Packaging production in Brazil, both containerboard and boxboard, currently seems resistant to weak domestic consumption thanks to external factors and structural changes in consumer behavior.

The strong increase in paper packaging and food production and exports from Brazil, both boosted by the currency devaluation observed between January and May, has supported the production of packaging and packaging papers. Higher demand from the food delivery segment has been boosting production of boxboard and sacks since the start of the year, despite the recent decline in drivers on the consumer side.

Production continues to be strong despite weak domestic sales

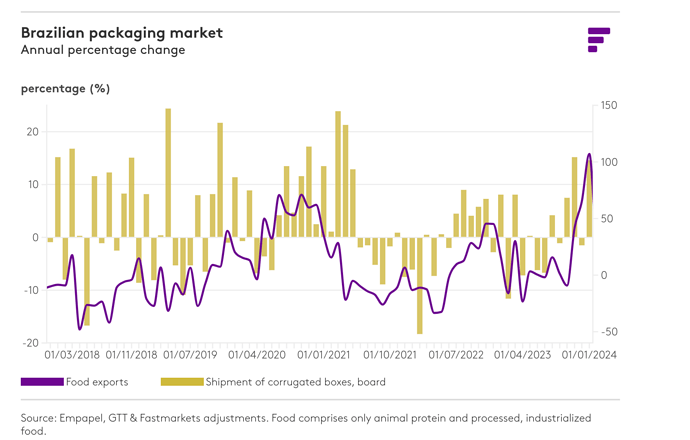

Total shipments of corrugated boxes, boards and accessories in Brazil grew 8% between January and May, according to data from the local packaging paper association (Empapel), higher than our forecast of around 5% released in January and much more than the market consensus at that time for a timid recovery of 1-2%.

Overall paper packaging and boxboard production data show a similar trend, increasing 9.9% and 4.9% year over year respectively between January and April from the same period in 2023, while domestic sales for both grades declined 0.4% and 2.5%, according to data from the Brazilian Tree Association (Ibá).

Production and domestic sales data show an even greater disconnect when we analyze industry inventory levels of durable and non-durable goods in tandem with weak demand. Overall inventories are high and at levels closer to those seen in the first and fourth quarter of 2023, while demand for durable goods has been reportedly weak, which is limiting their packaging procurement purchases.

If packaging and paper packaging production is strong despite the drop in domestic sales and the industry’s high inventories, what has been supporting production? The answer is in the external sectors.

Packaging and food exports supporting high packaging paper production

The external market has been one of the main production drivers in Brazil, affecting production through two channels: direct exports (of paper packaging and packaging) and indirect exports (of packaged goods, mainly food). In both cases, the change in the exchange rate, which grew 4.8% between January and May from December last year, increases international shipments by raising the profitability of those deals.

Direct paper and packaging exports have been growing at double-digit rates, according to Fastmarkets estimations based on trade data. Kraftliner exports totaled 176,000 tonnes between January and May, growing 15.3%, while testliner shipments almost doubled in the same period. Boxboard and other industrial packaging paper exports expanded 5.9% to nearly 43,000 tonnes in the same period.

A similar conclusion can be drawn by looking at Ibá’s data, despite differences between the grades analyzed. Overall paper packaging exports jumped 19.5% to 318,000 tonnes between January and April, while cartonboard exports jumped almost 70% to 39,000 tonnes in the same period.

Indirect exports have also improved in 2024, enough to continue supporting production and offsetting a further decline in domestic sales.

Food production in Brazil increased 6.3% between January and April, according to data from the National Bureau of Statistics, IBGE, supported by robust food exports, which soared 47.7% against the same period in 2023 or 38.4% if we include May in the analysis. Processed food exports rocketed 50.8% between January and May to more than 15.6 million tonnes, while offshore shipments of animal protein — mainly beef and poultry — jumped 8% to 3.6 million tonnes in the same period.

Industrialized food exports usually utilize two types of paper packaging: the primary packaging, usually a boxboard or cartonboard grade, which protects the product in retail stores, and the secondary packaging, usually made of containerboard, which bundles and protects a number of small individual units safely through the long distances of international trade.

Despite the positive performance of the external sector, post-pandemic changes in consumer behavior thanks to a more stable macroeconomic environment have only partially supported domestic sales, not enough to impede a larger drop in total domestic sales figures caused mostly by the drop in overall consumer goods demand.

Food delivery recovers and partially supports packaging paper demand

Demand for food delivery increased substantially between 2020 and 2021 due to the social isolation created by the pandemic but heavily declined between 2021 and 2023 thanks to the economic reopening and soaring inflation, which heavily eroded consumers’ purchasing power. However, available data for 2024 shows a recovery in food delivery demand due to the more stable macroeconomic environment.

The recovery in income levels for part of the population since 2022 and the inflation control between 2023 and 2024 both restored consumer purchasing power and allowed households to resume food delivery habits acquired during the pandemic. According to the IBGE, average incomes grew 4.7% between January and May of 2024 compared with the same period in 2023 and 12.2% from 2022, opening room for discretionary spending, such as ordering food online.

To improve sales, the majority of food establishments offer online ordering for delivery and/or takeaway; according to the Annual Foodservice Sectorial Research 2024, online orders account for about a third of their earnings. The resumption of in-office working and less constrained budgets for many middle-income households, as well as the convenience and large range of options available for order, have boosted online food ordering in Brazil.

Even the consumption of processed food, which was also harmed in the last two years by the shrinkflation trend to keep boosting sales despite the strong overall inflation, has been climbing thanks to the economic recovery. Retail sales at supermarkets increased 5.6% between January and April this year, according to data from IBGE.

If the food sector is performing so well, then why are overall packaging sales still so weak? The recent deterioration in consumption drivers and a comparison against other non-core sectors, such as durable goods, provide the answer.

Consumption drivers’ deterioration limits durable goods demand

The durable goods sector, which accounts for roughly 20-25% of packaging demand in Brazil, has been struggling with worsening consumption conditions since the start of 2024, despite the overall improvement in the macroeconomic landscape compared with 2022 and 2023.

Surprisingly, even with the increase in disposable incomes and the decline in unemployment rates, debt levels have been steadily rising since January. Data from the Local Commerce Confederation CNC indicates that about 78.6% of all households in Brazil are in debt to some degree, and more than 28% are behind in their debt repayments. The national debt-to-income ratio is currently nearly 45%, a level only slightly lower than the 50% registered during 2022 and 2023, according to data from the Brazilian Central Bank. The almost insignificant improvement in debt conditions is a concern for policymakers, especially when macroeconomic conditions are so much better than in 2022 and 2023.

In fact, debt levels retreated during the second half of 2023 due to the economic recovery and several debt renegotiation programs issued by both public and private entities, such as the Desenrola, but the effects from those programs were expected to last longer than they have.

The increase in household debt limits domestic consumption now and in the future, especially for durable goods. Since early 2024, consumers have been reporting that they are postponing durable goods purchases and consider current conditions to be similar to those in 2023 despite their higher income levels.

Surprisingly, access to credit has also been facilitated thanks to the drop in interest rates and the removal of consumers from blacklists issued by credit bureaus, according to data from CNC, but these conditions have not been enough to support demand for durable goods and thus have been limiting packaging demand from this sector. Retail sales of furniture and appliances grew only 1.7% between January and April, according to the IBGE, below market expectations and not enough to support packaging demand like the food sector did.

While the food delivery segment has been growing and supporting packaging demand, we cannot say the same for e-commerce. Listed companies have reported in their quarterly earnings calls that online sales have been poorer than market expectations, which anticipated a faster recovery versus 2023 thanks to the overall economic improvement.

Not by chance, road freight sales indices — which also include food delivery orders — grew 1.9% between January and April this year, according to the IBGE, while cargo storage and auxiliary transport services sales correlated to e-commerce dropped 1.5% in the same period. In other words, more perishable cargoes were hauled across the country, while the transport and storage of durable goods declined.

Other consumer habits, both old and new, are influencing household consumption and dampening durable goods purchases.

New habits: Experiences and gambling stealing durable goods’ budget share

Consumers have also opted to spend a significant part of their incremental income on experiences. As the economic reopening consolidated, so did consumer spending on services related to experiences away from home.

Data from IBGE show that consumer spending on hotels and accommodations increased 11.7% between January and April against the same period in 2023, while spending on food services away from home grew 10.1%, highlighting the new consumption priorities.

However, a new trend — which is also the subject of official investigation — has been draining significant resources from households: the unmapped and unregulated market of online betting. This market has been boosted since the pandemic, tracking the increase in digital inclusion (which has also been supporting the food delivery sector, for instance). It has been taking a significant share of household budgets.

Brazilians spent more than R$54 billion ($10 billion) on online bets in 2023, equivalent to 2.3% of the total retail market and more than the total earnings of animal protein exports, which were around R$46 billion last year. It is important to note that online betting figures are likely to be revised up because of the lack of data and transparency in this market.

According to recent research by the media group Folha and data from IBGE, Brazilians spend an average of about 10% of their monthly budget on online bets, a huge share considering the average debt-to-income ratio of 45%. Data show that the poorer consumers are, the greater the share of their income is spent on online betting.

Problems related to this unregulated market have already been affecting the reality of hundreds of households, which report a surge in debt levels to keep up with their gambling addiction, hoping to recover part of the money lost. This is especially true for sites hosted internationally, which are not regulated by local authorities and, in many cases, are being investigated for fraud.

Summary: Production should grow in 2024 despite stagnant consumption

The packaging market in Brazil should post positive figures for 2024 despite weak domestic sales and stagnant domestic demand.

In our Latin America Pulp & Paper Forecast, we anticipate that overall containerboard production will grow to 5.4 million tonnes in 2024, 3% above 2023. Exports will increase almost 20% in the year to more than 500,000 tonnes, while overall apparent consumption should increase by 2% to nearly 5 million tonnes. For the boxboard market, our projections show annual growth of 6.4% to 1.1 million tonnes.

For the total shipment of corrugated boxes, board and accessories assessed by Empapel, we expect annual growth of 6.1% to 4.2 million tonnes in 2024.

The external sector, driven by direct and indirect exports, should be the major production growth driver and should also support domestic sales in the year, boosted by the devaluation of the currency that is expected to continue through the end of the year.

The improvement in the Brazilian macroeconomic environment and demand drivers has not translated into growth in goods consumption but rather in experiences and food delivery (which is also an experience). The resumption of the food delivery habit, which was acquired during the pandemic but paused between 2022 and 2023 due to inflation and purchasing power erosion, has brought hope for the packaging sector, supporting sales and production. However, economic risks related to household debt have been increasing in Brazil, challenging improvement in domestic sales of goods and thus packaging.