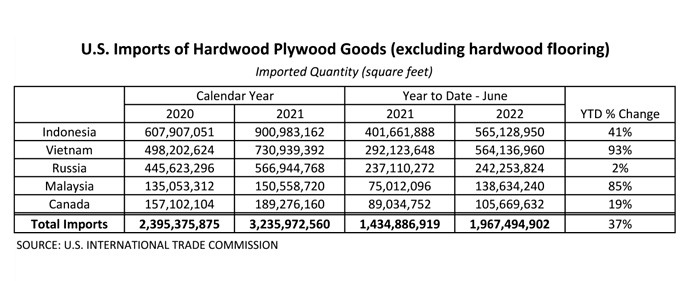

Imports of hardwood plywood from Vietnam are up 93% year to date and now the Department of Commerce is going to hit most of those imports with tariffs as high as 200%. Vietnamese plywood producers were taking Chinese plywood as a sub straight which has an anti-dumping duty on it and adding a different face and back veneer to circumvent the duty. This is great news for US domestic hardwood plywood producers, but not great news for cabinet manufacturers who relied on import hardwood plywood to stay competitive against import ready to assemble cabinet kits.

Great article @David_Stallcop which relates to @Leo_Spunt 's post from the day before on the same topic:

I’m a bit surprised and impressed the US commerce department has so much bandwidth to investigate and trace the origins in depth as an executive branch. Apparently our tax dollars at work.

Keta Kosman from @Madison_s_Lumber_Rep you had stated that it takes approx 1 year for the Trade Commission to evaluate the Canadian tariffs and come up with their new duty determination. So they have resources to divert to every country US imports from and for thousands of products?

This is only for products that are in a trade dispute, not every product every country!

The process for lumber (I assume it’s the same for other products): the exporting companies must collect sales data the US and report … if they don’t report they will not be allowed to ship wood over the border. This is a cost, they don’t get paid for this.

Then the Commerce Dept aggregates that data and sets the duty rate for the next Administrative Review. That’s why it’s always from the previous 2 years (1 year for the companies to collect and submit, 1 year for Commerce to calculate).

You can see what products are subject to duties on the Federal Register

https://www.federalregister.gov/documents/current

Wow! You are the ultimate expert on this @Madison_s_Lumber_Rep! No wonder the Madison Lumber Reports in the https://forum.pakira.com/c/market-reports/madisons-lumber-reporter/56

are so comprehensive and go to such depth!

So if a company decides to export from the US it needs to report ALL data to the US Trade Commission?!

Secondly, it takes 2 years for the US Commerce Dept to make the determination (after I had thought it was 1 year). Given the huge volatility and market swings, it makes no sense for LBM products and other physical commodities. I would assume it makes sense for other non-wholesale, manufactured, consumer products. So don’t they know the duties are applied today based on a 2 year old market?!

@Madison_s_Lumber_Rep @Michael_Haas @Thomas_Mende @David_Stallcop @william_giguere @Matt_Layman @Jim_Schumacher @David_Bagdy