🥸🥸🥸🥸🥸🥸🥸🥸🥸🥸🥸🥸

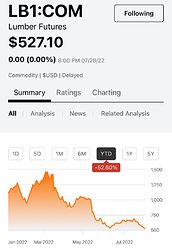

September Lumber Futures  heads into August with little to no momentum

heads into August with little to no momentum  and a much needed defensive stop

and a much needed defensive stop  .

.

If Lumber Futures

was a professional baseball

was a professional baseball  game, we would be approaching the 7th inning stretch and the fat lady

game, we would be approaching the 7th inning stretch and the fat lady

would be warming up ,

would be warming up ,

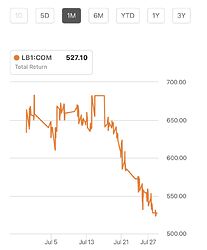

Commodity Lumber 🪵 continues to trade in and out:door: of over sold or over bought conditions faster than rabbits  multiply.

multiply.

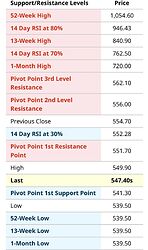

Although the current economic conditions might appear bleak, there could be a silver lining  due to lower overall lumber and wood product cost.

due to lower overall lumber and wood product cost.

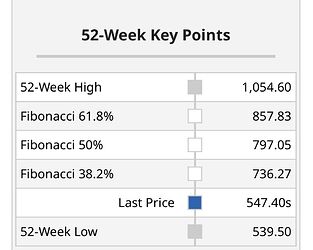

Commodity Lumber 🪵 pricing in the future might give us a nice opportunity to buy long term inventory needs at historically high levels that might be here to stay.

In conclusion, Lumber related products appear to be trending to an inflation adjusted price that is lower. Our future looks bright albeit higher than normal historical lumber averages that appear to be trending towards a “new normal”, that puts prices in and around the $4?? Fob-Mill, Chicago or Boston.

Have an Awesome Month !

Happy Monday !