Worldwide demand for lumber was down considerably in the 4th quarter of 2022. This decrease caused global sawlog prices to all fall from their record highs.

Increased interest rates, higher inflation, and market uncertainty regarding the ongoing possibility of recession in 2023 resulted in lower housing starts. Furthermore, renovations in the second half of 2022 also fell – amplifying the shift.

These two wood end-use sectors are significant drivers in the consumption of forest products demand worldwide. Their numbers often set consumption and pricing levels of sawlogs in many markets.

The weak lumber markets have led to reduced sawlog prices, with some delay, on most continents.

According to WoodMarket Prices data, the most significant price declines from the first and second half of 2022 occurred in the following areas:

- Western North America

- Baltic States

- Central Europe

During 2022, the US dollar saw some strengthening against most worldwide currencies with appreciation up to 12%. As a result, sawlog prices (in USD) dropped between 3% and 20% from the Q4 2021 to Q4 2022 in most of Europe and Asia.

From the North America perspective, prices moved down in the second half of 2022. But they were still up a few percentage points year-over-year by Q4 2022.

GSPI Sees 2 Quarters of Declines from All-Time Highs

The Global Sawlog Price Index (GSPI), consisting of sawlog prices from 21 key regions worldwide, has fallen for two consecutive quarters from its all-time high. The change was somewhat modest at 8%. For comparison, the GSPI rose nearly 30% from the 2nd quarter 2020 to 2022.

ESPI Also Declines After Record Highs

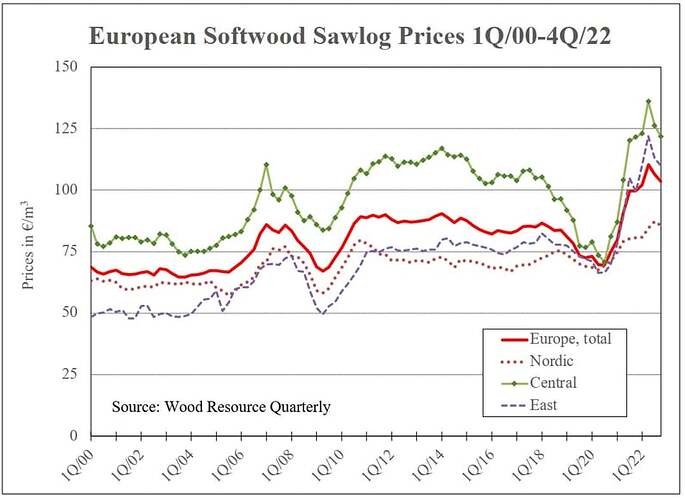

Following suit, the Euro-denominated European Sawlog Price Index (ESPI) also fell in late 2022 after reaching a record high in the 2nd quarter. Despite a 6% decline over 6 months, current sawlog prices are still close to their highest levels in over 20 years.

Over the past 5 years, log prices in Europe have undergone dramatic swings. The ESPI fell from a major high in 2018 to a 15-year low 2020. Of course, the pandemic fueled growth to an all-time high in 2022 (see chart).

The price discrepancies between the Nordic, Central, and Eastern regions have also changed since 2020. Back then only a small difference between the low-cost Nordic and high-cost Central regions were found.

This discrepancy increased over 5 times in 2022 because of relatively modest price changes in Northern Europe. Conversely, log prices surged in continental Europe.

Source: Global Sawlog Prices Finally Drop From Record Highs as Demand Sags