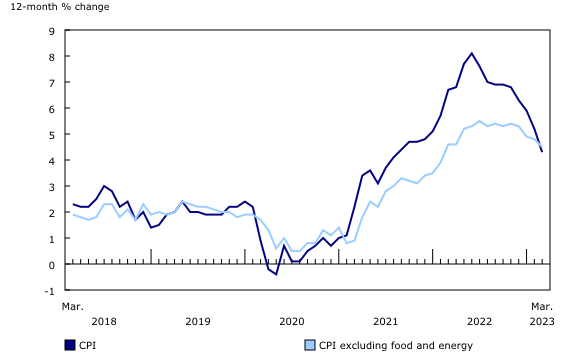

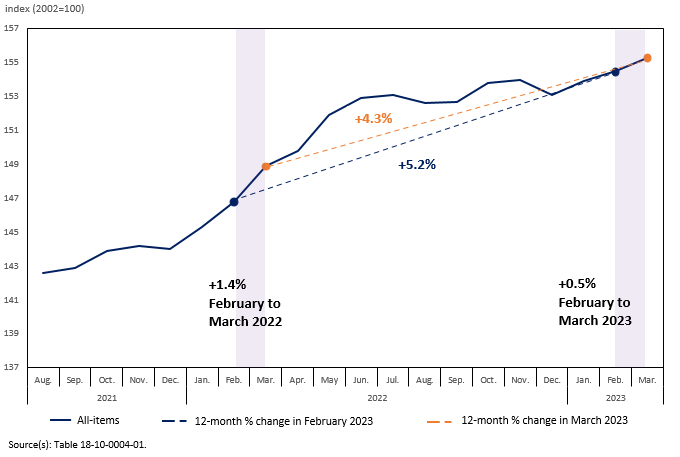

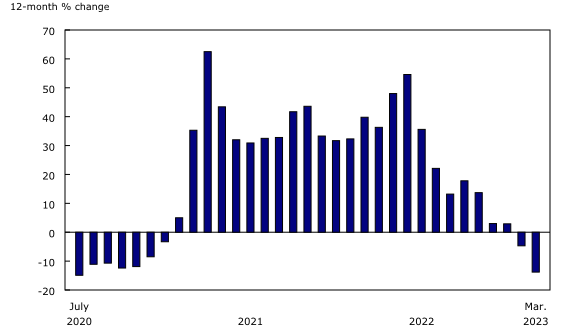

The Consumer Price Index (CPI) rose 4.3% year over year in March, following a 5.2% increase in February. This was the smallest increase since August 2021 (+4.1%). On a year-over-year basis, Canadians paid more in mortgage interest costs, which was offset by a decline in energy prices.

As a result of the steep monthly increase in prices in March 2022 (+1.4%), base-year effects, notably gasoline prices, continued to have a strong downward impact on consumer inflation, contributing to the year-over-year deceleration in March 2023.

Grocery prices increase at a slower pace

Year over year, prices for food purchased from stores rose to a lesser extent in March (+9.7%) than in February (+10.6%), with the slowdown stemming from lower prices for fresh fruit and vegetables.

Prices for fresh fruit increased 7.1% year over year in March, after a 10.5% gain in February. Prices for grapes and oranges contributed the most to the deceleration.

Similarly, fresh vegetable prices slowed year over year in March (+10.8%) compared with February (+13.4%), mainly driven by prices for cucumbers and celery.

Excluding food and energy, prices were up 4.5% year over year in March, following a 4.8% gain in February, while the all-items CPI excluding mortgage interest cost rose 3.6%, after increasing 4.7% in February.

On a monthly basis, the CPI was up 0.5% in March, following a 0.4% gain in February. Travel tours (+36.7%) contributed the most to the headline month-over-month movement, largely driven by increased seasonal demand during the March break. On a seasonally adjusted monthly basis, the CPI rose 0.1%.

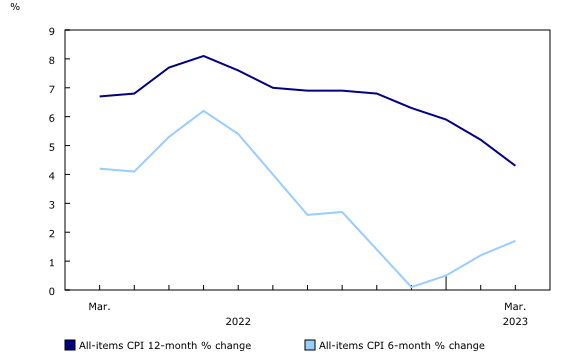

While headline inflation has slowed in recent months, having increased 1.7% in March compared with 6 months ago, prices remain elevated. Compared with 18 months ago, for example, inflation has increased 8.7%.

Gasoline prices fall year over year for the second consecutive month

Gasoline prices dropped year over year for the second consecutive month in March (-13.8%), the largest yearly decline since July 2020. The fall in gasoline prices was mainly driven by steep price increases in March 2022, when gasoline rose 11.8% month over month as a result of supply uncertainty following Russia’s invasion of Ukraine. This increased crude oil prices, which pushed prices at the pump higher for Canadians.

Chart 1

12-month change in the Consumer Price Index (CPI) and CPI excluding food and energy

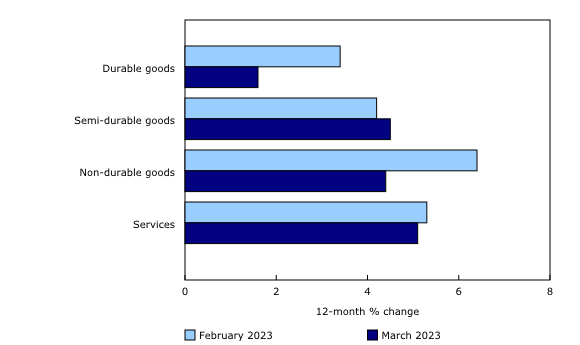

Price growth for durable goods slow on base-year effects

On a year-over-year basis, price growth for durable goods slowed in March (+1.6%) compared with February (+3.4%). Furniture prices led the deceleration in prices for durable goods, falling 0.3% year over year in March, following a 7.2% increase in February. The decline was largely due to a base-year effect, as prices for furniture rose 8.2% month over

Chart 2

Prices rise 1.7% over the past six months

month in March 2022 amid supply chain issues.

Prices for passenger vehicles also contributed to the deceleration in prices for durable goods, increasing at a slower pace year over year in March 2023 (+4.7%) compared with February (+5.3%). Higher prices for passenger vehicles in March 2022, as a result of the global shortage of semiconductor chips, put downward pressure on the index in March 2023.

Month over month, new passenger vehicle prices were up 1.3% in March, attributable to the higher availability of new 2023-model-year vehicles. For comparison, prices for used vehicles rose 0.6% month over month in March, after a 1.9% decline in February.

Infographic 1

Slowdown in headline inflation reflects a base-year effect following strong price increases in March 2022

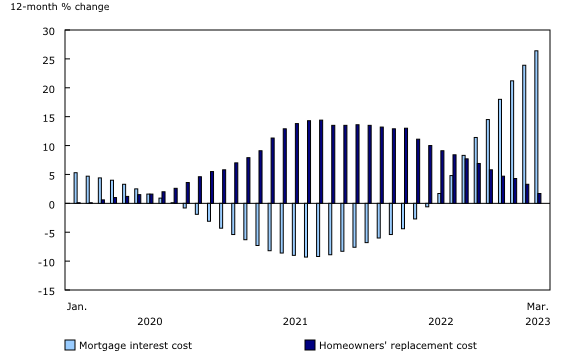

Homeowners’ replacement cost slows, while mortgage interest cost rises at the fastest pace on record

Homeowners’ replacement cost continued to slow in March, rising 1.7% year over year compared with a 3.3% increase in February, reflecting a general cooling of the housing market.

In contrast, mortgage interest cost rose at a faster rate in March (+26.4%) compared with February (+23.9%). This was the largest yearly increase on record as Canadians continued to renew and initiate mortgages at higher interest rates.

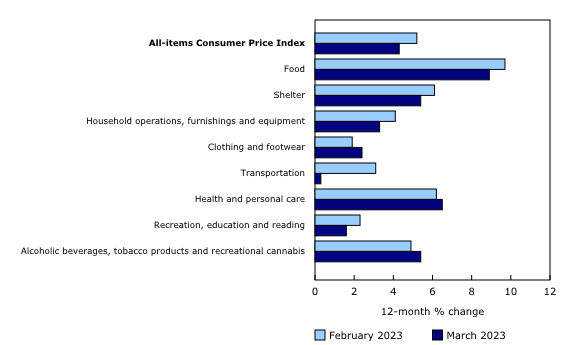

Chart 3

Prices increase at a slower pace in five major components in March

Grocery prices increase at a slower pace

Year over year, prices for food purchased from stores rose to a lesser extent in March (+9.7%) than in February (+10.6%), with the slowdown stemming from lower prices for fresh fruit and vegetables.

Prices for fresh fruit increased 7.1% year over year in March, after a 10.5% gain in February. Prices for grapes and oranges contributed the most to the deceleration.

Similarly, fresh vegetable prices slowed year over year in March (+10.8%) compared with February (+13.4%), mainly driven by prices for cucumbers and celery.

Chart 4

Gasoline prices decline on a year-over-year basis for the second consecutive month in March

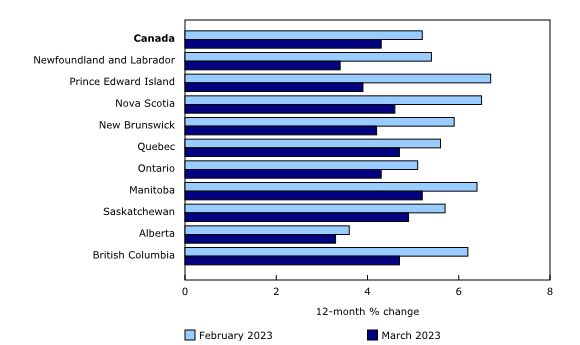

Regional highlights

Year over year, prices rose at a slower pace in March compared with February in every province. Price growth slowed the most in Atlantic Canada, as a result of lower prices for fuel oil and other fuels, which is more commonly used to heat homes in that region than in other provinces.

Chart 5

Prices for durable goods decelerate in March

Rent prices increase in Manitoba

In Manitoba, lower prices for gasoline and durable goods were offset by higher prices for rent in March. Rent prices in Manitoba rose 8.2% on a year-over-year basis, marking the fourth consecutive month of increases above 5%, as rental demand outpaces supply amid population growth.

Chart 6

Mortgage interest cost accelerates in March, while homeowners’ replacement cost slows

Chart 7

The Consumer Price Index rises at a slower pace in all provinces