Persistently high borrowing costs and uncertainty over the incoming Trump administration’s policies gave construction hiring managers pause in November, according to the latest labor market turnover data.

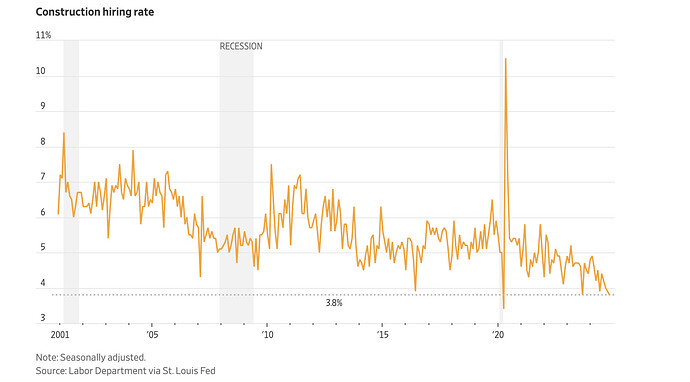

As measured as a percentage of total construction jobs, hiring hit its second lowest monthly reading on record, equaling September 2023’s rate of 3.8% and behind only April 2020, during the early days of the Covid lockdown when the rate dropped to 3.4%.

Investors have watched construction labor data for signs of a slowdown ever since the Federal Reserve began raising interest rates in March 2022 to slow inflation. Construction workers are typically among the first to lose their jobs when borrowing costs rise.

But the building boom ignited by the pandemic was prolonged by government outlays for infrastructure projects and a domestic manufacturing renaissance, resulting in record construction spending and employment even as the Fed raised interest rates to their highest level in a generation.

Tuesday’s employment data indicates that although the number of people employed in construction hit an all-time high in November, the sector may be cooling down.

Job openings were down 39% from a year earlier while hiring fell nearly 14% year-over-year.

To be sure, said Associated Builders and Contractors Chief Economist Anirban Basu, “the rates at which workers were laid off or quit also remained near historical lows, suggesting that both contractors and their employees were in a wait-and-see mode.”

Ryan Dezember

Source: WSJ