Wood Resources International, a ResourceWise company, has continued to monitor China’s critical wood market. Where does it stand now with continued tensions in Russia impact global trade?

Chinese Imports Weak but Potentially Looking Up

Currently, softwood imports remain weak in the Chinese market. However, the outlook appears somewhat optimistic into the 2Q and 3Q of 2023 (if not slightly ambiguous based on multiple other factors).

Reports at the end of last year showed softwood usage around the 70,000 m3 per day mark. This is considerably lower than the 80,000 to 90,000 m3 seen in years past at the same time.

From an import standpoint, 2022 lumber finished at about 26.66 m3 – a decrease of about 8% year-over-year from 2021. The total volume decrease was also down about 4% YoY.

Softwood log imports also dropped from 23 million m3 to 14 million m3 YoY between the first half of 2021 and 2022, respectively.

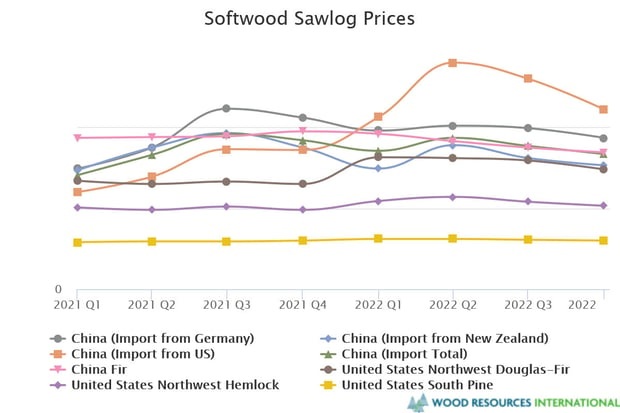

(Softwood Sawlog Prices in China and US, Q1 2021 to Q4 2022)

Continued strict COVID lockdown policies were a direct contributor to an across-the-board economic downturn in China. As these restrictions lift, however, the economy is likely to follow suit.

Chinese, Russian Timber Relationship Strengthens Amidst Trade Restrictions

In 2022, both the US and most of the EU placed several trade restrictions on Russia in wake of the country’s war on Ukraine. This move, unsurprisingly, dropped wood exports to zero by the end of 2022 for these countries.

China and other central Asian countries are not adopting the same restrictions seen in the west. This has led to several of these areas becoming the primary markets for Russian timber exports.

Despite the open policy for Russian exporting, the road between these countries is not so easily followed. Restrictions on the route between Russia and central Asian countries are causing issues in the supply chain process. This has driven the costs up for transport in all those who deal in Russian timber.

The precise numbers in terms of cost changes and expected increases have yet to pan out.

The reality of Russia’s war on Ukraine only paints an unclear picture in the year(s) to come. And the global wood market will continue to feel these impacts – both in China and the rest of the world.

Depending on how and where new Russian bans persist and current ones persevere, transport routes will also face an uphill battle for feasibility in the Chinese market.

Chinese Economy Moving Toward Consumption Over Investment

Another bit of important news: many of China’s import and export tariffs dropped at the start of 2023. The decrease is modest – from a 7.4% to 7.3% average tariff rate. However, this shows China’s intention to shift into a much broader growth economy focused on consumption.

China’s economic model has mostly relied on investment to drive its growth. As that investment now bears fruit, the model will adjust toward more consumption powered “high quality” domestic growth.

As for where the future will lead the Chinese wood market, multiple factors are at play:

- Relationship with Russia

Like the rest of the world, Russia’s export ban on raw softwood applied to China as well. China will continue importing Russian woods despite the political and economic hurdles they face in transport.

It is very likely that Chinese importers will continue upping their wood imports from Russia if they can strike discounted deals with exporters. Based on Russia’s political relationships in other major markets, a deal like this is certainly possible.

- Chinese Politics and Power Structures

President Xi Jinping carries a significant amount of power and influence across China. His ideological policies may cause further problems in their market due to potential misinformation on the state of global economic factors. Similarly, inter-country tensions and the ongoing struggles with Taiwan further exacerbate these issues.

- Superpower Status Battle with the US

China’s ambitious goals seek to vault the country into becoming the world leader in just 20-30 years. As a result, we will continue to see strife between the US and China within the next several years.

These tensions will assuredly impact the global wood market. Exactly how and where will remain an important focal point in market analysis and economic forecasting.