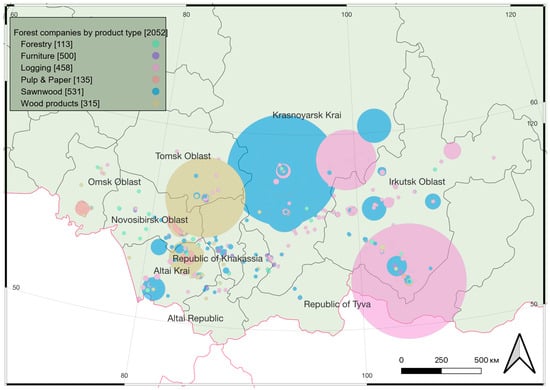

Location of Siberian forest companies by size and industrial specialization. The size of the circle reflects the firm’s revenue in 2022. Made using QGIS version 3.34.1.

In 2022, the Russian forest sector was severely affected by the government’s ban on the export of unprocessed timber and trade sanctions imposed by several countries. It is generally recognized that the regions of the Russian North-West are the most affected by trade barriers that have emerged. Against this background, the impact of bilateral trade restrictions on timber companies in the Asian part of Russia is not discussed.

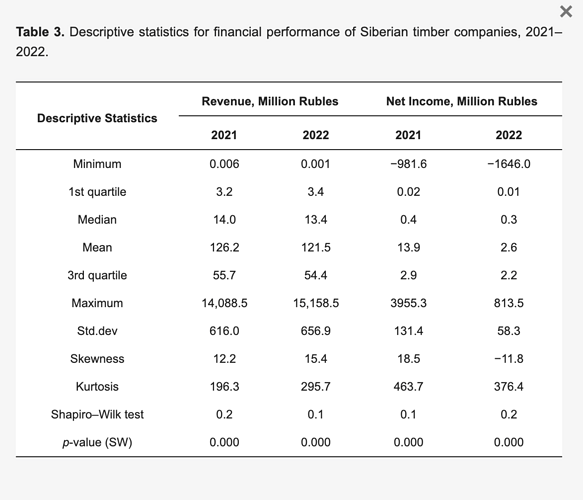

Nevertheless, the forest industry is an important sector of the Siberian economy that has an economic, social and environmental impact on the life of local communities. This paper analyzes the differences among Siberian timber companies in their response to the crisis depending on three factors: industrial specialization, scale of revenue and regional location.

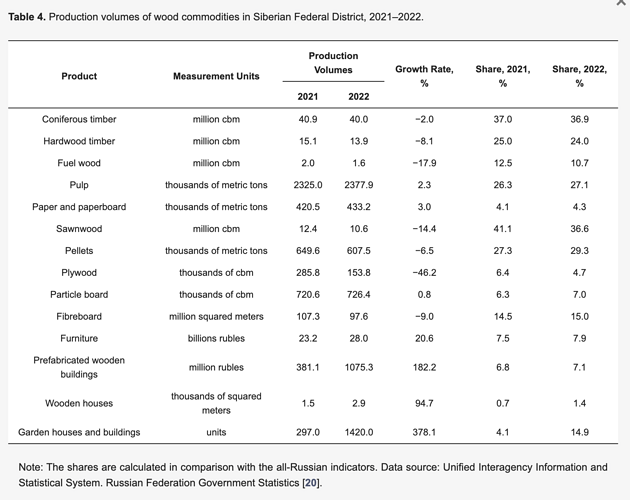

The results show that in 2022 the highest median revenues and net profits were generated by small firms that were focused on the domestic market and benefited from reduced competition due to sanctions. There is also evidence that spatial heterogeneity in the response to the crisis may be due to the different support measures of regional authorities and the proximity of the region to border points. We argue that the current conditions may become a new driver for the timber industry development, aimed at the growth of added value and expansion of domestic demand for wood products.

In summary:

- The analysis of the financial performance of Siberian forest companies showed that in 2022 the industry experienced a strong impact of internal and external effects. The ban on the export of raw wood combined with trade sanctions has created fundamentally new conditions and incentives for the development of timber companies in Siberia. These effects reflected both the structure of production and the financial results of forest companies.

-

The Kruskal–Wallis testing showed a significant difference in the response to the crisis for different sectors of the forest industry. The best financial performance were shown by sectors that are focused on the domestic market (forestry) and have gained new opportunities due to the departure of Western competitors (pulp and paper, furniture manufacturing). The biggest drop in revenue and net profit occurred among companies whose main activity was logging and sawn wood manufacturing, as well as companies focused on the markets of Europe and the USA (plywood, fiberboard, particle board).

-

The results demonstrate that the firm scale also had an impact on the financial results of Siberian timber companies in 2022. Large and medium-sized companies suffered more due to the large volumes of forest products that previously went to the world market, as well as due to the high base for comparison, since record export revenue was received in 2021. At the same time, this result may be a consequence of selection bias, since the sample did not include companies that ceased operations in 2022. Among such companies, naturally, there is a large proportion of microenterprises with small revenues. Therefore, this issue requires careful further research.

-

We confirmed the presence of spatial heterogeneity both in the level of development of the forest industry [33] and in the regions’ resistance to sanctions pressure [72]. Even regions with a similar structure of companies by type of activity such as Krasnoyarsk Krai and Irkutsk Oblast endured the crisis in different ways. It was shown that the financial results of forest companies located in different regions were influenced by their proximity to customs checkpoints and regulatory measures of regional authorities.

-

In the short term, Siberian forest companies suffered losses due to the closure of a significant part of the global market, lack of transportation capacity, logistical problems and the inability to export unprocessed timber. However, the new conditions and incentives that have developed in 2022 for Russian forest companies have opened up opportunities for the reindustrialization of the forest sector aimed at increasing added value in the production structure and the development of the domestic market. The drivers of future growth will be wooden housing construction, the transfer of residential heating systems from coal to pellets and the intensification of the transition to paper packaging instead of plastic.