By Alisa Zevin

Inflation, rising interest rates and a possible global recession continue to top the list of forecasters’ concerns for the coming year.

“The key issue facing the economy now is inflation, [which is] determining its path as we move forward,” says Richard Branch, chief economist at Dodge Construction Network. While he says the Federal Reserve was “a little late to the party,” a reference that it kept interest rates too low despite signs of post-COVID-19 economic recovery, the central bank now is aggressively raising them to reign in further inflation impacts. Should this be successful, Dodge expects rates to steady in the first quarter. “That should allow the economy to stabilize and start to recover in the back half of 2023,” Branch says. His forecast expects the U.S. to avoid a “technical” recession, but in many construction sectors, “it is going to feel recessionary,” he says.

Jay Bowman, a principal of industry management consultant FMI, expresses a similar sentiment. “Old economy” sectors such as hospitality and entertainment are likely to slow in the coming year, he says, while the “new economy”—represented by data centers, manufacturing plants and warehouses—won’t be tied to the overall economic outlook.

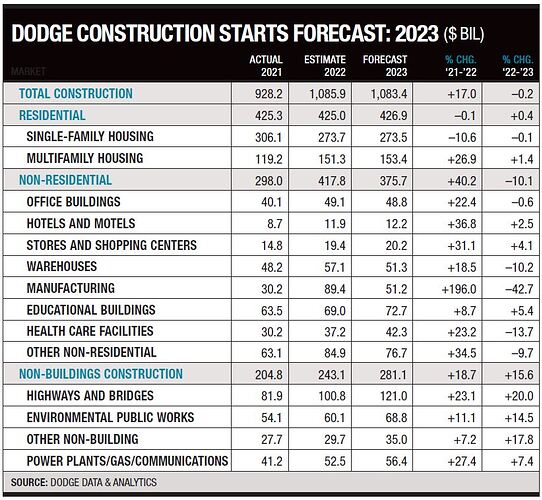

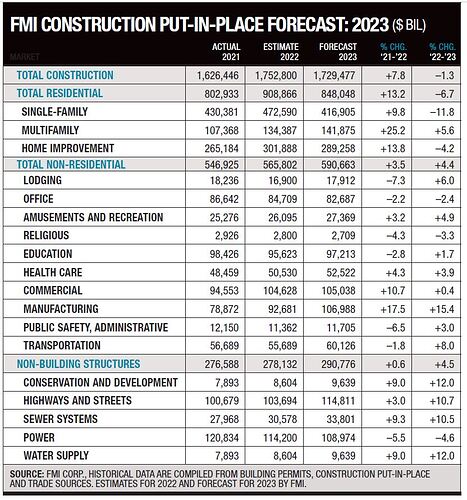

Dodge expects construction starts to reach $1.086 billion by year end, and stay roughly flat in 2023— falling just 0.2% to $1.083 billion. FMI, which forecasts put-in-place construction, estimates a 7.8% total construction hike in 2022, with a 1.3% decline in 2023. “I don’t think this is another great recession,” says Bowman. “I’ll take flat over down any day of the week.”

Residential Starts Decline

After years of strong growth, housing starts are declining, mostly due to higher interest rates. “Activity across different types of construction has been uneven, with single-family housing pulling back under the weight of the increasing interest rates,” says Julian Anderson, president of cost consultant Rider Levett Bucknall. While the overall construction outlook is “mixed,” he says single-family housing will “continue to struggle.”

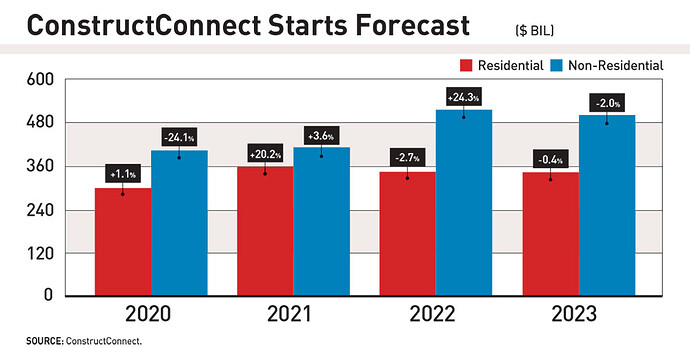

Alex Carrick, chief economist at ConstructConnect, agrees. “The Fed is being aggressive in raising interest rates to slow the economy and fight inflation. First to be affected is the residential component of total construction,” he says. “New or resale home affordability is taking a hit from a more than doubling of mortgage rates. Housing starts have recently set out on a downward path.” ConstructConnect forecasts that residential construction’s total dollar value will decline 2.7% by the end of 2022, with a 0.4% drop next year.

Measuring the total number of residential starts, Dodge forecasts a 0.1% drop in 2022, with a slight increase of 0.4% in 2023. Single-family starts are down 10% through the end of the year, and are expected to fall 0.1% next year, according to Dodge. Multifamily construction had a strong 2022, with a 26.9% increase, but growth is expected to contract to 1.4% next year.

“As the economy starts to slow down, household growth slows down,” Branch points out. The downturn reduces the previously high demand for new multifamily construction, as more people choose to live in family homes, or with roommates, to weather the economic storm.

Manufacturing Leads Non-Residential

But somewhat more favorable trends are seen for non-residential construction, with starts expected to end 2022 up 40.2%, according to Dodge, before dropping 10% next year. The star of this sector is manufacturing—up a whopping 196% in 2022—due to facilities that were once overseas being brought back to the U.S., and new federal development boosts.

The 2022 CHIPS and Science Act, which provides $52.7 billion for semiconductor research and development, manufacturing and workforce expansion, “was a major step toward reinvigorating domestic chip production and innovation for years to come,” John Neuffer, president of the Semiconductor Industry Association, said in a press release following its enactment. “Semiconductor R&D is essential to innovations powering America’s economy, national security, advanced manufacturing and critical supply chains.”

Additionally, the just enacted Inflation Reduction Act, which will allocate $369 billion in funds and tax incentives for green manufacturing and clean energy, will play a large part in the sector increase. While 2023 will see a decline of 42.7% from this year’s peak, according to Dodge, manufacturing sector construction will still be at a “historically high” level of activity, says Branch.

ConstructConnect’s forecast has a similarly strong estimate through the end of 2022, expecting manufacturing to rise 135% from the previous year. “Recent legislation … has also incorporated a strategic bent, with an eye to bringing home jobs from abroad in key industrial sectors, such as computer hardware manufacturing,” says Carrick.