A Global Housing Bust Looms

By

September 12, 2022, 7:00 AM EDT

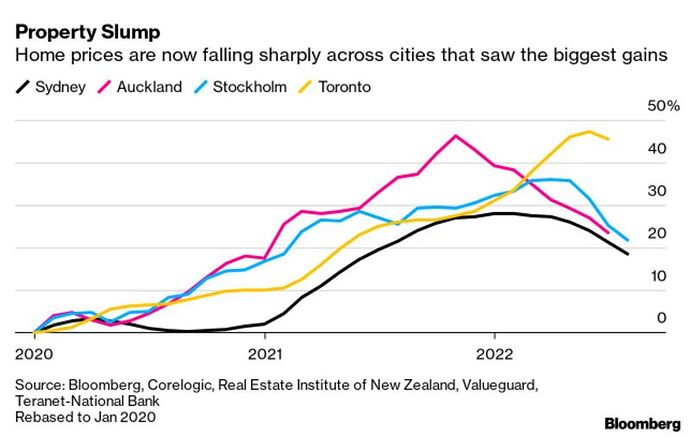

What Goes Up…

House prices around the world are taking a hit from rising interest rates.

How that housing slowdown plays out will be crucial to central banks’ efforts to guide their economies to a soft landing as they push up borrowing costs, according to Bloomberg’s Big Take today.

Real estate is a leading source of household wealth and a major multiplier of economic activity.

Frothy markets such as Australia, Canada and New Zealand are showing signs of a sharper cooling while some governments, such as South Korea, have already intervened to help hard-pressed consumers to manage their increasing repayments.

The cooling in house prices is nothing like the scale of collapse seen during the Global Financial Crisis. The period since then has seen banks and households mend their balance sheets and top up their savings, buoying confidence that the world can manage higher rates.

Still, policy makers are watching very carefully to gauge how this plays out.

Higher real-estate financing costs hit economies in multiple ways. Households with loans tighten their belts, while rising mortgage payments discourage would-be buyers from entering the market, dragging on property prices and development.

One set of borrowers especially vulnerable are those who took out floating-rate loans during the years of rock-bottom rates, or those on maturing fixed-rate terms who now face a painful adjustment.

That’s why economists are saying the full extent of this housing downturn has yet to play out.

“We will observe a globally synchronized housing market downturn in 2023 and 2024,” said Hideaki Hirata of Hosei University, a former Bank of Japan economist who co-authored an International Monetary Fund paper on global house prices. “Sellers often overlook signs of shrinking demand,” he said.