In a June 4 Barchart article, I asked if lumber prices were stuck in neutral, concluding:

Lumber prices are stuck in neutral, for now. When they decide to move, watch out, as another period of explosive and implosive price action will likely follow.

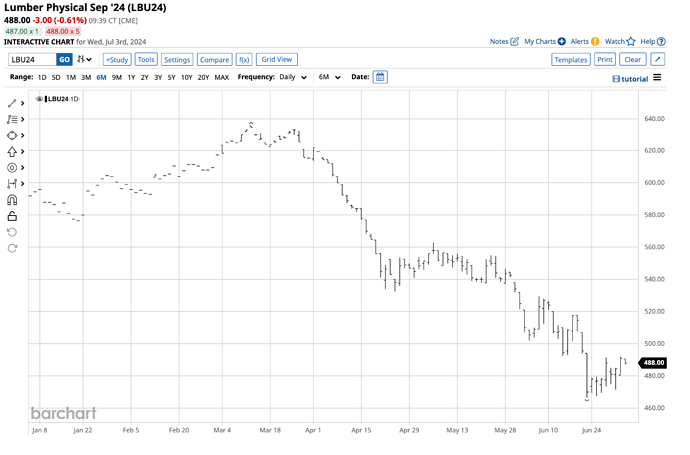

On July 3, nearby September physical lumber futures were below the $490 per 1,000 board feet level.

Lumber is in a bearish trend

Physical lumber futures on the Chicago Mercantile Exchange declined by 22.99% in Q2 and were 21.24% lower than the 2023 closing level at the end of June.

The active month September physical lumber futures chart highlights the 26.6% price plunge from $635.50 on March 12 to $466.50 on June 21. At the $488 level on July 3, lumber futures remain near the recent low.

Rates are staying higher for longer

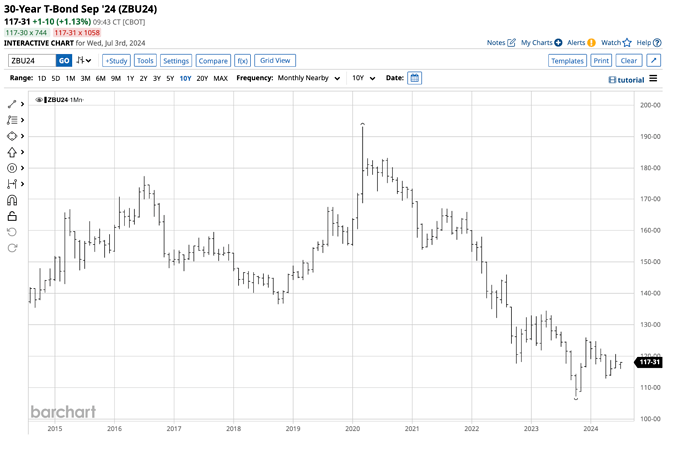

Lumber prices have suffered from higher interest rates for longer as the Fed has kept the Fed Funds level at a midpoint of 5.375%. While the central bank began reducing its quantitative tightening in June, the long bond remains under pressure.

The 30-year U.S. Treasury bond futures chart shows a bearish trend of lower highs and lower lows since the March 2020 peak. Treasury bond futures fell to a 107-04 low in October 2023, the lowest level since July 2007. At just below 118, the long bond remains closer to the late 2023 low, with interest rates at the highest level in over a decade and a half. Interest rates have remained higher for longer, and the path of least resistance remains steady to higher as the Fed waits for inflation to approach the 2% target level before easing monetary policy and lowering short-term interest rates.

Mortgage rates over 7% are a disaster for new home demand

Thirty-year fixed-rate conventional mortgage rates are hovering around the 7% level after rising from below 3% in late 2021. The Fed began increasing rates in 2022, causing mortgage rates to increase. Higher mortgage rates have caused the demand for new homes to decline over the past years.

Meanwhile, prices have not declined in a negative double-whammy for prospective new home buyers as rates increased. With many homeowners locked into sub-3% mortgage rates, existing home inventories remain at very low levels, forcing new home and existing home prices higher. However, mortgage rates above the 7% level have precluded many potential buyers from the market as monthly payments have soared. A monthly conventional $400,000 mortgage payment has increased by over $1,300 since late 2021.

The Fed’s next move is easing, but when?

After the recent Presidential debate, the odds of a second term for former President Trump have increased. The former president believes that interest rates are too high, and changes at the Fed under a Trump administration could cause the Fed Funds Rate to fall from the current 5.375% midpoint. A second term for the Biden administration would likely keep monetary policy steady, with the 2% inflation target as the critical factor for the path of short-term rates. While the Fed may follow the ECB with a 25 basis point rate cut before the end of 2024, the odds of significantly lower rates in 2025 could depend on the November election.

Lumber prices are highly sensitive to mortgage rates, but so are home prices. The housing market could experience a sudden spike higher if rates come down, as any increase in new and existing home demand may only push the current high prices even higher.

Lumber is in the buy zone, but that is only because of risk-reward and the price history

When looking at the price history in the former random-length lumber and the current physical lumber futures markets, the price range since the 2021 high has been from $326.60 in May 2023 to $1,711.20 per 1,000 board feet in May 2021. At below the $490 level on the nearby September physical lumber futures and around $450 on the July futures, wood prices remain near the low with lots of upside in the potentially volatile lumber futures arena. Over the coming years, risk-reward favors the upside for four compelling reasons:

- The price range displays the limited downside risk and significant upside potential.

- The odds favor lower interest rates as inflationary pressures have declined in 2024 with falling May PPI and steady CPI and PCE readings.

- Higher rates have caused many potential home buyers to move to the sidelines, increasing pent-up demand for new homes. When buyers return to the market, the demand for lumber will increase.

- Illiquidity in the lumber futures arena causes bids to purchase to disappear during bearish periods and offers to sell to evaporate during rallies, increasing price variance and exacerbating price moves.

While I have never traded one lumber contract over four decades of trading commodities, lumber is very attractive at the current price level. I favor the upside but would leave plenty of room to add on further declines as prices could fall to irrational, illogical, and unreasonable levels as the bearish trend continues. While I will not participate in the lumber futures arena, proxies like the iShares Global Timber & Forestry ETF (WOOD), the Invesco MSCI Global Timber ETF (CUT), and Weyerhaeuser Company (WY) tend to track lumber prices and pay shareholders attractive dividends.

Lumber could be close to a bottom near the $450 per 1,000 board feet level on July futures but the price could move lower as the wood futures market traded to a $326.60 low in May 2023. A long-term scale-down approach to buying lumber proxies (WOOD, CUT, and WY) could be optimal for the coming years at the current low price level.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Why is Lumber Stuck in Neutral?

Andrew Hecht - Barchart - Tue Jun 4, 12:00PM CDT

In a May 2 Barchart article on the wood futures market, I concluded:

Lumber is in a bearish trend in May 2024, and the trend is always your best friend. The path of least resistance of physical lumber futures could depend on the Fed’s monetary policy path over the coming weeks and months. Higher rates will likely be bearish, while rate cuts could ignite an explosive upside move.

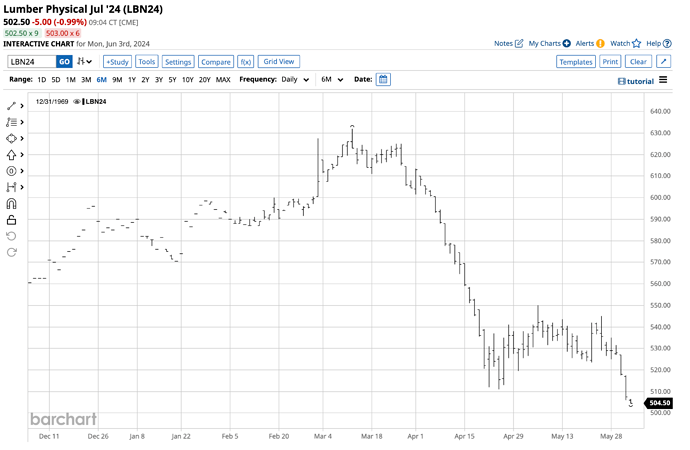

Nearby July physical lumber futures were at the $527 per 1,000 board feet level on May 1 and have only edged higher to the $538.50 level on June 1.

Lumber is stuck in a sideways range

Since April 18, CME physical lumber futures for July 2024 delivery have traded in a $500 to $550 per 1,000 board feet range.

After falling from a $632 high on March 12, the lumber futures market has settled into a narrow consolidation range of directionless trading.

A narrowing range over the past years

The trading ranges have significantly declined compared to the continuous random-length lumber futures market and the physical lumber contracts that replaced them over the past years.

- In 2021, nearby lumber futures traded in a $1,263.20 range from $448.00 to $1,711.20 per 1,000 board feet.

- In 2022, nearby lumber futures traded in a $1,006.80 range from $470.60 to $1,477.40 per 1,000 board feet.

- In 2023, nearby lumber futures traded in a $274.50 range from $352.50 to $627 per 1,000 board feet.

- So far, in 2024, nearby lumber futures traded in a $141.50 range from $470 to $611.50 per 1,000 board feet.

The narrowing ranges over the past years signal consolidation in the lumber futures arena.

Boom-and-bust action could be ahead- Lumber remains illiquid

The explosive and implosive price action in 2021 and 2022 gave way to an extended period of calm in the lumber futures market. While narrower trading ranges are often a sign of increased liquidity, lumber futures continue to suffer from highly illiquid trading conditions that can lead to wild price swings.

The contract size of the current physical lumber futures is one-quarter the size of the random-length futures they replaced. As of the end of May, open interest, the total number of open long and short positions in the lumber futures market, was at the 9,565 contract level. The current open interest would translate to under 2,400 total open interest in the old random-length contracts, hardly a liquid market.

Low liquidity often causes bids to buy to disappear during price declines and offers to sell to evaporate during rallies, leading to the type of boom-and-bust price action in 2021 and 2022. When lumber’s current consolidation ends, there is a high potential for another bout of extreme price variance.

Keep an eye on interest rates

Lumber is highly sensitive to interest rates. The 2021 and 2022 rallies resulted from historically low interest rates, leading to sub-3% 30-year conventional fixed-rate mortgage levels. With home financing above the 7% level, excluding many potential home buyers, the demand for mortgages and new homes has declined, weighing on lumber demand and prices. Falling interest rates could trigger increased demand for new homes, increasing lumber prices.

Given the inverse relationship, the path of least resistance of lumber futures is a function of rising or falling interest rates. We could see a sudden rally if mortgage rates fall below 6%, as many existing homeowners have financing at or below the 3% level. The existing home shortage means the demand for new construction could soar, and lumber is the critical ingredient in homebuilding.

Lumber has been stuck in neutral with the market going back and forth on the odds of rate cuts in 2024.

WY, WOOD, and CUT are liquid

I have been trading commodities since the early 1980s and have traded almost every raw material futures market. However, given the low liquidity, I have never bought nor sold one lumber contract and do not plan to ever venture into the arena.

I favor using stocks and ETFs that have a high correlation with lumber prices when bullish or bearish on wood prices. My products of choice include:

- Weyerhaeuser Company (WY) operates as a real estate investment trust in lumber, owning or leasing significant timberlands in the U.S. and Canada.

- The iShares Global Timber & Forestry ETF (WOOD) owns WY shares and other companies that tend to move higher and lower with lumber prices.

- The Invesco MSCI Global Timber ETF (CUT) has fewer assets under management than WOOD, but similar holdings and sensitivity to lumber prices.

Lumber futures are like a roach motel; getting into and out of profitable positions can be more than challenging, but losses can mount quickly as low liquidity increases risk dynamics to irrational levels. Meanwhile, WY, WOOD, and CUT are far more liquid assets that tend to correlate positively with wood prices over time.

Lumber prices are stuck in neutral, for now. When they decide to move, watch out, as another period of explosive and implosive price action will likely follow.