My view from the retail side.

First, I need to define retail from our perspective. We define retail as any customer that purchases product for its end use. This includes builders, framers, G.C.s, remodelers and consumers. In other words product that will not be resold to another party. This includes builders, framers, G.C.s, remodelers and consumers. Our business is 90% pro and 10% DIY.

Very simple economics, in my opinion. Demand is much greater than supply. This is true for almost every product used on any construction site. Until the demand is reduced, supply has no chance of catching up.

Lots of chatter about starts and permits and pent up demand - all good. The problem is not enough materials or labor to support this demand. If we continue to complete only 75% of what we start, things will begin to fall apart. All the scrambling to find any product to complete the project is not sustainable.

Our customers are more creative today and much more willing to listen to alternatives in trying to find solutions to keep the project moving. Species changes, brand changes, size changes, color changes, feature changes are just a few of the daily problems we are face in providing solutions.

Our industry is cyclical and it has been a good ride up but the downside is inevitable. It is just a matter of when and how far. We believe $800 is sustainable long term. Now just beginning to doubt we can avoid the big runs - both up and down.

I certainly relish any feedback on this.

Thanks,

@David_Hoglund you are a gold mine!

We, here at Pakira, are categorizing the LBM supply chain across it’s company types, various links in the chain, and subsequently the product categories of course. Just this week, we had a team discussion about the category “Retail”. For “Retail”, we group Lumber Yards, Builders, and Dealers together. Why? Because some large builders may be buying from Distributors directly vs from the Lumber Yards. Do you agree?

And we did assume the retail customers to be (I now see correctly!) smaller builders, framers, G.C.s, remodelers and consumers. Next, we need icons for every such “group” in the supply chain as we display the supply chain schematically.

We had a discussion whether to make this last link in the chain, “retail” (Lumber Yards, Builders, and Dealers), get the “shopping cart” icon or the “builder” icon. What do you think @David_Hoglund ?

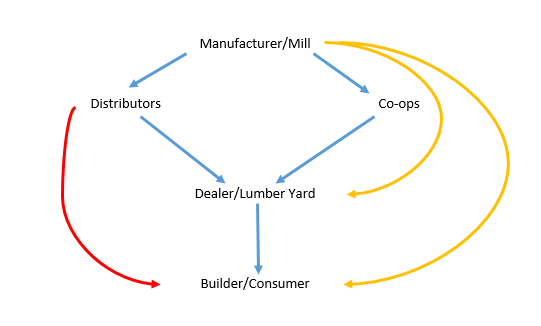

Sorry, I must disagree with you a little on this. Our view is distributors (actually three buckets here - 1 step directly to the builder/consumer, 2 step only sells to the dealer/lumber yard and a hybrid that sells both to the builder/consumer and and dealer/lumber yard), next is the dealer/lumber yard and the final category would be the builder/consumer.

Our view would have the shopping cart assigned to the builder/consumer.

@David_Hoglund this is super helpful and insightful for us to hear. So, granted everyone can buy/sell from/to everyone, if we speak on “typical” terms, you are saying:

*Wholesale = at least 1 truckload

Distributors: buy wholesale from Mills & Manufacturers and sell wholesale to LumberYards/Dealers

LumberYards/Dealers: buy wholesale from Distributors and sell retail to Builders/Consumers

Builders/Consumers: only buy retail and are the end of the line

@Craig_Parker do you agree w/ @David_Hoglund here?

Shall we take out the “Builders” from the LumberYards/Dealers link in the supply chain and move them to the Builders/Consumers as i describe above?

If it were only that simple.

Here is how we see product moving through the chain today. Many more smaller steps that I am leaving out for simplification.

@David_Hoglund when @Nadia sees this she is going to be ecstatic with joy.

When you guys are done I’d love to hear more about your retail perspective on the market. So much to unpack here… but I will be patient…

have already seen it @Andrew_Gibson

am totally ecstatic with joy!

@David_Hoglund thank you! will let you take a breather, as @andrew is pulling you away from the supply chain formulation and into the market dynamics right now.

The missing party, on both topics, remains the elusive @Craig_Parker who we’re waiting to pitch in his view point. But he’s busy shooting the video of waterskiing in his lumber yard in good ole Maine

I’m not sure I understand the question. That, and I’m recovering from working on some architect’s plans – I think his main influence is Picasso. Either that, or he never read the book “Don’t Design Houses and Create Blueprints When You’ve Been Smoking Crack.”

Where is the supply chain you’re talking about, and where are the links? I’m looking for a table of contents or something with LumberYards/Dealers and Builders/Consumers, but not seeing anything.

i will send one over the weekend from the Pakira perspective, which you can feel free to shred. Meanwhile, do you agree w/ the schematic by @David_Hoglund above?

Looks legit.

I think the retail perspective is very important!!

Thank you @Craig_Parker ! @David_Hoglund you seem to be in good company of like-minded lumber professionals! Glad to have you guys on board!

On another note, let’s get to back to @David_Hoglund 's original topic before I inadvertently hijacked the thread. @Craig_Parker @Michael_Haas do you have thoughts on this analysis and perspective?

As a trader it’s easier to be in or out of positions depending on market conditions. As a retailer you don’t have that luxury so be kind to the retailers that support you all the time.

I’m flying blind. I’m setting retail based on current market, always buying what I think I need to get through the next couple of months, losing sleep over whether I’ll be caught holding the bag when things tank.

I believe the guy I usually talk to at my primary lumber vendor is pulling for us to succeed, so he gives me a heads up as soon as he starts hearing price rumors.

i still think the industry is under supplied and lumber price ranges could be from $600-$700/mbf to $1500/mbf. for the next few years.