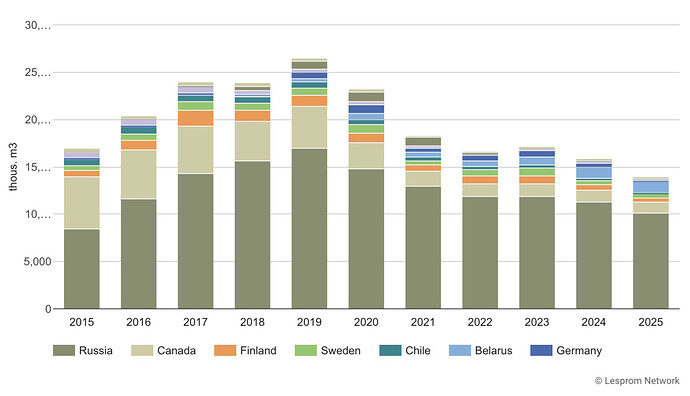

In 2025, China’s imports of softwood lumber decline 12% year-on-year to 14.6 million m3, marking the third consecutive annual reduction in import volume, according to Lesprom Analytics.

The value of softwood lumber imports contracts 11% to $3,002 million, while the average import price increases 1% to $206 per m3. China’s softwood lumber import volume in 2025 stands at about half of the 2019 peak level and represents the lowest annual volume of the past decade.

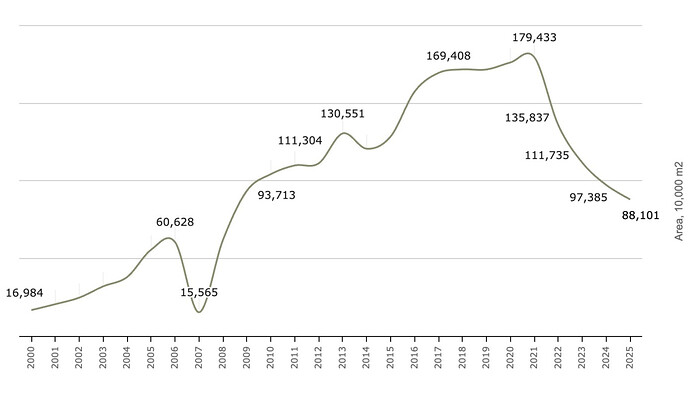

The decline reflects weak construction activity, as commercial housing sales fall to 881 million m2 in 2025, which is 37% below the five-year average and 41% below the ten-year average. New home prices continue to decrease, with prices in December falling 0.4% from November and standing 2.4% lower year-on-year, while housing starts in December fall 19% year-on-year and remain 59% below the five-year average and 64% below the ten-year average.

Image: Historical Trends in China’s Real Estate Sales / Lesprom Network

Russia accounts for 70% of China’s softwood lumber imports in 2025, with shipment volumes declining 10% to 10.2 million m3 and an average import price of $206 per m3. Canada supplies 8% of total imports, with volumes falling 11% to 1.1 million m3 and the average price rising to $191 per m3, while Belarus also holds an 8% share, with import volumes decreasing 5% to 1.1 million m3 and an average price of $195 per m3.

Finland supplies 3% of imports, with volumes dropping 28% to 448 thousand m3 and an average price of $231 per m3, while Sweden accounts for 3% of total imports, with shipment volumes declining 10% to 376 thousand m3 and an average price of $220 per m3.

Image: China’s softwood lumber imports by supplier, 2015–2025, with volumes peaking in 2019 and declining steadily to the lowest level of the decade by 2025 / Lesprom Analytics

New Zealand is the only major supplier to increase exports to China in 2025, with volumes rising 17% to 276 thousand m3 and an average price of $232 per m3. Imports from the United States fall 39% to 134 thousand m3, with the average price at $165 per m3.

Softwood lumber demand recovery will depend on construction activity aligning with housing demand.