India’s pulp and paper market is currently experiencing a significant transformation fueled by a mix of economic, demographic, and technological factors. Professionals in the paper industry need to understand and grasp these changes to capitalize on the various opportunities and navigate the many challenges that lie ahead.

In this blog post, we’ll provide a comprehensive overview of India’s pulp and paper market, shedding light on the key trends, opportunities, and challenges that industry stakeholders must keep in mind.

Overview of the Indian Pulp and Paper Market

India is one of the world’s fastest-growing economies, with a current GDP growth rate of 7.5%. This rapid economic development has led to an increase in demand for various goods and services, including paper products.

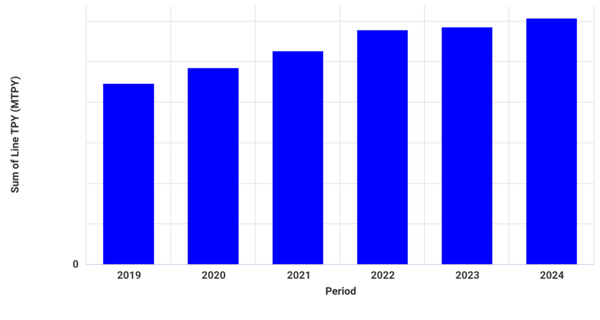

The country’s paper production capacity has experienced consistent and substantial growth in recent years. By the end of 2024, the country is projected to achieve a compound annual growth rate (CAGR) of 6.30% in pulp and paper capacity since 2019.

India’s Pulp and Paper Capacity (Actual and Announced)

Source: FisherSolve

The pulp and paper industry play/s a vital role in the Indian economy, offering employment opportunities to over 500,000 individuals. Their labor contributes approximately 1.6% to India’s total GDP.

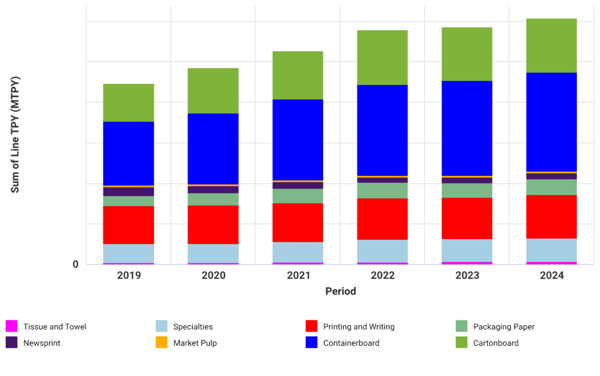

Growth in Different Grades

Writing, printing, and copier grades are performing fairly well compared to other paper grades, a trend not seen often in major producing countries. The steady demand reflects the essential nature of these products in education and business operations.

India’s Pulp and Paper Capacity by Major Grades (Actual and Announced)

Source: FisherSolve

Rising literacy rates, especially in rural areas, have fueled the demand for writing and printing paper. The growing emphasis on education and learning will continue to drive the consumption of these grades.

An example of this is the implementation of India’s New Education Policy (NEP) in the 2023-2024 academic year, which has positively influenced the demand for printing paper. Highlights of the NEP include extended schooling period, higher education reforms, universal access to school education, foundational literacy and numeracy, and more. This revamped syllabus and grade system restructuring present opportunities for paper producers.

Producers must prioritize upholding the quality and availability of printing and writing grades to meet market demands and exceed expectations. By aligning their strategies with the NEP, producers can effectively cater to the evolving educational landscape.

The demand for tissue products, whether for household or commercial use, has also seen significant growth. Items such as toilet paper, paper napkins, and kitchen towels are becoming increasingly popular.

While a large portion of the demand for paper napkins currently leans towards MG paper due to its cost-effectiveness, there is a noticeable shift towards soft tissue products. This change is primarily driven by a heightened awareness of hygiene practices and an increase in disposable incomes.

Investments in the tissue sector are on the rise, targeting both local consumption and international markets. Leading companies like GSPBL, APPM, and TNPL are spearheading these efforts with new projects and advancements. These investments showcase the potential for growth in the tissue industry and present opportunities for innovation and expansion.

An Overview of India’s Challenges

Navigating the dynamic landscape of the Indian pulp and paper market is not without its difficulties. Here are some of the key challenges that industry stakeholders must address to ensure sustainable growth and competitiveness.

High Raw Material Costs

One challenge India’s fine paper and packaging board producers are grappling with is high raw material costs. Be it waste paper, imported pulp, or wood chips, the cost pressures are significant.

The rise in raw material expenses has prompted producers to increase the prices of their final products. Fine paper and recycled board in particular have experienced notable price surges. While this adjustment is essential for sustaining profitability, it also presents a hurdle in terms of market acceptance.

Containerboard Sector Issues

India’s containerboard sector (kraft grades) has also been facing several challenges recently, including surplus capacity, volatile raw material scenarios, and outdated machinery.

The adoption of advanced and efficient machinery is essential for overcoming some of these issues as it can help optimize their operations and remain competitive. Despite the current challenges, the future prospects for containerboard in India are promising. The domestic market is growing, and with the right strategies, producers can capitalize on opportunities in this sector.

Container Freight Rates

Soaring container freight rates have also significantly contributed to the demand for price hikes in board mills. The increased shipping costs have subsequently impacted the overall supply chain, necessitating adjustments in product pricing.

To address the challenges posed by increasing freight rates, producers need a range of strategies at their disposal. These include optimizing shipping routes, engaging in negotiations for improved contracts with logistics providers, and harnessing technology to enhance visibility across the supply chain.

High Imports of Paper and Paper Products

The Indian paper industry is grappling with a significant challenge from imported paper. According to the latest data from the Directorate General of Commercial Intelligence & Statistics (DGCI&S), the volume of paper and paperboard imports in India surged from 1.145 million MT in 2021-22 to 1.436 million MT in 2022-23, reaching 1.929 million MT in 2023-24. This represents an increase of over 68% in just two years.

Notably, imports from China have skyrocketed by 181% over the past two years, while those from ASEAN countries have surged by an astounding 247%. The duty-free import of paper into India has made domestic paper production uncompetitive, posing a serious threat to the sustainability of the Indian paper industry.

Opportunities to Capitalize On

Despite the challenges, the Indian pulp and paper industry is ripe with opportunities for growth and innovation. By capitalizing on emerging trends and strategic investments, stakeholders can navigate the evolving landscape and achieve long-term success.

Surge in Demand for Recycled Board

After a prolonged slowdown, recycled board is witnessing a surge in demand. Economic recovery and growing industrial activities have contributed to this upward trend. The increased demand is a positive sign for the industry, indicating renewed growth and stability.

The market’s acceptance of higher recycled board prices is a testament to the product’s value and necessity. Customers recognize the importance of recycled board in packaging and other applications, leading to sustained demand.

Coated board grades are expected to see further price increases in the near term. The strong demand and market acceptance create a favorable environment for these adjustments.

Booming Flexible Packaging Market

India’s flexible packaging market is booming, driven by a growing middle-class population and increasing export demands. The shift towards convenience, hygiene, and sustainability enhances its appeal.

This growth presents significant opportunities for producers, enabling them to expand their product offerings and customer base.

Flexible packaging offers several advantages, including durability, lightweightness, and extended shelf life. These benefits make it ideal for perishable items and other consumer goods.

Innovations like resealable closures and sustainable materials are shaping the future of flexible packaging. These trends align with consumer preferences for convenience and eco-friendliness.

Decor and Absorbent Kraft Grades

With the real estate market growing steadily, décor and absorbent kraft grades have significant potential. These grades are essential for interior design and construction applications.

Most of the demand for décor grades is currently being served through imports. This presents an opportunity for local producers to capture a share of the market by offering competitive, high-quality products.

The total sales of décor paper in India are projected to reach US$ 448.5 million by 2033, with a CAGR of 7.2% over the next decade. This growth underscores the potential of the décor segment and the opportunities it presents for producers.

Emerging Trends and Consolidation

Emerging trends to watch out for in the next few years in India’s market include:

-

Increasing demand for paper products : There is a growing demand for paper and paper-based products in India. This trend reflects the essential nature of paper in various applications, from packaging to education.

-

Market fragmentation and consolidation : The Indian pulp and paper market is highly fragmented, with many small-sized mills operating in clusters like Morbi and Vapi. However, there is a trend towards consolidation with inefficient and low-profit mills closing down. Consolidating production into larger capacities optimizes resources and enhances efficiency, providing a competitive edge in the market.

-

Structured waste paper collection system : A more structured and organized waste paper collection system, similar to those in Europe and the US, holds significant potential for India. Reducing dependency on imported waste paper and OCC can enhance the sustainability and cost-efficiency of the industry.

The Future of India’s Pulp and Paper Industry

The future of India’s pulp and paper industry is bright, with numerous opportunities for growth and innovation. From expanding product lines to adopting advanced technologies, producers have several avenues to explore.

Focusing on sustainability, efficiency, and quality will be key to unlocking these opportunities and driving the industry forward.

However, despite the promising outlook, the industry faces several challenges, including high raw material costs, supply chain disruptions, and market fragmentation. Addressing these challenges requires strategic planning, investment, and collaboration.

Producers must remain agile and proactive, anticipating and responding to these challenges effectively. To thrive in this dynamic market, producers should focus on:

-

Investing in advanced machinery and technology.

-

Enhancing supply chain management and efficiency.

-

Expanding product lines to meet evolving market demands.

Source: India's Pulp and Paper Industry: Opportunities and Challenges