Lumber prices drop during usual seasonal buying slowdown

02:08 PM / May 31, 2022

Photo: Depositphotos

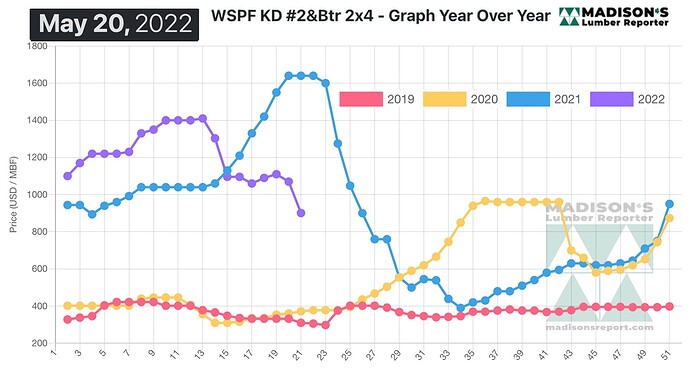

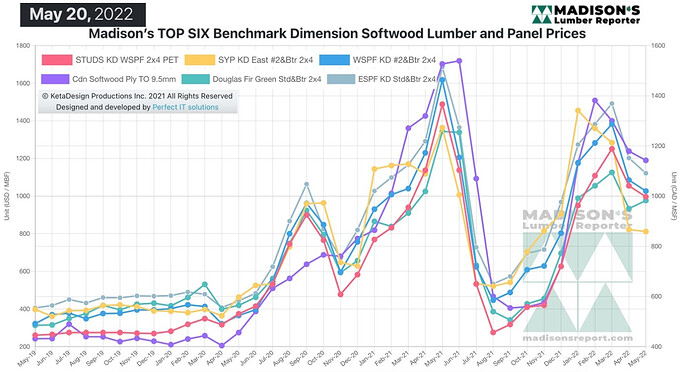

As recent supply-demand imbalance worked out, and for the usual time of year when buying slows, North American prices of most softwood lumber and panel commodities dropped significantly in the third week of May. Interestingly, this correlates almost exactly to where prices were at the end of June last year, both in trendline at actual price levels. Indeed, for the week of July 5, 2021, the price of benchmark lumber item Western S-P-F 2x4 was in the middle of a big drop downward from previously unimaginable highs, at US$760 mfbm, compared to US$700 toward the end of May this year. While prices might fall still a little bit more during June, they are not expected to reach the lowest point of last year; when they were US$390 mfbm during September, then immediately started rising again.

Most industry folks agree that the extreme volatility of spring 2020 to late winter this year should be worked out, and – while prices could still fluctuate quite a bit – levels are stabilizing. So those highest-highs and lowest-lows of the past two years should be behind us, as the “new normal” is becoming recognizable.

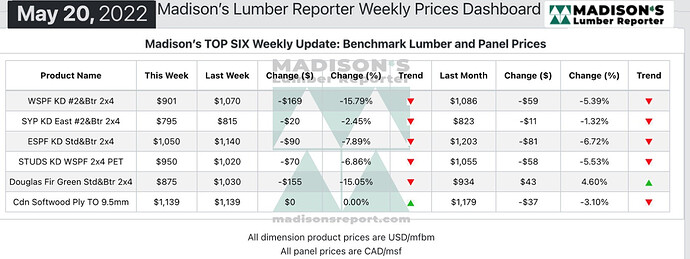

Sliding significantly from the previous week, for the week ending May 20, 2022 the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) was US$901 mfbm, down -$169, or -16%, from the previous week when it was $1,070, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.That week’s price is down by -$185, or -17% from one month ago when it was $1,086.

Sawmills marched closer to their static order files, which were into the last week of May or first week of June depending on item and source.

As spring building season should be ramping up into full swing, a tentative sense of worry permeated the lumber market. Buyers in the United States showed virtually no urgency, only buying from those from suppliers who could guarantee quick shipment.

Downward pressure late the previous week in Western S-P-F lumber rolled resoundingly into according to Canadian suppliers. The market as a whole had a benighted feel to it. Asking prices varied considerably between producers in Western Canada as large national sawmills and smaller regional facilities jockeyed for limited orders with aggressive numbers depending on the item, source, and destination. Secondary suppliers remained busy furnishing the most desperate buyers with non-discounted, quicker-shipping transactions.

Purveyors of Western S-P-F studs in Western Canada described a softening market, with prices correcting and many purchasers retreating to the sidelines in hopes of buying the bottom. Scattered sales activity persisted from customers looking to cover immediate needs, but supply appeared to be firmly ahead of demand. Sawmills order files remained into early- or mid-June.”

When compared to the same week last year, when it was US$1,640 mfbm, that week’s price is down by -$739, or -45%. Compared to two years’ ago when it was $372, that week’s price is up by +$529, or +142%.