The global economy, including the European paper packaging industry, has started to shake after the US tariffs announcements.

Uncertainty has deepened due to vague arguments and misinformation. This is shifting the global power balance as trust in the US administration weakens.

Grasping the consequences of this crisis is challenging as circumstances continue to evolve rapidly, leading to increasing suspicion. However, this certainly has a global effect, although the influence on consumers differs by region and remains unclear.

Uncertainty is expected to reduce consumer confidence and purchasing activity. Moreover, a shift in consumer behavior might, in certain instances, result in boycotts of brands originating from particular regions.

Consequently, indirect changes resulting from uncertainty may cause more harm to demand than imposed tariffs. These events are expected to have impacts that last beyond a single electoral term. This presents Europe with a chance to strengthen its independence and take on a larger role in the global economy.

As a result, the European packaging paper market is experiencing both positive and negative demand shifts in the near term. However, rising uncertainties and tariffs are having a more significant impact, prompting us to lower our demand and trade forecast for containerboard and cartonboard for this year and next.

A reduction in trade is not seen as significant since tariffs are historically easy to bypass. European manufacturing is improving faster than expected, with rising defense spending likely to boost economic recovery further.

Trade wars and high tariffs may push containerboard and cartonboard production growth back into contraction. The show has begun and may harm globalization, potentially leading to a new age of self-sufficiency.

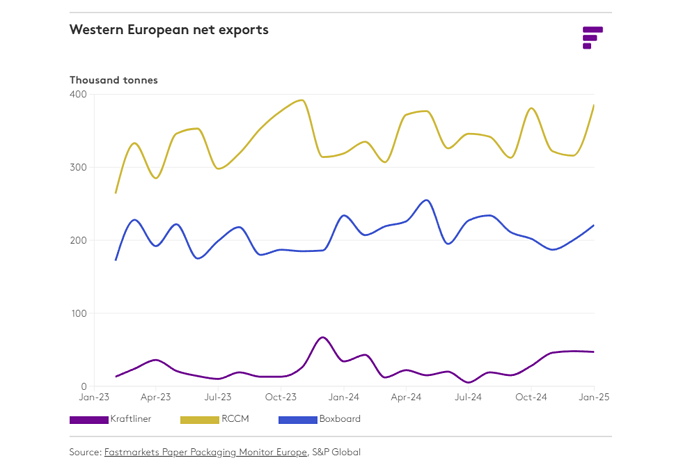

Virgin and recycled containerboard net exports remained at record high levels in January and increased more than 20% compared with the previous year.

Western European packaging: corrugated boxes and containerboard

The European manufacturing sector continued its recovery, with output increasing for the second consecutive month in April. The increase in production was the fastest since March 2022 and exceeded expectations after the United States introduced a 10% tariff at the beginning of April.

Additionally, the decline in new orders was the mildest since April 2022. This indicates that the manufacturing sector is stabilizing; however, the outlook remains vague due to an uncertain US tariff policy.

The growth of the industrial economy is evident in increased retail trade activity and the production of non-durable consumer goods. Nevertheless, the consumption and production of durable consumer goods remain pessimistic. Ongoing economic uncertainties are expected to further reduce purchasing intentions for these durable goods. Western European corrugated board shipments recovered 1.0 billion m2 (2.6%) in 2024 over 2023.

The recovery was not notably swift, given the significant reductions in corrugated board shipments in 2023 and 2022. The growth in shipments experienced a slowdown during the second half of 2024. Preliminary figures suggest that this deceleration has persisted into early 2025.

Shipments are projected to rise to 10.2 billion m². This reflects a year-on-year growth of 2.2% in the first quarter of 2025. So far, political and economic uncertainties seem to have little impact on corrugated board shipments. However, conditions became more uncertain in the early second quarter. This is expected to further reduce the growth of corrugated board shipments.

Western European containerboard demand growth has shown similar patterns to corrugated board demand growth. Demand increased more than 880,000 tonnes (3.8%) in 2024 over 2023; virgin containerboard demand grew 345,000 tonnes (8.6%) and recycled containerboard rose 535,000 tonnes (2.8%). Preliminary figures suggest that containerboard demand growth was mild and increased 50,000 (0.8%) in the first quarter of 2025 over the same period in 2024.

Western European packaging: cartonboard

Recovery in the European manufacturing sector has improved cartonboard demand in Western Europe faster than expected in the first quarter of 2025. The recovery hike resembles that seen in the first quarter of 2024. An increase in cartonboard demand is due to widespread improvement in retail trade and non-durable consumer goods demand.

The demand for food and beverage products, as well as pharmaceutical items, is estimated to have made the most significant contribution to the increase in cartonboard demand. Nevertheless, the prevailing uncertainty in the economy and tariffs are hindering the consumption of durable goods and branded luxury items, thereby restricting the recovery of cartonboard demand.

However, the recovery in the manufacturing sector continued in April, supporting faster-than-expected growth in cartonboard demand in the coming quarters. Cartonboard grew more than 515,000 tonnes (10.6%) in Western Europe in 2024 compared with 2023.

Preliminary figures indicate that cartonboard demand soared 169,000 tonnes (13.8%) in the first quarter of 2025 compared with the previous quarter. The year-on-year comparison of cartonboard demand is estimated to be nearly 10,000 tonnes (0.5%) lower in the first quarter.

However, improved conditions within the manufacturing sector have elevated the estimation of cartonboard demand by approximately 70,000 tonnes compared with prior forecasts.

Western European cartonboard net exports recovered fast in the first half of 2024 but weakened significantly toward the end of 2024 and even started to decline to Asia, Africa and the Middle East. However, net exports increased more than 275,000 tonnes (9.6%) in 2024 over 2023.