As the overall cost of doing business continues to climb, logging and timber-hauling companies within the region are adapting to remain viable

Clint Krueger, owner of Mahtowa-based Krueger Dirtwerx, “slashes” timber into 102-inch lengths at a harvest site in the Superior National Forest north of Two Harbors on Jan. 3.

Contributed / Ray Higgins

January 09, 2024 at 6:00 AM

Share

News reporting

DULUTH — In the wake of the pandemic, inflation has continued to affect businesses across all sectors, including the forest products industry.

As the fifth-largest manufacturing industry in Minnesota, logging accounts for nearly 68,000 jobs and has a $9.9 billion annual direct impact on the state’s economy, with a total output of $16.8 billion, according to the “2020 Economic Contribution Study of Minnesota Agriculture and Forestry” compiled by AgriGrowth.

Maple harvested from a site in Superior National Forest waits to be processed.

Contributed / Ray Higgins

While it also ranks among the top five economic sectors in the Lake States Region, the forest products industry faces new challenges in adapting to a higher cost of doing business due to inflation. These issues are compounded by an aging workforce, market declines and harvests stalled by higher winter temperatures.

According to professionals, logging is less viable now than it was pre-pandemic.

“Every sector is being impacted, and when that happens, you have less markets to bring your timber to when you’re a logging business,” Tim O’Hara said.

O’Hara is vice president of government affairs for the Forest Resources Association, comprising about 350 members. O’Hara also manages the Lake States Region, covering Iowa, Michigan, Minnesota, North Dakota, South Dakota and Wisconsin.

In his 30-plus years in the industry, this is the first time he’s seen every sector down simultaneously.

A stroke delimber operated by Mitch Olson processes harvest maple at a site in the Superior National Forest north of Two Harbors on Jan. 3.

Contributed / Ray Higgins

Government aid was made available for businesses in the timber industry during the economic downturn of the pandemic. To qualify for federal Pandemic Assistance for Timber Harvesters and Haulers funding, a business had to show a gross revenue loss of 10% or greater yearly from 2019 to 2020. The need for the program far exceeded expectations.

The U.S. Department of Agriculture approved over 5,000 applications nationwide, including 94 for timber businesses in Minnesota. Overall, the average gross revenue loss reported by logging and timber-hauling businesses was 22% when comparing 2019 to 2020.

Many timber-producing businesses in Minnesota also received Paycheck Protection Program loans to aid during the pandemic. While this aid helped sustain businesses initially, many continue to struggle from the current state of the economy.

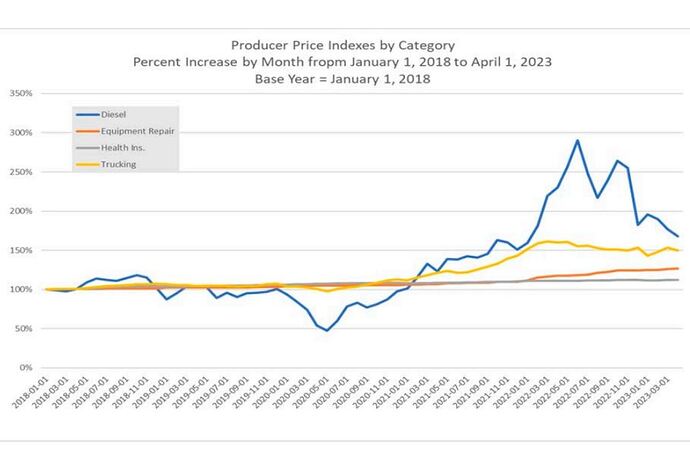

“Inflation was up 21% from 2018 to the first quarter of 2023,” O’Hara said. “Bottom line, inflation is impacting the forest industry as a whole, and the logging sector is feeling that as well.”

Forest product producer costs measured by percentage of increase and decrease from Jan. 1, 2018, to April 1, 2023, excluding logging wages.

Contributed / Timber Bulletin

In an article in the November/December issue of the Timber Bulletin, “Assessing the impacts of inflation on logging businesses,” O’Hara outlines case study results of an unnamed logging operation in the region. While the case study profiles a single logging business at a point in time, O’Hara believes it implies other businesses are experiencing similar pressures of inflation and higher operating costs.

The study examined the costs of fuel, contract trucking, wages, health insurance and equipment maintenance at the logging and timber-hauling operation, showing an overall unit cost increase of 39% for production.

According to the report, the total per-unit cost increase was $21.56, with the greatest increase in unit costs for fuel at $7.62, followed by wages, which increased by $6.39.

The takeaway from the case study is that the cost of doing business has increased throughout the logging industry since the pandemic due to the inflationary economy and supply chain issues.

With logging at the forefront of the forest products industry, timber is first harvested from either county, state or federal forests or from private land. Across the state, 60% of timber is supplied by public lands and roughly 40% by the private sector.

Driver Andy Jobe leaves a harvest site in the Superior National Forest north of Two Harbors with a truckload of harvested aspen, headed for the Sappi North America mill in Cloquet.

Contributed / Ray Higgins

Timber is then hauled on semitrailers to mills around the region, typically within 75 miles from its harvest site. In northern Minnesota, larger mills include the Packaging Corporation of America in International Falls, which makes printer paper, and Blandin, which makes specialty paper. The PotlatchDeltic sawmill and the West Fraser oriented strand board plant are located near Bemidji. Louisiana Pacific in Two Harbors is a siding plant. Among the larger companies are smaller sawmills as well.

Mills use the harvested timber to make products like paper, dimensional lumber, utility poles, pallets and siding for home construction, and for dissolving pulp for various products, including fabric for the garment industry, cellphone screens and biomass to produce energy. These products are distributed nationally and globally.

MORE STORIES FOR SUBSCRIBERS ONLY

Will the world’s largest spaceport be built in northern Minnesota?

4h ago

Former Rochester bank building gets a new life as a Muslim community center

7h ago

Rochester music scene: What we heard in 2023

7h ago

“The pulp wood is primarily what drives the lake states economy, especially Minnesota. That product goes to paper mills and engineered wood product mills,” O’Hara said.

These products are then transported to retail outlets or other “secondary” users such as print shops and garment makers.

“You look at that timber supply, as the price for that increases due to inflation and the costs associated with bringing the wood from the forest to the mill —fuel, trucking, wages — it all squeezes that profit of the businesses,” O’Hara said. “Eventually, these high costs get passed on to the consumer in the long run.”

Ray Higgins serves as executive vice president of the Minnesota Timber Producers Association, representing loggers, truckers, sawmills and other allied businesses in the state’s forest products industry. His members have also seen costs to deliver a cord of timber to the mill increase along with the inflation rate.

“These inflationary increases have been constant over the past four years. Diesel fuel has leveled off some, but still fluctuates. This makes it extremely difficult for any business owner plan, particularly in the logging industry,” Higgins said. “In addition, inflation generally results in higher interest rates, which has negatively impacted loggers and their ability to invest in their businesses.”

Krueger Dirtwerx owner Clint Krueger loads a truck with harvested aspen.

Contributed / Ray Higgins

As costs rise, margins become tighter, and cost-saving measures must be implemented for a logging operation to remain financially viable. Loggers have implemented various strategies over the past four years in response.

In 2020, Duluth’s Verso paper mill stopped production. Its closure impacted loggers that supplied the mill with timber. Some laid-off employees downsized their operations or sold logging equipment while scrambling to find alternative markets for timber they planned to deliver to Verso.

ALSO READ

Duluth paper mill’s pending sale to Italian company may lead to expansion

6d ago

“Some of these efforts were successful, but the timber was often sold for a lower price than Verso would’ve paid. These loggers had to re-structure their businesses in a variety of ways, plus had to deal with rising costs due to inflation,” Higgins said. “Not all loggers delivered to Verso, but even the ones who didn’t were impacted by increased competition for markets across the region.”

Clint Krueger, left, logger and owner of Mahtowa-based Krueger Dirtwerx, talks with driver Andy Jobe.

Contributed / Ray Higgins

O’Hara noted there has been a 12% decline in logging businesses nationwide.

“Logging companies are typically based in the smaller rural communities in our region and affect all businesses in those small towns: local shops, grocery stores and restaurants,” Higgins said.

Entering into the first quarter of 2023, Minnesota also showed a decrease greater than the national average in logging employment, O’Hara added.

The FRA has worked to introduce legislation such as the Jobs in the Woods Act in both the House and Senate.

“Our goal is to get a program in the Farm Bill, which will provide funding or grants for these programs that are existing across the country, or develop new programs to address the workforce issue in the forest products sector as a whole,” O’Hara said.

Shifts in the market for product demand are another challenge impacting the forest product industry, as well as market declines.

With the Federal Reserve dropping interest rates, O’Hara anticipates the home development sector will recover due to its high demand. However, the market for products such as white copy paper continues to decline, while packaging paper is projected to increase, O’Hara said.

“Throughout the lake states, we have a number of white paper mills that continue to compete for that market share,” O’Hara said.

Lars Johnson drives a semitrailer loaded with harvested aspen.

Contributed / Ray Higgins

To adapt, companies like Billerud in the Upper Peninsula of Michigan have announced plans to invest over $1 billion to convert two fine-paper machines to cartonboard production within the next five years. Sappi in Cloquet has begun producing more dissolvable paper products used in diapers or high-end clothing.

Clint Krueger owns Krueger Dirtwerx, a logging company based in Mahtowa that primarily supplies wood to Sappi. Krueger has been in the industry since 2003 and began the forestry work year-round in 2009.

Before the pandemic, he said it wasn’t unusual for timber markets to fluctuate based on seasonal conditions and other varying factors. In spring 2020, government-mandated closures required the mill Krueger Dirtwerx supplied to shut down for approximately six weeks. When the mills reopened, the market shifted from a standstill to “wide open,” Krueger described, a trend that has continued.

“For the last few years, we haven’t really had to deal with any kind of quotas. Everything elevated quite a bit,” Krueger said. “Initially in that spring and summer, some items, some parts were starting to get a little bit hard to come by, but not too bad.”

Clint Krueger, right, logger and owner of Mahtowa-based Krueger Dirtwerx, talks with driver Andy Jobe.

Contributed / Ray Higgins

By late 2021 or early 2022, business costs increased abruptly, Krueger said. While some mills provided higher rates to help compensate suppliers, operating costs continued to climb as margins slimmed — even with the increased demand for timber.

“When you make 10 years worth of a jump in just a year or two —that fast and that hard of a hit, I think most sound businesses will be able to survive through that — this time,” Krueger said.

Krueger Dirtwerx took out additional financing in the form of a low-interest loan that it otherwise wouldn’t have needed to maintain and replace necessary equipment, Krueger said. In 2018, a new semitrailer cost about $150,000 and is roughly $100,000 more now. Equipment that may have cost $400,000 two to three years ago is now $550,000, according to Krueger.

In the last few years, Krueger Dirtwerx has also seen standard trailer cab tires for a semitrailer that previously cost $175 increase to $375. Synthetic hydraulic oil that previously cost about $8 per gallon is now over $16.

Clint Krueger uses a propane canister to repair a loosened fender.

Contributed / Ray Higgins

“What hasn’t gone down and what continues to climb is the cost of everything,” Krueger said. “We’ve also increased our labor prices just to help our employees compensate with the same things they’re dealing with at home.”

Going forward, Krueger Dirtwerx will explore expanding its market opportunities to diversify its business.

“Every logging operation is different, with different markets (mills) to sell their timber to, they’re located in different areas in the state, they work in forests with different composition of species, so it’s difficult to make a blanket statement,” Higgins said. "Efficiencies/cost-cutting measures that work for one logging company may not be relevant to another. What I can say is as costs have risen, profitability has become more challenging.

Fortunately, loggers are some of the best, most resilient and most creative business people in our region, so they always seem to make it work," Higgins said. “But it is incredibly difficult.”