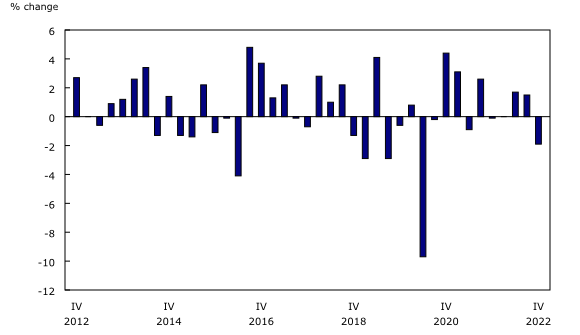

Natural resources real gross domestic product falls in the fourth quarter

Real gross domestic product (GDP) of the natural resources sector fell 1.9% in the fourth quarter, after rising 1.5% in the third quarter. In contrast, the economy-wide real GDP was unchanged in the fourth quarter.

Compared with 2021, real GDP of the natural resources sector increased 2.5% in 2022, while the economy-wide real GDP rose 3.4% for the entire year. Annual real GDP of the energy subsector (+4.0%) carried the natural resources sector, whereas forestry (-1.3%) and minerals and mining (-0.9%) both decreased.

Energy

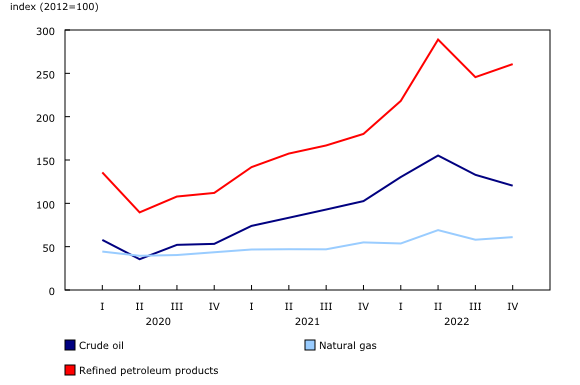

Real GDP of the energy subsector decreased 2.0% in the fourth quarter, driven by services (-6.7%) and refined petroleum products (-2.6%). Crude oil real GDP was steady (+0.3%) as production was constrained by unplanned maintenance. An oil spill in the fourth quarter, south of the border in Kansas, also disrupted the supply of Canadian crude oil to the Keystone export pipeline.

Natural resource export volumes fell 3.9% and import volumes rose 2.5% in the fourth quarter, largely influenced by volume changes in energy exports (-2.8%) and imports (+4.0%). Refined petroleum export volumes decreased 15.3%, partially due to lower exports of diesel fuel to the United States. Volumes of natural gas exports fell 5.7%, coinciding with relatively mild November temperatures in the United States, as well as rising production in that country. Exports also fell in nominal terms due to significantly decreasing prices in the fourth quarter.

Natural resource prices fell 2.7% in the fourth quarter, heavily influenced by the price of crude oil (-9.4%). The decline in total natural resource prices was also reflected in the decline in natural resource wealth in the fourth quarter. The price decline of crude oil coincided with the temporary closure in December of an export pipeline to the United States, leading to higher Canadian inventories that placed downward pressure on export prices. This was the second consecutive quarterly decrease in prices as global production was slightly in excess of global demand, among other factors.

Forestry and minerals and mining

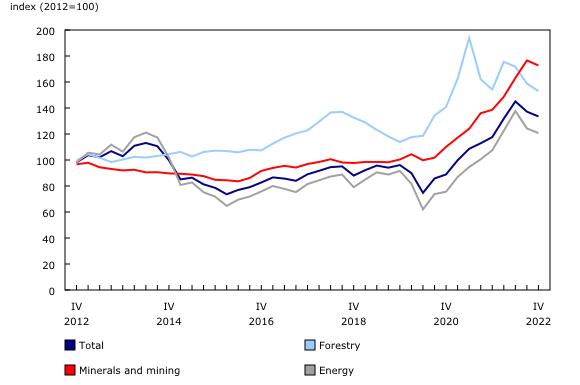

Real GDP of the forestry subsector decreased 1.8% in the fourth quarter, mostly influenced by primary pulp and paper products (-2.8%), reflecting upstream reductions in lumber extraction (-7.6%). Minerals and mining real GDP fell 1.9%, driven by metallic minerals (-2.5%) as mining of copper, nickel, zinc, gold and silver decreased due to an extreme cold weather event affecting mines in North and Western Canada. Export volumes of the minerals and mining subsector decreased 5.1%, due to lower export volumes of coal (-9.9%) to Asian countries.

Forestry prices decreased 3.6% in the fourth quarter, led by primary sawmill and wood products (-9.4%). Higher prices among services (+5.6%) and primary pulp and paper products (+2.6%) mitigated the overall decrease for the subsector. Prices of the minerals and mining subsector fell 2.2%, largely driven by a decline in the price of metallic minerals (-7.1%) due to softening demand for iron (used in steel) amid global economic uncertainty. This decrease was partially offset by rising coal prices (+12.0%).

Natural resource prices and employment

Falling prices amplified the decline in natural resources nominal GDP (-4.5%) in the fourth quarter. The decline in natural resources activity was also reflected in a 2.3 percentage point decline in the industrial capacity utilization rate in the mining and oil and gas extraction industry as well as a 2.6 percentage point decline in the forestry and logging industry. Expressed as an annual rate, the nominal GDP of natural resources was $343.7 billion in the fourth quarter, representing 13.1% of the Canadian economy.

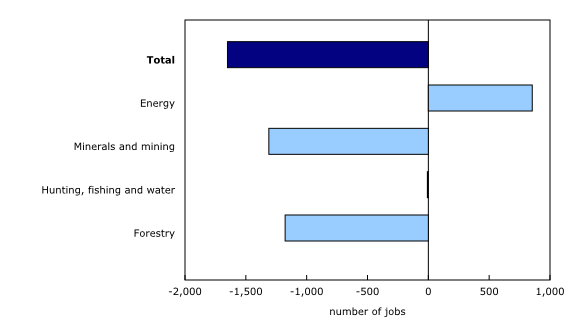

Employment changes were muted (-1,650 jobs) for the sector in the fourth quarter, with gains in the energy subsector (+850) more than offset by losses in the forestry (-1,170) and minerals and mining (-1,300) subsectors.

From the fourth quarter of 2021 to the fourth quarter of 2022, employment in the natural resources sector rose 3.3% (+20,000 jobs).

Downstream activities

The nominal GDP of downstream activities reached $11.0 billion in the fourth quarter, a 1.4% increase. Prices continued to fall (-1.5%), following a 0.5% decline in the third quarter of 2022.

Chart 1

Natural resources real gross domestic product

Chart 2

Energy prices recover from the COVID-19 pandemic, and refined petroleum prices remain high

Chart 3

Natural resource prices

Chart 4

Employment changes, fourth quarter of 2022