Canadian forestry giant Paper Excellence won’t have its sustainability certification revoked by the world’s premier forestry credentialing body after an examination of the company’s ties to a notorious Indonesian resource conglomerate, but environmental NGOs and legal experts say the assessment appears to be rife with conflicts of interest and far from independent.

The international Forest Stewardship Council, whose “FSC” designation on wood and paper products certifies them as sustainably sourced, conducted a “corporate group review” of allegations that Paper Excellence has deep operational and ownership ties to Indonesian conglomerate Asia Pulp & Paper (APP), which has a record of rainforest destruction and lost its FSC designation in 2007.

Greenpeace and Indonesian environmental NGO Auriga Nusantara had petitioned the FSC in November to revoke its sustainability certification of Paper Excellence’s products, following an investigation by CBC News and other media outlets last year that found that, until at least a few years ago, Paper Excellence appears to have been closely co-ordinating business decisions and sharing resources with APP. The environmental groups cited those reports, as well as their own research, in their complaint.

The FSC hired one of Paper Excellence’s go-to law firms, McMillan LLP, to conduct the review of the company.

“We are shocked that the FSC would hire McMillan LLP, Paper Excellence’s lawyers, to conduct an investigation of Paper Excellence,” Shawn-Patrick Stensil, program director at Greenpeace Canada, said in a statement.

The FSC said in a statement Friday that “prior to engaging McMillan LLP, FSC conducted a conflict of interest check and found none.”

McMillan CEO Tim Murphy said in a statement, “McMillan observes the rules of professional conduct at all times but we can say that there is no conflict.”

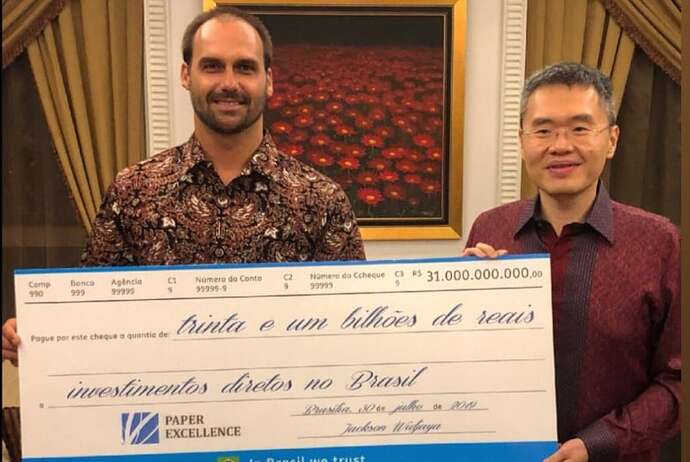

The Forest Stewardship Council says documents show Paper Excellence’s sole owner and controlling mind is Jackson Wijaya, seen at right with Brazilian politician Eduardo Bolsonaro. (BolsonaroSP/Twitter)

Review not credible, groups say

Most of Paper Excellence’s operations have some kind of FSC certification, which enables a forestry company to command higher prices and attract environmentally conscious clients. It stood to lose that certification if it was deemed a part of the APP business empire.

But the FSC announced Friday morning that its review confirmed there is “no corporate control” between Paper Excellence and APP. It said that Indonesian businessman Jackson Wijaya “is the sole direct or indirect legal owner of the Paper Excellence Group Entities and holds the sole and exclusive right to control them.”

Wijaya’s father is the head of APP and his family controls it; he held executive positions in the large China wing of his family’s business empire until at least 2017.

Greenpeace and Auriga Nusantara both said the FSC’s review wasn’t credible.

Jackson Wijaya’s father, Teguh Ganda Wijaya, is chairman of Asia Pulp & Paper. (Adek Berry/AFP via Getty Images)

“They do not disclose the data that they used,” Auriga Nusantara’s chairman, Timer Manurung, said in an interview with CBC News. “They possibly do not have comprehensive data in their analysis.”

The FSC said it could not share more information because the source documents are confidential and it signed a non-disclosure agreement with Paper Excellence.

“The evidence the FSC used in the ‘investigation’ was limited to public and corporate government records and documents provided by Paper Excellence, which naturally would not reveal how control is actually exercised in these companies,” the statement from Greenpeace’s Stensil said.

Both NGOs denounced the FSC using Canadian law firm McMillan to do the assessment.

Paper Excellence has hired McMillan at least six times over the last six years to advise on more than $6 billion US in transactions, including its takeovers of forestry companies Catalyst Paper, Domtar and Resolute Forest Products. It also represented a Paper Excellence subsidiary in a dispute with CN Rail.

‘Clearly in a financial conflict of interest’

Multiple legal ethics experts who spoke with CBC News said they felt the FSC’s decision to hire McMillan was problematic.

“If Paper Excellence has been their client previously, then they clearly are in a financial conflict of interest, because the decision that they render will have impact on their client’s willingness to continue their business relationship,” said Christina Bellon, a philosophy professor at California State University, Sacramento with expertise in practical and professional ethics.

A photo from 2017 shows Indonesian rainforest cleared to plant oil palm trees. Asia Pulp & Paper is trying to hoping to regain its FSC certification after losing it in 2007 over destructive forestry practices in Indonesia. (Goh Chai Hin/AFP/Getty)

“Paper Excellence might say in response: ‘Wow, you ruled against us. We’re going to go find another law firm.’”

Allan Hutchinson, a law professor at Osgoode Hall law school in Toronto and author of two texts on legal ethics, suggested there are “on the face of it, a number of conflicts of interest.”

“The corporation may be happy for this law firm to be involved, because they think that the law firm will protect their own interests against the agency,” he said.

“The agency may think, ‘We’re happy to use the corporation’s lawyers because we’ll get a better sense of what’s going on.’ Both of those are conflicts of interest.”

He said the review “obviously wasn’t an independent one, because if you wanted an independent one, it’s hard to imagine why you would utilize and employ the law firm of the corporation that you’re looking into.”

Paper Excellence did not answer questions about how much it has paid McMillan LLP over the years or whether it has a current retainer with the firm. A spokesperson said in an email that the company is “pleased” with the FSC’s conclusion and has “done nothing to warrant” the revocation of its certifications.

The FSC previously told CBC that it has examined ties between APP and Paper Excellence “multiple times” and has always arrived at the same conclusion: that “there is no majority ownership relationship” between the companies.