The landscape of the global lumber market has undergone significant transformations when it comes to the pricing of sawlogs, the cost component that accounts for about two-thirds of the production costs. British Columbia (BC) has had the cheapest wood costs in North America for most of the past three decades, giving businesses stability and predictability. However, exceptional events, including beetle infestations, forest fires, and governmental restrictions on timber harvests, have reduced wood supply over the past five years.

Exploring British Columbia’s Market Landscape

From 2018 onwards, British Columbia has experienced a decline in available timber and a deterioration in log quality. These factors have led to a significant increase in the prices of wood raw materials, presenting a challenge for forest products manufacturers as they navigate these elevated costs.

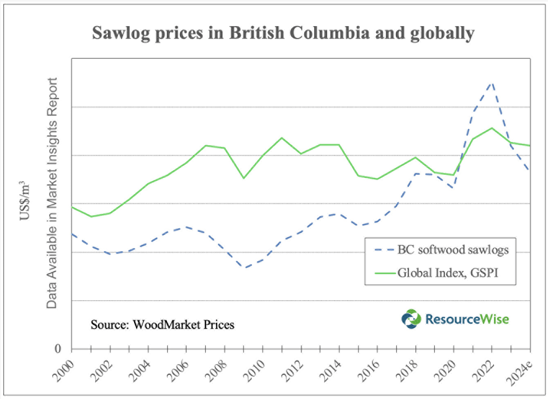

Looking back to the 2009 economic downturn, sawlog prices in BC were a comfortable US$32/m³. Fast forward to 2022, and the landscape has drastically changed. Prices have skyrocketed to nearly US$120/m³, turning BC from the most affordable region to the most expensive for logs in North America.

On the flip side, the sawmill industry in the US South saw a boost in capacity, fueled by remarkably low wood costs in 2023 and 2024. This, coupled with dwindling lumber demandand a drop in log quality, led to a sharp decrease in sawlog prices not only in British Columbia but also in other regions across North America, Eastern Europe, Central Europe, and Russia. Interestingly, according to WoodMarket Prices, BC sawlog prices experienced a steeper decline compared to many others over the past year, as highlighted by the Global Sawlog Price Index (GSPI).

Over time, British Columbia has historically maintained wood fiber costs below the global Softwood Fiber Price Index (SFPI). However, the past decade has witnessed a sharp rise in prices, a trend that peaked in 2022 and has declined slightly in the past year. Consequently, the pulp industry in BC now faces a challenge in remaining competitive in North American markets, creating an opportunity for pulp manufacturers in the US South, US Northwest, and Eastern Canada to benefit from their notably lower wood fiber costs.

The higher wood costs and grim projections for available timber supply triggered forest product manufacturers to take drastic measures such as permanently closing facilities in BC and seeking investments in regions outside of the province.