International Paper Acquires DS Smith

At the beginning of the second quarter, International Paper announced its intent to acquire DS Smith. This strategic deal will lead to nearly 90% of the merged company’s revenue coming from sustainable, fiber-based packaging solutions.

The acquisition will lead to the opening of a corrugated packaging firm, making substantial strides in its commitment to sustainability. The combination will create the opportunity to integrate both the companies’ mill and box networks and optimize the supply chains in Europe and the United States. It will leverage the market expertise of two experienced and innovative management teams to enhance innovation in sustainability products for customers.

The merger is expected to drive significant synergies including higher integration, commercial and operational improvements, and economies of scale across sourcing, supply chain, and administration.

Upon completion of the merger, the combined sales of the two companies are projected to yield a pro forma 2023 combined revenue of approximately $28.2 billion along with a combined adjusted EBITDA of approximately $4.1 billion. The merger is also expected to generate substantial pre-tax cash synergies, estimated to be at least $514 million on an annual run-rate basis by the end of the fourth year post-merger.

International Paper’s acquisition of DS Smith could also have rippling effects on market dynamics. This integration is projected to include a significant benefit of 600,000 short tons per year, enhancing the operational efficiency and output of the combined entity.

With DS Smith positioned as a net buyer of paper, with a greater capacity for corrugated cut-up than for manufacturing containerboard, it’s likely International Paper could increase its exports to Europe to supply DS Smith’s box plants’ demand. A shift in the supplier dynamics within the region could occur as a result.

Given this strategy, it is anticipated that there will be a noticeable impact on other manufacturers, particularly those producing virgin kraft linerboard in Sweden and Finland. These producers could find themselves at a competitive disadvantage, potentially losing business as International Paper leverages its global supply chain to optimally service DS Smith’s needs.

This strategic move highlights the complexity of mergers in global industries. The benefits accrued through synergies and integrated operations can significantly disrupt existing market balances and relationships.

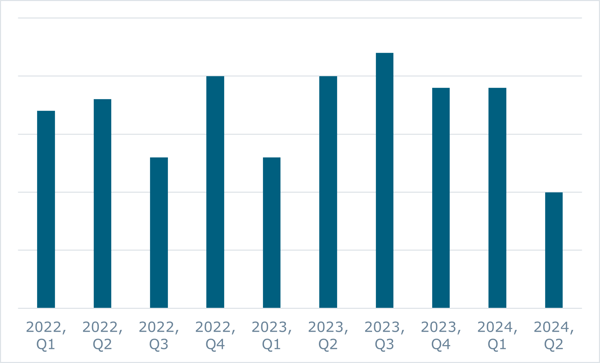

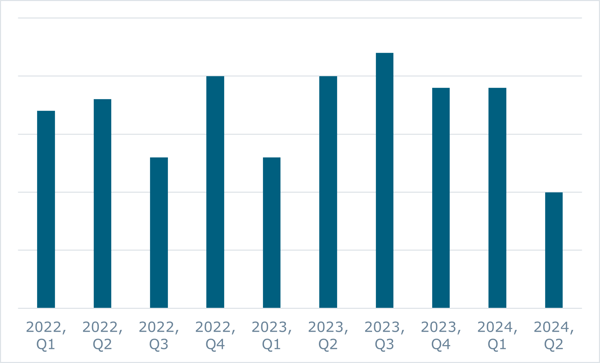

2Q Experiences the Least Amount of Mill Closures Globally in 10 Years

In 2023, the pulp and paper industry saw a significant amount of mill closures. One of the most evident factors behind the numerous mill closures in 2023 was the economic climate.

Because of this, there were several downward turns within various major grades across the pulp and paper industry. These included containerboard demand, the packaging market, the consumer board segment, and an accelerated decline in the already declining printing and writing market.

However, according to FisherSolve , Q2 2024 had the lowest amount of quarterly mill closures globally over the last 10 years. There was a 55% decrease in mill closures in Q2 quarter-over-quarter (QoQ) and a 53% decrease year-over-year (YoY).

Global Pulp and Paper Mill Closures

Source: FisherSolve

As recent earning reports have been released, many pulp and paper companies have shown positive growth in the second quarter. Notable mentions include Sappi’s graphic paper sales volume, Suzano’s pulp sales, and Smurfit WestRock’s corrugated volume, among others.

This prompts the question: does the decline in mill closures relate to the earning reports? Could this indicate improving market conditions, or are North American companies awaiting the upcoming election’s outcome before making decisions about further consolidation? Or is this simply a one-off trend?

Mergers, Acquisitions, and Divestments

-

Ansell Acquires Kimberly-Clark’s Personal Protective Equipment Business – Ansell, a manufacturer of personal protection equipment for healthcare and industrial workplaces, entered into a binding agreement to acquire the assets of Kimberly-Clark’s Personal Protective Equipment business (KCPPE) for a transaction value of US$640 million. With this deal, Ansell will acquire Kimtech and KleenGuard brands. This is expected to help Ansell enhance its sale of specialist products designed for clean room applications while also widening the portfolio of products sold into scientific verticals like pharmaceutical manufacturing, medical devices and semi-conductors, and laboratories for academic and industrial research. The deal is expected to be completed by September 2024, subject to regulatory conditions.

-

European Commission Approves Merger of Smurfit Kappa Group and WestRock – The European Commission approved the merger of Smurfit Kappa Group and WestRock. The Commission concluded that the transaction would not raise competition concerns, given the companies’ limited combined market position resulting from the proposed transaction. The transaction was examined under the simplified merger review procedure.

-

Huhtamaki Plans to Consolidate Three Packaging Plants in UAE – Huhtamaki decided to consolidate its three flexible packaging manufacturing plants in the United Arab Emirates (UAE). It will maintain one plant in Jebel Ali and expand another plant in Ras Al Khaimah. The transition will take place during the second half of 2024. The aim of the consolidation is to optimize the manufacturing footprint, improve competitiveness, and strengthen the foundation for future growth in the region, said the company.

-

Asia Pulp & Paper to Acquire MSS Holding – Morgan Stanley PE signed a contract with Asia Pulp & Paper Group to sell 100% of its stake in MSS Holdings, the majority shareholder of Ssangyong C&B. MSS Holdings has toilet paper brands Cody and Mona Lisa under its wing. It manufactures and sells a wide range of household paper products such as tissue, wipes, sanitary pads, and diapers. The transaction value of the deal is KRW 420 billion.

-

West Fraser Timber Divests Two Mills to Atlas Holdings – West Fraser Timber completed the sale of its Quesnel River Pulp mill in British Columbia and Slave Lake Pulp mill in Alberta to an affiliate of a fund managed by Atlas Holdings. Both the mills will be operated by Millar Western Forest Products, which joined the global Atlas family of manufacturing and distribution businesses in 2017. They produce bleached chemi-thermomechanical pulp.

-

Metsä Group Completes Sale of Its Assets in Russia – Metsä Group completed the sale of its assets to VLP Group in Russia on 13 May 2024. In this transaction, the group’s Russian subsidiaries Metsä Svir, Metsä Forest St. Petersburg, Metsä Forest Podporozhye, and Metsä Board Rus were transferred to VLP Group. VLP Group operates in the forestry and forest products industry mainly in the Vologda region. Metsä Group held a minority ownership in VLP Group during 2003–2017.

-

Suzano Terminates Its Proposal to Buy International – At the end of the quarter, Suzano terminated its proposal to buy International Paper. In a bourse filing on 26 June 2024, the company said International Paper did not engage with the highest price it was willing to pay. However, as of recently, Suzano announced it will acquire two mills from Pactiv Evergreen. The two mills are located in Pine Bluff, Arkansas, and Waynesville, North Carolina. Both mills manufacture liquid packaging board and cupstock. This will expand the company’s operations in North America and mark its entry into the region’s consumer and food service packaging segments. These assets will add 420,000 TPY of paperboard to Suzano’s production capacity.

International Paper Acquires DS Smith

At the beginning of the second quarter, International Paper announced its intent to acquire DS Smith. This strategic deal will lead to nearly 90% of the merged company’s revenue coming from sustainable, fiber-based packaging solutions.

The acquisition will lead to the opening of a corrugated packaging firm, making substantial strides in its commitment to sustainability. The combination will create the opportunity to integrate both the companies’ mill and box networks and optimize the supply chains in Europe and the United States. It will leverage the market expertise of two experienced and innovative management teams to enhance innovation in sustainability products for customers.

The merger is expected to drive significant synergies including higher integration, commercial and operational improvements, and economies of scale across sourcing, supply chain, and administration.

Upon completion of the merger, the combined sales of the two companies are projected to yield a pro forma 2023 combined revenue of approximately $28.2 billion along with a combined adjusted EBITDA of approximately $4.1 billion. The merger is also expected to generate substantial pre-tax cash synergies, estimated to be at least $514 million on an annual run-rate basis by the end of the fourth year post-merger.

International Paper’s acquisition of DS Smith could also have rippling effects on market dynamics. This integration is projected to include a significant benefit of 600,000 short tons per year, enhancing the operational efficiency and output of the combined entity.

With DS Smith positioned as a net buyer of paper, with a greater capacity for corrugated cut-up than for manufacturing containerboard, it’s likely International Paper could increase its exports to Europe to supply DS Smith’s box plants’ demand. A shift in the supplier dynamics within the region could occur as a result.

Given this strategy, it is anticipated that there will be a noticeable impact on other manufacturers, particularly those producing virgin kraft linerboard in Sweden and Finland. These producers could find themselves at a competitive disadvantage, potentially losing business as International Paper leverages its global supply chain to optimally service DS Smith’s needs.

This strategic move highlights the complexity of mergers in global industries. The benefits accrued through synergies and integrated operations can significantly disrupt existing market balances and relationships.

2Q Experiences the Least Amount of Mill Closures Globally in 10 Years

In 2023, the pulp and paper industry saw a significant amount of mill closures. One of the most evident factors behind the numerous mill closures in 2023 was the economic climate.

Because of this, there were several downward turns within various major grades across the pulp and paper industry. These included containerboard demand, the packaging market, the consumer board segment, and an accelerated decline in the already declining printing and writing market.

However, according to FisherSolve , Q2 2024 had the lowest amount of quarterly mill closures globally over the last 10 years. There was a 55% decrease in mill closures in Q2 quarter-over-quarter (QoQ) and a 53% decrease year-over-year (YoY).

Global Pulp and Paper Mill Closures

Source: FisherSolve

As recent earning reports have been released, many pulp and paper companies have shown positive growth in the second quarter. Notable mentions include Sappi’s graphic paper sales volume, Suzano’s pulp sales, and Smurfit WestRock’s corrugated volume, among others.

This prompts the question: does the decline in mill closures relate to the earning reports? Could this indicate improving market conditions, or are North American companies awaiting the upcoming election’s outcome before making decisions about further consolidation? Or is this simply a one-off trend?

Mergers, Acquisitions, and Divestments

-

Ansell Acquires Kimberly-Clark’s Personal Protective Equipment Business – Ansell, a manufacturer of personal protection equipment for healthcare and industrial workplaces, entered into a binding agreement to acquire the assets of Kimberly-Clark’s Personal Protective Equipment business (KCPPE) for a transaction value of US$640 million. With this deal, Ansell will acquire Kimtech and KleenGuard brands. This is expected to help Ansell enhance its sale of specialist products designed for clean room applications while also widening the portfolio of products sold into scientific verticals like pharmaceutical manufacturing, medical devices and semi-conductors, and laboratories for academic and industrial research. The deal is expected to be completed by September 2024, subject to regulatory conditions.

-

European Commission Approves Merger of Smurfit Kappa Group and WestRock – The European Commission approved the merger of Smurfit Kappa Group and WestRock. The Commission concluded that the transaction would not raise competition concerns, given the companies’ limited combined market position resulting from the proposed transaction. The transaction was examined under the simplified merger review procedure.

-

Huhtamaki Plans to Consolidate Three Packaging Plants in UAE – Huhtamaki decided to consolidate its three flexible packaging manufacturing plants in the United Arab Emirates (UAE). It will maintain one plant in Jebel Ali and expand another plant in Ras Al Khaimah. The transition will take place during the second half of 2024. The aim of the consolidation is to optimize the manufacturing footprint, improve competitiveness, and strengthen the foundation for future growth in the region, said the company.

-

Asia Pulp & Paper to Acquire MSS Holding – Morgan Stanley PE signed a contract with Asia Pulp & Paper Group to sell 100% of its stake in MSS Holdings, the majority shareholder of Ssangyong C&B. MSS Holdings has toilet paper brands Cody and Mona Lisa under its wing. It manufactures and sells a wide range of household paper products such as tissue, wipes, sanitary pads, and diapers. The transaction value of the deal is KRW 420 billion.

-

West Fraser Timber Divests Two Mills to Atlas Holdings – West Fraser Timber completed the sale of its Quesnel River Pulp mill in British Columbia and Slave Lake Pulp mill in Alberta to an affiliate of a fund managed by Atlas Holdings. Both the mills will be operated by Millar Western Forest Products, which joined the global Atlas family of manufacturing and distribution businesses in 2017. They produce bleached chemi-thermomechanical pulp.

-

Metsä Group Completes Sale of Its Assets in Russia – Metsä Group completed the sale of its assets to VLP Group in Russia on 13 May 2024. In this transaction, the group’s Russian subsidiaries Metsä Svir, Metsä Forest St. Petersburg, Metsä Forest Podporozhye, and Metsä Board Rus were transferred to VLP Group. VLP Group operates in the forestry and forest products industry mainly in the Vologda region. Metsä Group held a minority ownership in VLP Group during 2003–2017.

-

Suzano Terminates Its Proposal to Buy International – At the end of the quarter, Suzano terminated its proposal to buy International Paper. In a bourse filing on 26 June 2024, the company said International Paper did not engage with the highest price it was willing to pay. However, as of recently, Suzano announced it will acquire two mills from Pactiv Evergreen. The two mills are located in Pine Bluff, Arkansas, and Waynesville, North Carolina. Both mills manufacture liquid packaging board and cupstock. This will expand the company’s operations in North America and mark its entry into the region’s consumer and food service packaging segments. These assets will add 420,000 TPY of paperboard to Suzano’s production capacity.