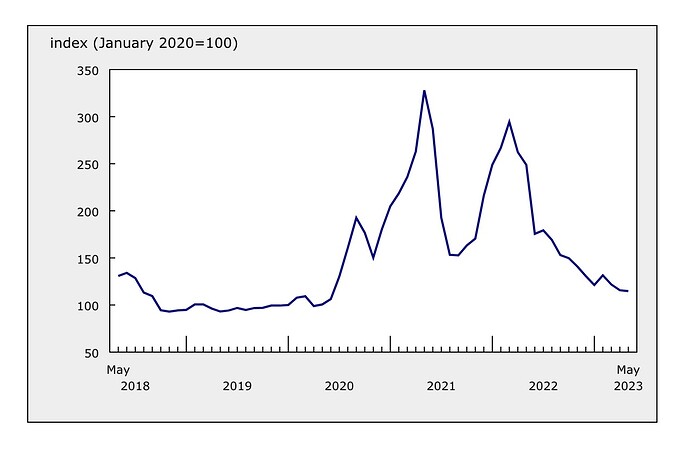

The Industrial Product Price Index (IPPI) for softwood lumber, except tongue and groove and other edge worked lumber, in May 2023 stood at 114.7, according to the latest data of Statistics Canada. This figure reflects a slight decrease compared to the previous month’s index of 115.7, indicating a continued downward trend in prices.

In May 2022, the idex for softwood lumber reached 175.6, which demonstrates a substantial decrease of approximately 34% over the course of one year. Examining the historical data, the current index of 114.7 in May 2023 is notably lower than the peak index of 328.0 recorded in May 2021. This indicates a substantial decline of about 65% from the highest point in the past two years.

Image: Industrial Product Price Index for softwood lumber (except tongue and groove and other edge worked lumber) / Statistics Canada

Prices of products manufactured in Canada declined 1.0% month over month in May, following a 0.6% decrease in April. Compared with May 2022, the index was down 6.3%. This is the largest year-over-year decline since October 2009 (-6.5%). Prices for energy and petroleum products (-5.9%) fell for a fourth consecutive month in May 2023, leading the monthly decrease in the IPPI. Compared with May 2022, prices were down 33.2%, the largest year-over-year drop since May 2020 (-45.8%). Lower prices for diesel fuel (-8.5%) and finished motor gasoline (-2.9%) were mainly responsible for the decline in the energy and petroleum products group in May 2023. Light fuel oils (-14.5%) and jet fuel (-14.5%) also posted a monthly decrease in May. These decreases were mainly due to lower prices for crude oil. In spite of production cuts by OPEC+, prices were subdued by negative sentiments regarding global macroeconomic conditions.

Prices for primary non-ferrous metal products fell 2.8% in May, after posting a 1.8% increase in the previous month. On a yearly basis, the prices declined 2.0% in May. Lower prices were widespread among industrial metals, including unwrought copper and copper alloys (-6.5%), unwrought nickel and nickel alloys (-7.0%) and unwrought zinc and zinc alloys (-10.4%). Lower prices for industrial metals were partially attributable to slowing global economic conditions and output surpassing demand, especially in China. According to the Chinese National Bureau of Statistics, the manufacturing purchasing managers’ index (PMI) continued to fall in May, signalling a contraction of the manufacturing sector in China.