Recycled fiber markets are volatile, meaning industry professionals need reliable data to stay ahead of changes. Let’s look at OCC price data from Q1 2024 to examine some of these changes that have occurred so far. All data below is sourced from Recycled Fiber 360, a transparent transaction-based benchmark for recycled fiber prices.

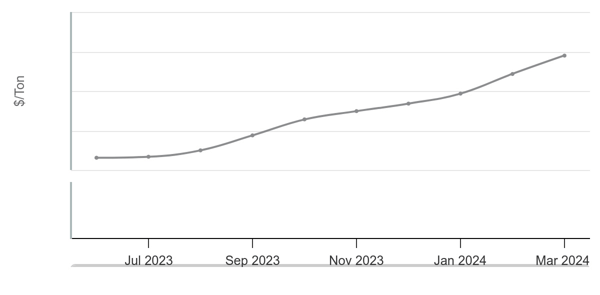

Overview of Price Trends in 1Q2024

During 2024, there has been a consistent upward trend in recycled fiber prices. Compared to the same period in 2023, there has been a significant 117% increase.

North American Fiber Price Trend

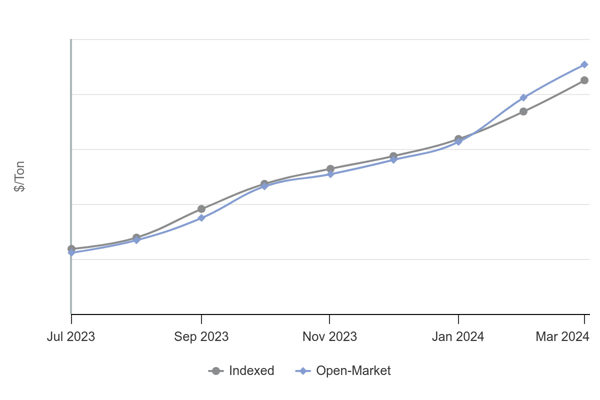

Open-Market vs. Indexed Prices

Analyzing the differences between open-market and indexed prices provides valuable insights. For those new to transaction-based price reporting, “Open-Market” refers to any transaction that was negotiated. This includes what many think of as “spot tons,” along with contract negotiations that set a new baseline price.

Indexed Prices are those transactions that move with a benchmark index only, and therefore not negotiated. Since July 2023, indexed-driven prices were slightly higher than open-market prices. By February and March 2024, however, we saw open-market prices exceed indexed prices.

North American Indexed vs Open-Market Fiber Prices

It is essential for companies to consider various factors when deciding whether to lock in their OCC prices through contracts or purchase on the open market. By analyzing the differences between indexed and open-market prices, businesses can make informed decisions that align with their procurement strategies and financial goals.

For example, companies under long-term contracts can benefit from the stability provided by indexed prices, avoiding sudden price spikes in the open market. On the flip side, businesses purchasing OCC on the open market can capitalize on cost-saving opportunities when open-market prices drop below indexed rates.

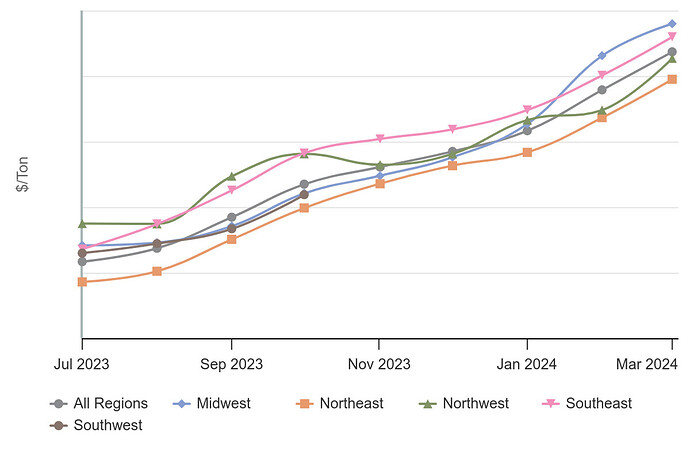

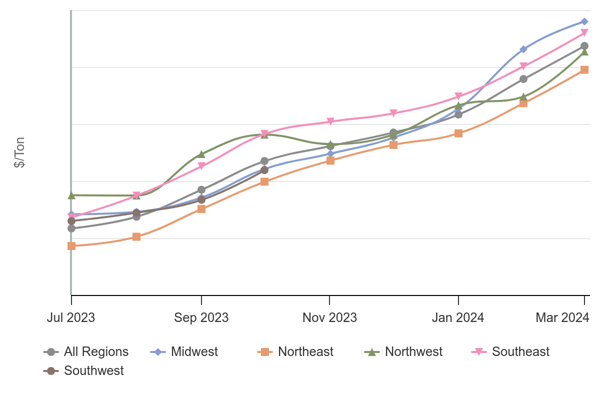

Regional Price Differences

Turning to regional differences, we see that all prices increased from January to March 2024, following the broad market. However, prices in the Midwest had the most substantial increase, rising by 24%. This regional variation is significant as it can impact procurement strategies and cost management. It also changes the competitiveness of paper mills, especially containerboard mills (the largest consumer of OCC in the US).

North American Fiber Price Trend by Region

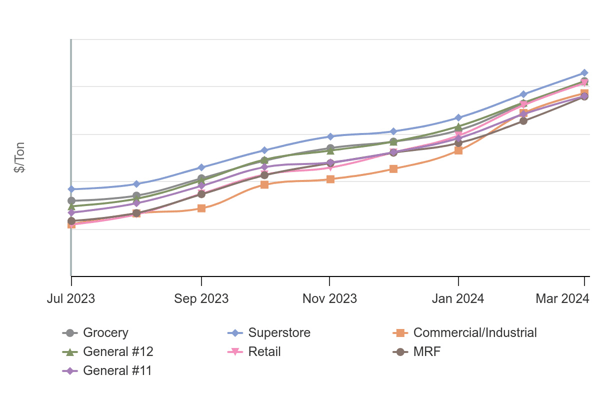

Prices by Source

When analyzing prices by source, we observe clear differences in prices by channel, likely due to quality, consistency in volume, and other factors. Notably, prices from superstores have consistently been the highest. Interestingly, average prices from commercial or industrial locations have moved higher than the other channels, indicating an increased relative demand from these sources.

North American Fiber Prices by Source

The Value of Recycled Fiber 360

Recycled Fiber 360 provides comprehensive pricing information and more for the recycled fiber market. Unlike many other benchmarks, this one is based on actual transactions, offering up-to-date and high-quality data.

This transparency allows businesses to make more informed decisions and improve their ability to negotiate prices, secure supply agreements, and benchmark procurement strategies.

Advantages of a Transaction-Based Index

- Reliability : Because it is based on real market transactions rather than survey-based methods, the data is more accurate and reflective of actual market conditions.

- Actionable Insights : The index offers detailed breakdowns by region, product, and contract types, providing users with the exact pricing data they need when they need it.

- Predictive Power : By tracking historical price trends and market movements, businesses can gain insights into future market directions.

The first quarter of 2024 has demonstrated significant price movements in the recycled fiber OCC market. Using Recycled Fiber 360 data, recycled fiber professionals can better understand these trends and make strategic decisions to navigate this volatile market effectively. The transaction-based approach of Recycled Fiber 360 ensures that businesses receive reliable, actionable insights, reducing uncertainty and enhancing decision-making capabilities.