Mortgage rates have been on a roller-coaster ride over the past three months. After hitting a low for the year (6.08 per cent) in September, the 30-year mortgage increased steadily through the end of October. Rates then held flat for a few weeks before climbing back up to 6.81 per cent in the last week of November. They have since fallen back to 6.6 per cent in mid-December.

In mid-December, the U.S. Federal Reserve’s open market committee (Fed) cut its benchmark rate to between 4.25 per cent and 4.5 per cent. At the same time, they changed their guidance, signalling that they would likely make fewer cuts in 2025 (two versus four). So, while we expect mortgage rates will be lower in 2025, we do not expect them to fall by much.

The residential improvement market is the largest consumer of lumber. Spending in this sector has surged in recent years, averaging $240 billion in 2022-24. This is a 21 per cent jump compared to the $198 billion average from 2019 to 2021. This increase is likely due in part to rising interest rates, which have motivated homeowners to invest in their existing properties rather than face the higher costs associated with moving.

However, we anticipate a slight dip in residential improvement expenditures in 2025-26 as this backlog of projects is completed. That said, several factors will continue to support strong spending in this market. Rising home equity, limited availability of starter and trade-up homes, the aging of existing hoU.S.ing stock and homeowners’ desire to hold onto low mortgage rates will likely keep expenditures at an elevated level of around $230 billion.

We expect housing starts to be 1.347 million units in 2024, a 5.3 per cent decline from 2023, their lowest level since 2020. With mortgage rates remaining elevated in 2025, we do not expect much relief for the year. Our forecast calls for housing starts to edge only slightly higher to 1.38 million units for the year. We do expect mortgage rates will continue to trend lower through 2025 and into 2026. This, combined with the strong fundamentals (extremely high pent-up demand and demographic tailwinds) underlying softwood lumber’s main end-use markets, as well as the historically low inventories of homes for sale, will help push starts up to 1.501 million in 2026.

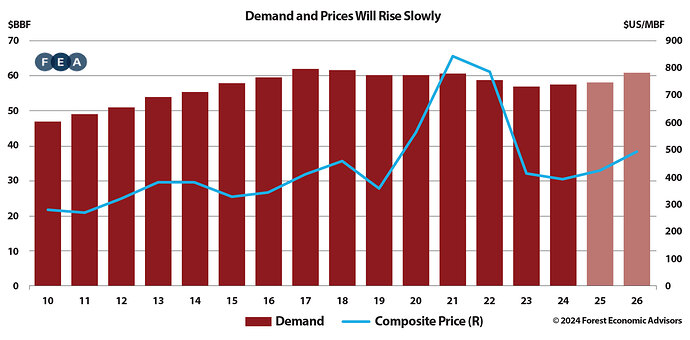

The declines in residential-improvement expenditures next year will mostly offset growth in housing starts, with North American consumption forecast to increase just 0.7 per cent for the year. We expect North American consumption growth to increase to 4.8 per cent in 2026 as the recovery in the U.S. economy and end-use markets builds momentum. Our forecast calls for demand to average 59.6 BBF in 2025-26, about 1.0 BBF or two per cent above the 58.6 BBF average of 2022-24.

Slow U.S. consumption growth, coupled with sawmill closures and higher import duties on Canadian lumber, will lead to lower U.S. imports from Canada in 2025. We do expect Canadian shipments to the U.S. to increase some in 2026 as U.S. consumption rises. Still, at an average of 11.3 BBF, U.S. imports of Canadian lumber in 2025-26 will be 8 per cent below their 2022-24 average.

Mirroring the trend in Canadian lumber imports, we anticipate a decline in offshore lumber imports. This decrease is driven by several factors, including weakened U.S. demand, lower lumber prices, and increased production costs in Europe (the primary source of U.S. lumber imports outside of Canada). Supply constraints in Europe are pushing timber prices higher, making exports to the U.S. less competitive. Conversely, U.S. offshore lumber exports are projected to rise slightly in 2025-26, as competitively priced southern pine gains traction in international markets.

Putting all this together, demand on North American mills (consumption plus exports minus imports) is expected to grow 1 per cent in 2025 and 4.8 per cent in 2026.

Weaker demand has caused more capacity closures, so even with the new capacity coming online in the U.S. South, we expect North American capacity to fall 0.4 per cent this year. This will allow the demand/capacity ratio to increase only slightly to 79 per cent. In 2025, we expect demand to grow, while timber supply constraints in the West and low prices in the South cause capacity to fall further. With prices now at or below variable costs, producers will likely curtail production sooner than we saw last spring/summer. Having recently experienced significant losses, producers have less financial leeway and tolerance for further losses. As buying ramps up in the new year and production is curtailed, the demand/capacity ratio will increase to 81 per cent. Finally, we expect the demand/capacity ratio to increase to 84 per cent in 2026 as demand growth rebounds robustly.

Canadian lumber shipments to the U.S. are currently subject to a 14.40 per cent combined duty rate. On March 5, 2024, the U.S. DOC initiated its sixth Administrative Review (AR6) of the antidumping and countervailing duties on certain softwood lumber products from Canada. AR6 covers the period January 1, 2023, through December 31, 2023. Given low prices in 2023, we expect the duty rates will increase to 30 per cent once the final determination in AR6 is published in August 2025.

These factors will significantly impact lumber prices. We forecast an 8.1 per cent rebound in the Framing Lumber Composite (FLC) in 2025. However, without more significant curtailments, prices will likely languish. We do think those curtailments will come once the duties jump up to around 30 per cent. This should push prices higher in Q3, and we then expect prices to jump 16 per cent in 2026. Weak demand, low dealer inventory levels, and low mill production will likely contribute to market volatility throughout the forecast period.

Paul Jannke is a lumber analyst and principal of the North American wood products analysis and information source, Forest Economic Advisors, LLC (FEA). www.getfea.com.