Businesses that burn wood to produce energy have struggled in the United States to compete economically, even as wood-pellet exports to Europe from states like Alabama and North Carolina have soared with overseas subsidies.

But the industry’s domestic fortunes could soon change.

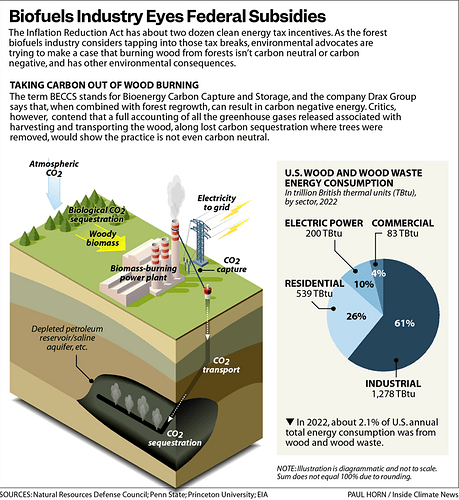

With the Inflation Reduction Act (IRA) designed to take on climate change through billions of dollars of direct appropriations or tax breaks, forest biomass-to-energy could potentially see sizable growth domestically.

In response, environmental groups worry the U.S. might be about to follow Europe down its controversial path of burning wood to generate electricity as part of a renewable energy policy, despite a lot of scientists having concluded the practice is worse for the climate than burning coal.

The Biden administration, including the U.S. Treasury Department, is now navigating competing claims about the risks and benefits of burning wood to the climate and to the health of forests. Treasury’s Internal Revenue Service will have a key role to play in deciding which businesses get tax breaks even as provisions of the IRA were written so as to not overtly pick winners and losers among various types of energy production, such as natural gas, wind, solar or biomass.

One global business player—the British utility Drax Group—that buys and makes wood pellets in the United States and burns them in the United Kingdom, has opened an office in Houston and announced two new biomass power plants with carbon capture and storage technology in the American South, and possibly nine others.

Drax officials declined a request to be interviewed. But last year, Drax Chief Executive Officer Will Gardiner said Biden’s approach to climate change through the IRA “has turned heads overseas,” calling out the law’s $85 credit for every ton of captured and sequestered carbon dioxide.

“For businesses, including my own, the investment opportunities are transformative for both companies and the climate,” he said in a written statement. “The provisions in the Inflation Reduction Act … make the U.S. an attractive place to be.”

Environmental groups are watching the Treasury Department closely, noting it could tip the scales, depending on various assumptions built into computer models that calculate greenhouse gas emissions, and how it decides who gets the financial incentives.

“If harmful, polluting forest biomass energy production is wrongly credited under these IRA tax provisions, then the industry could grow and generate climate pollution in an exponential fashion, the way it has in the U.K. and the EU—undermining the climate objectives in the Act itself,” said Sami Yassa, a senior research specialist with the Natural Resources Defense Council.

Officials with the Treasury Department declined to comment on its handling of IRA tax incentives.

“Innovation” or “a Threat?”

Burning wood to produce electricity is a relatively small industry in the United States. As of 2022, about 2 percent of U.S. annual total energy consumption was from wood and wood waste, including bark, sawdust, wood chips, wood scrap and paper mill residues, according to the U.S. Energy Information Agency. But in the last dozen years, fueled by European subsidies and other policy incentives, wood pellet mills feeding overseas power plants have grown like kudzu vines across the South, making the U.S. the largest wood pellet exporter.

In theory, carbon dioxide emitted from burning wood gets taken up and stored by newly planted trees in a form of carbon recycling.

But in practice, some scientists have found that burning wood on a large scale to produce electricity is more damaging to the climate than burning coal. They cite a “carbon debt” that cannot be paid back fast enough by regrowth during the two-decade time frame in which a rapid reduction of carbon emissions is needed to meet the goals of the U.N. Paris Agreement on climate, which some scientists see as already slipping away from the world’s grasp.

There are also concerns that incentivizing forest biomass electricity could damage local ecological systems by accelerating tree cutting beyond what could be deemed sustainable.

To environmental advocates like Adam Colette, program director with the Dogwood Alliance, a North Carolina-based environmental nonprofit, the IRA is “one of the biggest emerging threats to southern forests.”

The law, Collette said, for the first time provides incentives for “large-scale energy generating facilities … in the United States, being built in the United States, using forest biomass. That’s something we have not seen.”

Industry representatives dispute the characterization of forest biomass energy as anything but renewable.

“What I see is innovation,” said Elizabeth Woodworth, the interim executive director of the U.S. Industrial Pellet Association, a trade group that advocates for wood energy as a solution to climate change, and whose members include DRAX, Weyerhaeuser and Enviva, the world’s largest wood pellet maker that announced it was filing for Chapter 11 bankruptcy on Tuesday.

“The thrust behind the IRA in general is to find alternative and renewable energy sources. Our (energy) demand, unfortunately, is not going down. And yet, we are in a critical phase with climate change. So this bioenergy is a tiny part of it, that it’s also meant to incentivize wind and solar and battery, battery storage, hydroelectric, etcetera.”

Spurring a Clean-Energy Transition

The Inflation Reduction Act of 2022, President Joe Biden’s signature climate bill, commits the federal government to providing $370 billion—an unprecedented amount—for reducing heat-trapping pollution. Federal spending or tax breaks in the IRA are a big part of the president’s goal of cutting economy-wide carbon emissions 50 percent by 2030 and 100 percent by 2050.

One tax measure that could benefit wood burning, along with other forms of energy production, boosts tax credits for technology that captures and permanently stores the heat-trapping gas carbon dioxide, such as what Drax is considering. These carbon capture tax credits are already available for companies that seek them.

Another tax incentive given a lift by the IRA centers on the actual production of what’s deemed to be “clean energy,” and it is viewed by the wood biomass industry and private forest owners as a potential benefit to them. The Treasury Department has the rest of 2024 to develop guidelines, and business and environmental groups have been trying to influence the agency’s thinking as it decides whether burning wood qualifies as a clean energy source, like wind and solar power.

And a third tax break is one that can be used to offset the cost of production of “advanced manufacturing” equipment, typically thought of as things like solar and wind energy components.

Environmental advocates were unsure how many wood biomass companies may be seeking the advanced manufacturing subsidy, but they know of at least one that has said it was. Financially troubled Enviva has told investors it was seeking millions in those tax breaks to help build two new large pellet mills—one in Mississippi and one in Alabama.

In all, the Biden Administration counts about two dozen clean-energy tax provisions of the IRA, as Biden touts a climate record that helps the environment and generates jobs in his pursuit ofe re-election to a second term this fall. Together, the tax incentives are meant to “save families money on their energy bills and accelerate the deployment of clean energy, clean vehicles, clean buildings, and clean manufacturing,” according to the White House.

Drax has announced, without identifying the specific locations, two so-called “BECCS” plants, referring to “bioenergy with carbon capture and storage,” and the company has said it is working to develop nine more in the United States. The company has said the plants will actually be carbon negative, going beyond carbon neutral.

At the end of January, Drax also announced a partnership with Mississippi-based Molpus Woodlands group to supply it with what it described as “low-grade roundwood including forest thinnings and residues left over from timber harvesting.”

It’s not likely that BECCS plants would need to burn pelletized wood, since the pellet-making process is used to dry out and reduce the weight of forest materials—and to sanitize it—for overseas shipping, said Woodworth, the industrial pellet association leader.

Woodworth said forest biomass is but part of the climate solution.

“I want everybody to have a shot at this,” she said. “I want to see more solar, I want to see more wind, I want to see more hydro energy. And I want to see more bioenergy using renewable resources, because we need every ounce of renewable energy that we can get right now.”

If it takes government money as an incentive, “fine, let’s do it,” she added.

The American Biomass Energy Association, which represents companies producing energy in the United States by burning woody materials or other agricultural debris, and the National Alliance of Forest Owners have also come out in favor of tax credits for domestic forest biomass energy development.

“… I want to see more bioenergy using renewable resources, because we need every ounce of renewable energy that we can get right now.”

The nation’s 46 million acres of private “working” forests are in good health, and growing, the forest owners group wrote to the Treasury Department in 2022, commenting on the IRA tax provisions.

“Credible third-party certification systems are available in the United States to ensure sustainable practices in support of climate and other co-benefits,” the group wrote, encouraging the Treasury Department to recognize United Nations protocols that have encouraged biomass combustion.

“It’s really important to look at the economics,” said Carrie Annand, executive director of the American Biomass Energy Association based in Washington, which represents a lot of member companies that are “trying to make ends meet.”

Democratic Lawmakers’ Objections

Environmental advocates remain deeply skeptical of the forest biomass industry and any efforts to boost it through the tax codes.

While the industry generally maintains that it only uses wood waste or low-value trees, critics have issued reports with photographs that they say show destructive logging practices and the conversion of entire trees to wood pellets.

They also often point to a 2021 letter, now signed by more than 800 scientists, to President Biden and European leaders, defending the need to protect Southern forests from biomass energy.

“Trees are more valuable alive than dead both for climate and for biodiversity. To meet future net zero emission goals, your governments should work to preserve and restore forests and not to burn them,” the scientists wrote.

A logging site in Chowan County, North Carolina, where photographer Tom Brennan saw trees being chipped and hauled to the Enviva Ahoskie wood pellet mill in 2022. Credit: Tom Brennan

Adding carbon capture to burning wood doesn’t make this energy source’s climate threat go away, environmental advocates contend.

Real-world carbon capture rates are much lower than utilities typically claim, and that would likely be true with a dirty process like burning wood, said Anika Juhn, an energy data analyst with the Institute for Energy Economics and Financial Analysis (IEEFA). “Post combustion, you’ve got all kinds of pollutants you need to clean out before you can capture the C02, so it’s a very inefficient process that takes a lot of work,” she said.

Yassa, with NRDC, argues that carbon emissions associated with logging, fuel preparation and transportation need to be factored into any forest BECCS plants. Even without making pellets and shipping them overseas, the “upstream” emissions are substantial, as is the lost carbon sequestration in the logged forests.

Others point out that if forests are not allowed to regrow, either because of development, or if they burn in a wildfire, then any carbon neutrality calculations become faulty.

But the potential IRA incentives could add up to real money, if the industry can get it.

“Trees are more valuable alive than dead both for climate and for biodiversity.”

Drax, for example, has said its first two BEECS power plants could capture as much as 3 million tons of carbon a year each, which, according to the IRA provisions, could potentially produce a combined tax break of $510 million a year for 12 years.

Under the clean energy production credit, even a power plant just burning wood to make electricity with no carbon capture could save millions a year for a decade, depending on its capacity.

For the announced Enviva wood pellet mill in Epes, Alabama, the company could potentially get an advanced manufacturing equipment tax credit of $110 million, or 30 percent of a project that the company has said could cost $375 million, according to AL.com. Advocates in Alabama have questioned that proposed plant’s climate and community benefits.

“I don’t know what seems less advanced than burning wood,” said Heather Hillaker, a North Carolina-based staff attorney with the Southern Environmental Law Center, a nonprofit environmental law firm, referring to the advanced manufacturing production credit.

Enviva had been teetering on the edge of bankruptcy, its stock having fallen from a high of $51 in January to less than a dollar for the last month, with company officials blaming unfavorable wood pellet pricing, problems at a plant in Virginia, higher interest expenses and other factors.

Hilliker said it was unclear how the company’s financial condition could affect Treasury’s decision—expected by the end of March—on whether Enviva will be among the companies getting the tax break, though she said she does not believe manufacturing wood pellets to ship overseas to burn should even qualify. The company’s bankruptcy filing, she said, “demonstrates what we have argued for years—the biomass energy industry is not financially viable.”

Also, pellet mills across North Carolina and the South are often located near Black and low-income communities, where the pollution has become a significant environmental justice concern, Hillaker said, adding that Treasury officials are supposed to factor such concerns into their decision-making.

Enviva did respond to a request for comment.

“We look forward to emerging from this (bankruptcy) process as a stronger company with a solid financial foundation and better positioned to be a leader in the future growth of the wood-based biomass industry,” said Glenn Nunziata, interim chief executive officer of the company, in a press release.

Earlier this month, Reps. Don Beyer (D-Va), Ro Khanna (D-Ca), Alma S. Adams (D-NC), Valerie Foushee (D-NC), Raúl Grijalva (D-Az) and Barbara Lee (D-Ca) sent a letter to Energy Secretary Jennifer Granholm and IRS Commissioner Daniel Werfel objecting to what they called the “carbon-intensive, industrial-scale wood pellet bioenergy producers” seeking the IRA tax break.

“Industrial-scale wood bioenergy producers—which operate wood pellet mills in the U.S. Southeast and then export pellets to biomass power plants in Europe and Asia—do not meet our climate goals,” the lawmakers wrote.

To energy expert David Schlissel, director of resource planning analysis with IEEFA, the unprecedented climate investments found in the IRA also bring a large measure of unpredictability, as illustrated by all the questions surrounding the law’s potential impact on the country’s forests.

“Welcome to the world of gigantic subsidies, and to the same world of great uncertainty about whether the subsidies are going to mean meaningful reductions in carbon dioxide emissions,” said Schlissel. “I am very cynical about this whole process.”

Source: How Clean Energy Tax Breaks Could Fuel a US Wood Burning Boom - Inside Climate News