Huge volumes of sawn timber traded into the West through the Port of Hong Kong could be sourced from illegal and deforested forests, according to Forest Trends, which warns that the European Commission’s new country classification list does little to end the trade of deforested products infiltrating European supply chains. (Photo Credit: Janusz Kolondra / Alamy Stock Photo)

The EUDR—and its new country classification list—will do little to curb the constant flow of deforested and illegal timber arriving in European ports via Singapore, India, and China. That is according to Marigold Walkins and Kerstin Canby, from Forest Trends, who spoke to Wood Central about the fundamentally flawed way policymakers have classified 194 countries as high, medium, and low risk.

Under the country benchmarking system, just four countries are classified as ‘high-risk’ (Russia, Belarus, North Korea, and Myanmar—all with current EU sanctions), 49 are ‘standard risk’, and 141 are ‘low risk’—with the categories missing out on many additional legality risks that drive deforestation. And this doesn’t pass the pub test for Walkins and Canby, who fear the ratings are shaped by diplomatic convenience rather than actual risk.

Under the European Commission’s country classification list, timber from Papua New Guinea—a traditional hotspot for deforestation—is classified as ‘low risk.’ (Photo Credit: Jeremy Sutton-Hibbert / Alamy Stock Photo)

“I think that the benchmarking results reflect the concerns within the EU Member States around enforcement,” said Walkins, a senior advisor at Forest Trends. “The whole point of the country benchmarking is to set the enforcement parameters – the percentage checks – and I think it has been created with that in mind. We know there has been pushback in the EU on the scale of checks and the resources required to fulfil them. (And) I think this might be a way of reducing some of the burden on those competent authorities.”

Both Walkins and Canby are concerned that labelling and source of origin information ‘may disappear’ when timber is exported into major timber hubs (for example China), manufactured and then re-exported into Europe: “Presumably, declarations would still need to indicate the original country of harvest,” Canby said. “But if the country of harvest is categorised as standard risk and the re-exporting country (e.g. China) is listed as low risk, how would that be treated? We already know from years of experience that much of the labelling and origin information tends to “disappear” during processing and re-export, which raises significant concerns,” she said.

[

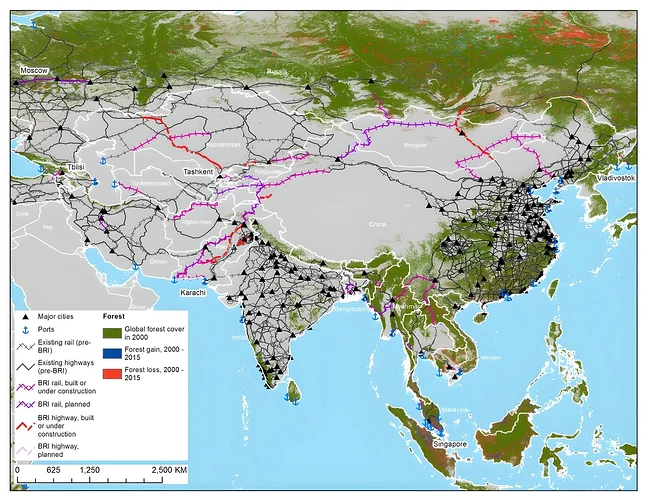

]Under the China’s Belt and Road project, more than 30% of the global supply chain of forest products will be directly impacted by Chinese industry, in the planting, production, manufacturing and distribution of products worldwide. (Photo Credit: Brookings Institute)

Canby said illegal deforestation and associated commodity trade widespread in many of the countries classified as low and standard risk: “We estimate that 50-90% of trade in some tropical countries could be connected to illegal deforestation—and that’s a level of illegality that cannot be ignored,” according to Canby, Forest Trend’s Senior Director of the Forest Policy, Trade, and Finance Initiative.

“That’s not a minor oversight. More than a decade of implementing laws like the EU Timber Regulation, the US Lacey Act, and Australia’s Illegal Logging Prohibition Act has shown that corruption, weak governance, and limited enforcement capacity are some of the clearest signals of risk—and essential for directing enforcement efforts where they matter most.”

Forest Trends ranks more than 100 countries as high-risk.

Using the Forest Trends IDAT Risk Dashboard as a reference, Watkins and Canby said that the number of high-risk countries is much higher, 104 in total, with 54 classified as ‘medium risk’ and 54 as ‘low risk’—painting a very different picture from the global benchmarking system.

“The origins (for the IDAT Risk assessment) go back 10-15 years, and are based on data provided by the World Bank, UN agencies, the Economist Intelligence Unit and other sources,” according to Canby. Wakins said the ratings look at legality, governance and the risk of circumvention in transhipment: “We take NGOs and experts in the know to work out what’s happening in countries. So when Hong Kong comes out as low risk, we know it’s not right, and categorise it as having a transhipment risk.”

As one of the world’s largest exporters of forested products into the European Union, 3% of all Brazilian products will need to be physically checked to ensure that they are EUDR compliant. (Photo Credit: BrazilPhotos / Alamy Stock Photo)

As for the EUDR, “For a regulation meant to be a gold standard for global deforestation-free supply chains, this first round of benchmarking is a missed opportunity,” Canby said. “Because even if a country is rated low risk on deforestation, it doesn’t mean it’s low risk on legality. Due diligence and enforcement targeting must be guided by a fuller picture.”