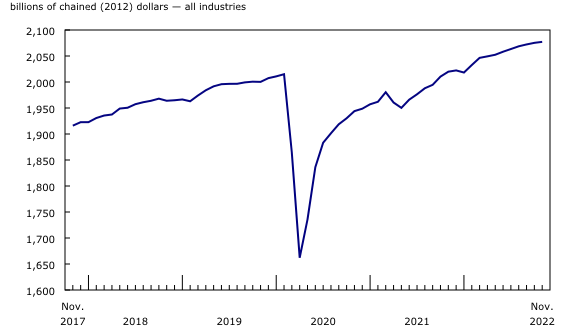

Real gross domestic product (GDP) edged up 0.1% in November, following a +0.1% uptick in October. Growth in services-producing industries (+0.2%) was partially offset by a decline in goods-producing industries (-0.1%), as 14 of 20 industrial sectors increased in November.

Chart 1 Chart 1: Real gross domestic product edges up in November

Real gross domestic product edges up in November

Chart 1: Real gross domestic product edges up in November

Advance information indicates that real GDP was essentially unchanged in December. Increases in the retail, utilities, and public sectors were offset by decreases in the wholesale, finance and insurance, and mining, quarrying, and oil and gas extraction sectors. This advance information indicates a 0.4% increase in real industry GDP in the fourth quarter of 2022 and a 3.8% increase for the year. Owing to its preliminary nature, these estimates will be updated on February 28, 2023, with the release of the official GDP data for December and the fourth quarter of 2022.

The removal of travel restrictions and rising interest rates continues to affect certain industries

On October 1, 2022, all COVID-19 border restrictions, including vaccination, mandatory use of the ArriveCAN app as well as any testing and quarantine requirements, were removed for all travellers entering Canada by land, air, or sea. This removal of restrictions continued to support gains in the transportation and warehousing sector in November.

Meanwhile, interest rate hikes by the Bank of Canada over the course of 2022 continued to have an effect on activity at offices of real estate agents and brokers, residential building construction and legal services which have been trending downward since the spring.

The transportation and warehousing sector rolls amid further travel recovery

Transportation and warehousing rose 1.0% in November, the third consecutive monthly gain, as all subsectors were up.

Chart 2 Chart 2: Transportation and warehousing sector increases in November

Transportation and warehousing sector increases in November

Chart 2: Transportation and warehousing sector increases in November

Air transportation (+4.6%) rose sharply in November and was the largest contributor to growth in the sector for a second consecutive month. This gain brought the subsector to its highest level of activity since January 2020’s pre-pandemic level as movements in domestic air carriers continued their recovery. Nevertheless, despite 10 months of uninterrupted gains, air transportation’s activity level in November 2022 was about 31% below the pre-pandemic level.

The accommodation services subsector (+2.5%) also expanded in November, driven by an increase in traveller accommodation.

Finance and insurance bounces upward following three consecutive monthly declines

After decreasing for three months in a row, the finance and insurance sector posted an increase of 0.5% in November, its largest growth rate since March 2022 when the conflict in Ukraine contributed to increased trading activity and an inflow of funds to Canada. Credit intermediation and monetary authorities contributed the most to the growth in November. Increases in household mortgage and non-mortgage debt amid the ongoing higher interest rate environment, coupled with an increase in fixed-term deposits at chartered banks, boosted activity in the subsector.

Also contributing to the increase in November was financial investment services, funds and other financial vehicles (+1.2%). The release of lower-than-expected US inflation data on November 10, contributed to falling yields and stronger activity in both the stock and bond markets, buoying equity and fixed-income asset values in Canada.

Construction falls as residential building construction activity continues to contract

Construction contracted 0.7% in November, as a result of declines across almost all subsectors. The only exception was engineering and other construction activities (+0.5%), which posted its 24th consecutive monthly gain.

Residential building construction was the main driver behind November’s decrease, contracting 1.8%. This was its seventh decline in eight months, and the largest decline since May 2022, when many unionized construction workers were on strike, causing delays in numerous construction projects. All types of residential activity fell in November, with new construction of single detached homes and home alterations and improvement leading the contraction. These two types of residential construction activity have been large contributors to the decline in residential building construction in 2022.

Repair construction (-1.0%) was also a large contributor to the overall decline in the construction sector in November, due to contractions in both residential and non-residential repairs. Non-residential building construction contracted for the first time in five months (-0.4%). Declines in alterations and improvement and new construction of public buildings more than offset gains in new construction of industrial and commercial buildings.

Retail activity down in November

Retail trade declined 0.6% in November, as 8 of 12 subsectors decreased. The most notable declines were at food and beverages stores (-1.8%), building material and garden equipment and supplies dealers (-2.9%), as well as general merchandise stores (-1.6%).

In November, the food and beverage stores subsector fell to its lowest level since April 2018. Broad-based declines were observed across all four store types in the subsector, with beer, wine and liquor stores contributing the most to the decline. Canadians saw prices increase at a faster pace in November 2022 for non-alcoholic beverages, fresh fruit, and meat.

Increased activity at gasoline stations (+4.2%) and a gain in motor vehicle and parts dealers’ stores (+1.4%) partially offset other declines. On a monthly basis, gasoline prices fell 3.6% in November following a 9.2% increase in October, largely driven by price declines in Western Canada. The reopening of refineries in the western United States contributed to lower prices in British Columbia, Alberta, Saskatchewan and Manitoba.

Accommodation and food services contracts on lower activity in the food services and drinking places subsector

The accommodation and food services sector contracted 1.4% in November following three consecutive monthly increases. Food services and drinking places drove the decline with a 2.9% contraction, which more than offset the gain recorded in the previous month. After rebounding from the effect of the Omicron variant of COVID-19 in the first half of 2022, activity in the subsector has been alternating between monthly gains and losses in the second half of the year and activity in November was 0.3% below where it was in May 2022.

Public sector continues to grow, in part due to continued high demand for health care services

The public sector rose 0.3% in November, up for the seventh consecutive month. Public administration (+0.5%) contributed the most to the growth, followed by health care and social assistance (+0.2%), also up for a seventh month in a row.

Almost all industries within public administration posted gains, with federal public administration (except defense) (+0.7%) and provincial and territorial public administration (+0.7%) contributing the most to the increase.