Well, wood you look at that: The lumber bubble is back on.

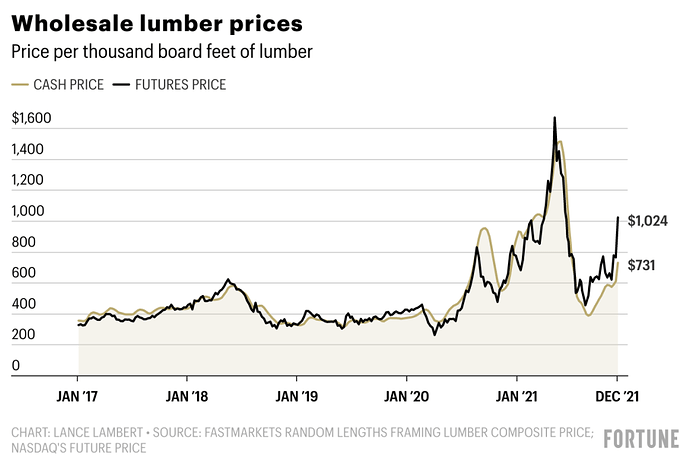

In May, the futures price of lumber peaked at an all-time high of $1,711 per thousand board feet. But during the summer those prices crashed, hitting a bottom of $454 in August. But in recent months that price correction has flipped back into another price run. As of Friday, lumber futures are back up to $1,024—a 126% gain since the August bottom. That’s already translating into a higher wholesale “cash” market price ($731) and will ultimately cause prices to rise for do-it-yourselfers who shop for lumber at retailers like Home Depot.

“Prices will start rising very quickly on the retail side to catch up as the cash price is jumping at a very similar rate to the futures gains,” says Andy Goodman, CEO of Sherwood Lumber, a national wholesaler of building materials. “We have already heard of many jobs that aren’t ready to frame take delivery just to secure today’s price rather than risk what the price may be. If you need wood for the first quarter and can afford to buy it now, then no need to wait.”

Michael Wisnefski, CEO of MaterialsXchange, a lumber e-commerce company, agrees. He says if DIYers have upcoming projects, they may want to buy the wood products now.

What’s driving this run is different from the last go-around. The previous one was simply a shortage. Lumber production, which fell during the COVID lockdowns, was overtaken by rising demand from a coinciding housing and DIY boom during the pandemic. It eventually got worked out as sawmills increased production and DIYers got priced out.

This time, it’s less of a shortage and more of a supply-chain issue. Record rainfall in British Columbia—the epicenter of North American lumber—last month created flooding and mudslides that caused road, bridge, and train closures across the province. That’s made it harder to get wood through the Port of Vancouver—the largest port in Canada. Of course, supply and demand are playing a role too. Some of the priced-out DIYers have returned to the market as prices fell this summer, while a strong housing marketcontinues to keep homebuilders busy. Additionally, a bad wildfire season in the U.S. Pacific Northwest and British Columbia forced some major lumber producers like Canfor to curtail production over the summer and fall.

The good news: Already, some roads and trains in British Columbia are beginning to reopen and more wood is starting to move. However, industry insiders tell Fortune it will take time to catch back up. In the meantime, Wisnefski says, he isn’t quite sure where lumber futures will go from here.