funny to hear what people try to do and get away with.

Maybe it’s legal because pellets can be used as cat litter. Especially if you pack them in bags with a picture of cat.

To be honest, it is much easier to use intermediary companies, for example in Turkey. Passing through Turkish customs, Russian pellets turn into Turkish ones. At the moment it is profitable because of the prices for pellets in Europe.

These loopholes are crazy. Do you think we are going to see an ever increasing amount of tariffs and restrictions? Is there an end in sight? or is the era of open markets and free trade over?

#MakeFreeTradeCoolAgain

Trade relations between Russia and The USA will return to normal, the question is when. “Protectionist” trade policies fail miserably, undoubtedly at the expense of the consumer. It seems we have to learn this lesson over and over again.

Golden words @David_Bagdy !

Did you see the 200% tariffs on Vietnamese plywood in @David_Stallcop’s article?

I did read this. Great post by David Stallcop, as always. It is concerning. “It’s great for US domestic producers” always makes me nervous. Translation “be prepared for higher prices and lesser quality.”