China’s paper industry heavily depends on a combination of local and imported pulp and wood chips to fulfill its fiber requirements. The balance between these two fiber sources is mainly influenced by the fluctuating prices of pulp in the global market and the expenses associated with bringing in hardwood chips for the country’s pulp mills.

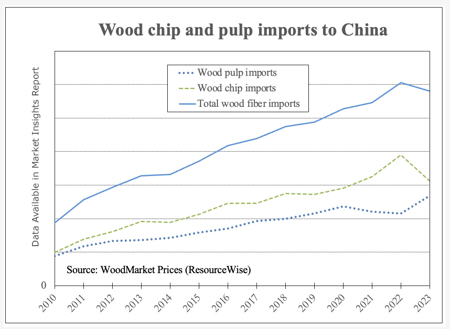

In the last 15 years, the influx of wood chips has outpaced that of pulp. It reached a record high of 64% of the total wood fiber imports in 2022.

Exceeding the 56% average from 2010-23, this ratio soared to new heights. As market pulp prices dipped more significantly than wood chips in 2023, China saw a surge in pulp imports. 2023 volume was at a record-breaking 28 million tons, marking a 24% increase from 2022.

A Look at Wood Fiber Consumption

Wood consumption in the global pulp and paper industry is estimated to be around 400 million tons annually. The majority of this consumption, roughly 80%, is attributed to the top 10 papermaking countries.

Among them, the United States leads the pack in terms of wood fiber consumption, followed closely by Brazil. China ranks third as a major consumer of wood raw materials for papermaking with an expected consumption of around 34 million tons this year.

Over the past few years, there have been significant changes in China’s papermaking industry due to the implementation of bans and restrictions on plastic. The introduction of scrapping orders has also played a major role in the changes. This has led to a shift in the raw materials used for paper production, with a growing demand for wood pulp.

Wood Chip Supply and Price Movements

One main factor contributing to this trend is the fact that domestic tree plantations are a limited supply source for China’s growing domestic pulp industry. Many newly built pulp mills rely on 90-100% of imported wood fiber, primarily hardwood chips.

When examining global wood prices, hardwood prices are the lowest in the Americas (Brazil, Chile, United States, and Canada). Europe and Asia experience relatively higher hardwood prices in comparison. Softwood price trends are similar across these countries.

As we all know, supply and demand affect prices. Brazil and Chile have 100% industrial plantation forests. North America has over 50%, and Europe mainly consists of ordinary industrial forests. Naturally, Japan and China must rely on imports, creating higher prices.

Since 2011, China’s import volume of hardwood chips has steadily increased, driven by the continuous growth of the papermaking industry. In 2011, the import volume was 6.2 million tons which nearly tripled by 2022.

Read More: Trends in China’s Pulp, Paper, and Forestry Industry

Read More About China’s Trade Dynamics and Import Trends

For further insights on China’s pulp industry, the nuances of domestic industry expansion, international trade dynamics, and the management of resources, ResourceWise’s Market Insights report is available for download