Source(s): Table 18-10-0265-01.

![]()

![]()

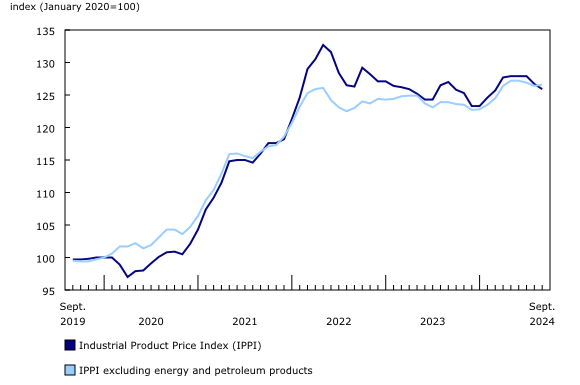

Prices of products manufactured in Canada, as measured by the Industrial Product Price Index (IPPI), fell 0.6% month over month in September and decreased 0.9% year over year. Prices of raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index (RMPI), declined 3.1% month over month in September and fell 8.8% year over year.

Chart 1

Prices for industrial products decrease in September

Industrial Product Price Index

The IPPI decreased 0.6% from August to September. Excluding energy and petroleum products, the IPPI rose 0.2%.

Prices for energy and petroleum products (-6.5%) fell for the second month in a row in September, leading the monthly decrease in the IPPI. Lower prices were widespread among refined petroleum energy products, particularly finished motor gasoline (-10.0%) and diesel fuel (-6.6%). These decreases were partly influenced by lower prices for conventional crude oil, the primary input for refined petroleum products, as measured in the RMPI.

Prices for meat, fish and dairy products decreased 1.1% in September. In this group, the price for fresh and frozen pork decreased 3.1%, falling for the second consecutive month. Abundant supply and slow seasonal demand in September put downward pressure on prices. According to data from Agriculture and Agri-Food Canada, hog slaughter numbers in both Canada and the United States rose significantly from August to September.

The IPPI’s monthly decline in September was moderated by higher prices for multiple product groups, including primary non-ferrous metal products and lumber and other wood products.

Prices for primary non-ferrous metal products increased 1.0% month over month in September, mainly on higher prices for unwrought gold, silver, and platinum group metals, and their alloys (+3.7%). Interest rate cuts from the US Federal Reserve and other central banks, combined with ongoing geopolitical tensions in the Middle East, put upward pressure on precious metals prices.

Prices for lumber and other wood products rose 1.2% in September, increasing for the second consecutive month. Higher prices for softwood lumber (+3.2%) led the gain. Sawmills’ curtailed activities and closures in the British Columbia interior region due to high operating costs caused a negative supply shock which contributed to this price increase. Similarly, prices for logs and bolts (+3.9%) increased in the RMPI.

Year over year

The IPPI was 0.9% lower in September compared with one year earlier, the first year-over-year decrease since March 2024 (-0.4%).

The largest contributors to September’s year-over-year decrease included diesel fuel (-27.6%), finished motor gasoline (-18.8%) and grain and oilseed products, n.e.c. (-25.7%).

Partly offsetting the IPPI’s year-over-year decrease, several product categories rose year over year in September. Most notably, prices were up for unwrought gold, silver, and platinum group metals, and their alloys (+28.9%), and unwrought aluminum and aluminum alloys (+29.9%).

Raw Materials Price Index

Following a 3.0% decline in August, the RMPI declined 3.1% month over month in September. This was the largest month-over-month decline in the RMPI since December 2023 (-4.9%). Excluding crude energy products, the RMPI was up 0.6% in September 2024.

Prices for crude energy products (-8.5%) drove the RMPI’s monthly decline in September, mainly due to lower prices for conventional crude oil (-8.2%), which posted its largest monthly decrease since December 2023 (-9.2%). Synthetic crude oil prices (-10.1%) also fell in September 2024 relative to August. Concerns over the weak global economy and petroleum future demand put downward pressure on oil prices in September.

Animals and animal products (-1.5%) also contributed to the decline of the RMPI in September, mainly due to lower prices for hogs (-7.4%).

The prices of metal ores, concentrates and scrap rose 1.5% in September compared with August. Higher prices for gold, silver, and platinum group metal ores and concentrates (+2.7%) mainly contributed to the increase in this group in September.

Year over year

The RMPI decreased 8.8% year over year in September, the largest year-over-year decrease since July 2023 (-10.9%). Conventional crude oil (-21.4%), synthetic crude oil (-28.4%) and canola (-23.0%) were the largest contributors to the year-over-year decrease in the RMPI in September 2024.

Conversely, gold, silver, and platinum group metal ores and concentrates (+28.4%) and cattle and calves (+9.6%) contributed the most to moderating the RMPI’s year-over-year decrease in September.