Lumber: Can Wood Prices Rally in Spring 2024?

February 27, 2024 — 06:37 pm EST

Written by Andrew Hecht for Barchart →

The Chicago Mercantile Exchange attempted to increase liquidity in the lumber futures arena by replacing the random-length lumber contract with a physical contract. The new lumber futures offer smaller contracts with more flexible delivery specifications. However, volume and open interest have not increased significantly. Open interest is the total number of open long and short positions in a futures market. Lumber futures’ low liquidity does not support hedging and speculative activity and causes high price volatility. During rallies, low participation causes offers to sell to disappear, and when the price moves lower, bids to purchase lumber tend to evaporate. Therefore, lumber futures can rise or fall to prices that defy logical, reasonable, and rational levels.

In a December 22 Barchart article on lumber, I wrote:

Lumber prices tend to peak during spring and summer as new home construction increases. The Fed’s pivot to a more dovish monetary approach could send mortgage rates down over the coming months, pushing lumber demand and prices higher.

The latest economic data shows inflation remains a nagging economic condition

Over the past months in late 2023, inflationary pressures had been receding, with the consumer and producer price index data moving towards the Fed’s 2% target level. The signs that inflation was under control caused the Fed to pause its rate hikes. Moreover, the central bank shifted rhetoric to prepare markets for an eventual 2024 rate cut.

Meanwhile, the January CPI and PPI data came in higher than expected, making inflation a continuing concern. At the first FOMC meeting of 2024, the committee told markets it was waiting for further confirmation that inflation was approaching 2%. The January data validated the Fed’s cautious approach. While the central bank is unlikely to increase rates, the data could mean interest rates remain higher for longer in 2024.

Mortgage rates remain high compared to recent years

In 2021, thirty-year conventional fixed-rate mortgages were below the 3% level. In 2023, hawkish monetary policy that tightened credit pushed mortgage rates over the 8% level at the high. In late February 2024, the rate is hovering around the 7% level, still double the level before 2022.

High mortgage rates weigh on the demand for new and existing home purchases as the financing costs have put home purchases beyond many potential buyers’ reaches. The move from 3% to 7% has increased monthly payments on a $400,000 mortgage by over $1,300.

Existing home availability versus new home building

While high rates reduced the addressable market for home purchases, existing home prices have remained relatively high. The existing home inventories have dried up because homeowners who purchased or refinanced homes when rates were 3% or lower are not moving any time soon. Therefore, the demand for new home construction remains robust in the current environment, supporting lumber demand.

Meanwhile, as the market digests the higher interest rate environment with home prices steady, more buyers could appear over the coming months as pent-up demand has increased.

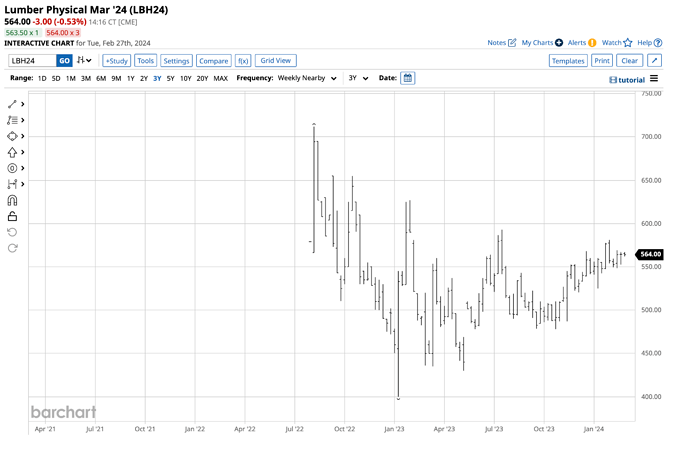

Physical lumber futures have been trending higher for over a year

Physical lumber futures have been making higher lows since early 2023.

The three-year chart of nearby physical lumber futures shows the bullish price pattern since early last year when the price reached a $400 per 1,000 board feet bottom. The price reached its most recent $581 high in late January and was over the $560 level in late February as the spring approaches. Construction activity tends to increase after winter.

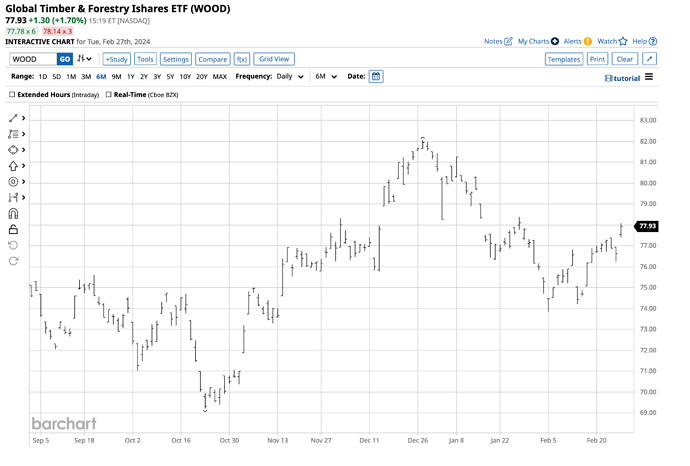

The WOOD ETF tends to follow lumber futures prices

Lumber futures remain illiquid for hedgers, speculators, and all market participants. In late February, the total number of open long and short positions in all physical lumber futures was below 9,000 contracts. Since the new contract size is 25,000 board feet, compared to 110,000 board feet in the retired random-length lumber futures contracts, the current open interest translates to under 2,000 contracts.

At $77.93 per share, the iShares Global Timber & Forestry ETF product (WOOD) is liquid, with nearly $197.7 million in assets and an average of 10,146 shares changing hands daily. WOOD charges a 0.40% management fee. WOOD’s top holdings include the leading lumber-related companies.

On December 22, 2023, nearby lumber prices were $585.50 per 1,000 board feet. On February 28, they had declined 3.6% to the $564 level.

Meanwhile, the WOOD ETF at $77.93 on February 27 was 4.1% lower than the December 22, 2023, $81.26 closing price. The WOOD ETF tends to follow lumber futures prices, which could be an opportunity for the coming months.

Lumber futures tend to peak in spring and early summer each year. In 2018, lumber futures reached a high in May. The 2021 all-time high was in May, while the 2022 lower peak was in March. If pent-up demand in the housing market despite higher mortgage rates leads to more lumber demand, lumber futures, and the WOOD ETF could move higher over the coming weeks and months. WOOD’s liquidity makes the ETF a safer approach for lumber exposure.

I believe the current environment limits lumber’s downside. At the same time, the price action over the past years suggests the upside could become explosive when the Fed finally cuts rates, increasing the addressable market for home buyers.

https://www.nasdaq.com/articles/lumber:-can-wood-prices-rally-in-spring-2024