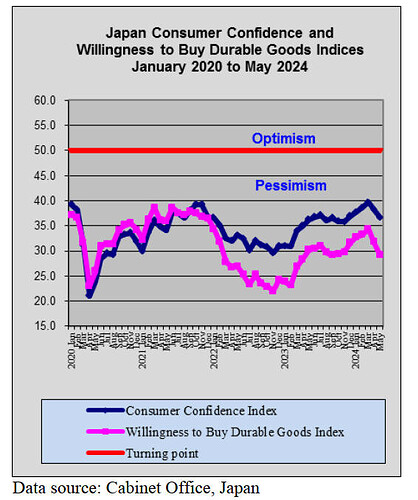

No clear signs of economic recovery challenge the Bank of Japan Japan’s economy has yet to show clear signs of recovery, making decisions on the timing of its next interest rate rise difficult. GDP shrank at an annualized pace of 1.8% in the first three months of this year compared with the 2% decline reported in preliminary data. The data showed both consumers and companies cutting back on spending and unsold supplies building up.

Cash handouts for low-income households The Japanese Prime Minister has announced the government will compile fresh inflation relief steps in the autumn, providing cash handouts to low-income households struggling with the cost of living. The aid will come on top of government subsidies that will be retained to lower household utility bills. Rising prices continue to weigh heavily on consumers. However, there is some positive news. Retail trade in Japan expanded year on year by 3% in May, according to data from the Ministry of Economy, Trade and Industry. Month-on-month, the figure grew by 1.7%. This was above analysts’ expectations. Commercial sales jumped 5.6% year-over-year while increasing 2% on a monthly basis. The seasonally adjusted value of sales in the wholesale industry surged 6.7% compared to May 2023. The figure expanded by 2.3% compared to the previous month.

Private consumption in Japan accounted for 54% of nominal GDP in March 2024, and the slump in consumption contributed to the economic contraction in Q1 2024. Private consumption fell by almost 1% in the first quarter of 2024, with the Japanese economy contracting by 0.5% quarter-on-quarter.

Capital investment falls The Cabinet Office has reported core machinery orders fell in April for the first time in three months, casting some doubt about the strength of capital spending, which is key to a durable economic recovery. Despite the fall, the Cabinet Office left its assessment of machinery orders as “showing signs of picking up,” unchanged from a month earlier. Core orders fell 2.9% month-on-month in April, the first drop in three months. Machinery orders are a highly volatile data series regarded as an indicator of capital spending in the coming six to nine months. Japanese firms have plans to boost output but are now cautious due to uncertainty over the economic outlook. The weakening of the yen has not helped domestic capital investment.

Companies say prolonged yen weakness will undermine profitability In May 2024, Japan’s exports grew at the fastest rate since 2022, driven by the steady fall in the value of the yen against major currencies, a positive development for the manufacturing sector. Exports increased 13.5% year on year in May, the sixth monthly advance, according to Ministry of Finance data. Japan’s exports to the United States jumped 24%, while those to China increased 18%, but shipments to the European Union fell by 10%. There are reports of growing concern among importers about a cycle of cost-push inflation. More than 60% of Japanese firms surveyed and reported by Teikoku Databank said prolonged yen weakness will undermine profitability.

Earnings from tourism second only to auto exports Spending by foreign visitors in Japan has quintupled over the past decade to become Japan’s second-largest export category after automobiles but higher than electronic components, including semiconductors and steel exports, underscoring a shift from goods to services. Government data shows quarterly spending by visitors grew over 60% in the five years through the first quarter of March 2024, while annual exports of autos and steel each rose around 45% between 2019 and 2023, and electronic components climbed less than 40% in that period.

Expectations of another currency market intervention Recent currency interventions by Japanese authorities have had little effect on strengthening the yen exchange rate, and towards the end of June, the yen fell to historic lows against the US dollar, Swiss franc, British pound, and more. The Japanese government and the BoJ spent 9.7 trillion yen (US$61.4 billion) intervening in the currency market in April and May, but the yen continues to depreciate and was at 160 to the US dollar at the end of June. Comments after the Bank of Japan’s (BoJ) mid-month policy fueled selling pressure on the yen. One issue is the interest rate gap with the US, where interest rates are now around 5%. The US Federal Reserve is also not expected to start cutting interest rates until at least the fall.

Japan has a new foreign exchange ‘diplomat’ to take control as the yen plummeted to a 38-year low against the US dollar, heightening expectations of another currency market intervention to support the battered yen. Atsushi Mimura, a financial regulation veteran, replaces Masato Kanda, who launched the biggest yen-buying intervention on record this year. In related news, the US Treasury Department added Japan to its "monitoring list” for foreign-exchange practices but stopped short of labeling Japan or any other trade partner as a currency manipulator. A statement from the US Treasury Department said, "Treasury’s expectation is that in large, freely traded exchange markets, intervention should be reserved only for very exceptional circumstances with appropriate prior consultations,” adding "Japan is transparent with respect to foreign exchange operations.”

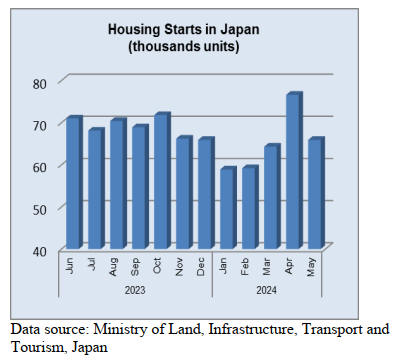

Derelict houses fueling a cycle of weak prices in some urban areas Abandoned and derelict homes in Japan are pulling down the value of surrounding properties with losses forecast at as much as US$24.7 billion in the five years through to 2023, according to estimates by the Japan Akiya Consortium. This huge sum highlights the scale of a problem that is fueling a cycle of weak prices in some urban areas. The forecast was compiled by the Japan Akiya Consortium, which brings together 14 companies and a research institution to tackle the problem of abandoned homes. The figures were based on 2023 government statistics and research by the Center for Real Estate Innovation at the University of Tokyo. The researchers note that “while the Ministry of Land, Infrastructure, Transport, and Tourism said that residential land prices rose for three consecutive years until 2024, abandoned houses may have suppressed the rate of that increase.”

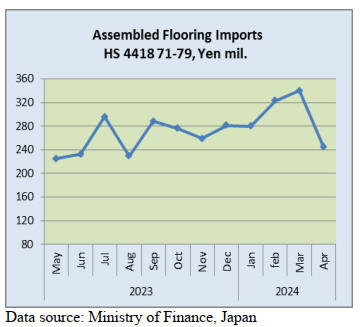

Assembled wooden flooring imports The value of imports of assembled wooden flooring (HS441871-79) in April 2024 was up 22% from the same month in 2023, which is significant given the pace at which the yen exchange rate has fallen over the past 12 months. Compared to the value of March 2024 imports, there was a 28% decline in April. In April, the main category of assembled flooring imports was HS441875, accounting for almost 75% of the total value of assembled flooring imports, of which shippers in China accounted for 40%. Japan is a major market for flooring from China, but flooring manufacturers are facing challenges in other international markets. The second-largest category in terms of value was HS441879, followed by HS441874. The main shippers of assembled flooring in April were China, Vietnam, Malaysia, and Indonesia.

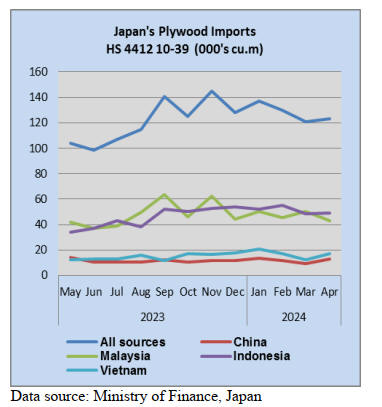

Plywood Imports Year on year in April 2024, there was a 17% rise in the volume of plywood imports into Japan, and at 123,514 cu.m the volume of April imports was little changed from that in March (121,000 cu.m). Of the various categories of plywood imported, 84% was HS441231 in April, with HS441233 and HS441234 accounting for the balance. The four main shippers of plywood to Japan—Indonesia, Malaysia, Vietnam, and China—consistently account for over 90% of plywood imports. The Japan Lumber Report says that in April 2.4mm 3ft x 6ft plywood from SE Asia was wholesaling/delivered at around US$950 per cu.m while 3.7mm plywood was around US$880. The price for 5.2mm panels was around US$850 per cu.m.

Trade news from the Japan Lumber Reports (JLR) The Japan Lumber Reports (JLR), a subscription trade journal published every two weeks in English, is generously allowing the ITTO Tropical Timber Market Report to reproduce news on the Japanese market precisely as it appears in the JLR. For the JLR report please see: Japan lumber reports – 日刊木材新聞社

100% falcata FSC plywood PT. Semeru Makmur Kayunusa in Indonesia got a certification of FSC’s (Forest Stewardship Council) FM (Forest Management) on its own 3,005 hectares of plantation. The company is now able to supply FSC plywood made of all falcata layers. Monthly production of FSC falcata plywood will be 10,000 cbms. The company has already got the certification of FSC’s COC (Chain of Custody) at its plywood plant in April 2024. Sojitz Building Materials Corporation in Tokyo, Japan, which is a sole agent of PT. Semeru Makmur Kayunusa, also has the FSC’s COC certification, so the companies are ready to supply the FSC products.

Semeru Makmur Kayunusa is a pioneer of supplying falcata plywood in the Japanese market, and the company established a plant in 2013. Moreover, the company established its second plant in 2016. The company started producing plywood made of MLH and falcata in February 2023. Normal plywood and structural plywood of Semeru Makmur Kayunusa are certificated as JAS (Japanese Agricultural Standards). Monthly plywood production is 6,500 cbms. There are about 1,200 employees at the company.

Total plywood supply to Japan in 2023 is about 63,000 cbms. Now, the company produces 1,200 – 1,500 cbms of normal plywood, 1,500 cbms of base plates for floors, and 1,000 – 1,500 cbms of structural plywood in a month. The company also produces 5,000 – 6,000 cbms of other kinds of plywood. The company aims to produce 68,000 cbms of plywood this year.

The company applied for FSC certifications due to the growing need for FSC certifications in the world. The company applied by “Community - Forestry,” which is a group of local farmers planting trees by themselves. Sojitz Building Materials plans to import more plywood made of plantation timber and certified forest products than last year.

Long softwood plywood for structures Jutec Corporation in Tokyo Prefecture started selling its original brand called “Ju-Jitsu eco” and “PEFC long softwood structural plywood” in June 2024. The company has been expanding selling certificated products such as laminated large boards with the PEFC certification since this spring.

According to the company, it is the first company to sell long softwood plywood with the PEFC certification in this industry. The company will consign its products for sale to Seihoku Corporation in Tokyo Prefecture, Ishinomaki Plywood Manufacturing Co., Ltd. in Miyagi Prefecture, and Nisshin Group in Shimane Prefecture to produce long softwood plywood for Jutec and will sell the long softwood plywood in Japan except Hokkaido Prefecture.

The size of long softwood plywood is 9 mm thickness, 3 x 8, 3 x 9, and 3 x 10. In the Tohoku area, the long softwood plywood is made of all Douglas fir layers or Douglas fir layers on the front and back, and domestic red pine layers are inside the long softwood plywood. In central Japan, domestic larch layers or Douglas fir layers are used on the front and back. Cedar layers are used in the middle of the long softwood plywood. In western Japan, Douglas fir layers are used on the front and back, and cedar layers are used in the middle of the long softwood plywood. Domestic larch, red pine, and cedar are certificated as the SGEC (S) but the company will supply 100% PEFC certificated plywood. The company also has normal plywood with the FSC certification and has domestic softwood plywood with the FSC certification. The long softwood plywood with the PEFC certification is delivered to major DIY stores.

South Sea Logs and Lumber The inventories of lumber for decks and laminated large boards have been declining, and consumers have started to purchase lumber. Demand for trucks has been increasing. Hardwood trees in the temperate zone are highly priced, and inquiries for furniture and interior materials used at luxury apartments are firm. However, domestic hardwood timber or domestic hardwood sheets are used for the general public.

It is difficult to forecast whether demand will recover. Since the yen has been nearly 160 yen against the dollar, it is hard to lower the selling price in Japan. There is no shortage of South Sea logs because a certain volume of South Sea logs have arrived in Japan in March 2024.

Daiken shows carbon stocks on catalog Daiken Corporation in Osaka Prefecture shows carbon stocks on its several products, such as floors and interior doors, on its catalog and website. The reason is to realize carbon neutrality. Fourteen popular products, which are used in houses and public buildings, show the carbon stocks. The company has shown about 739,000 tons of carbon stocks of insulation boards and MDF before. The company expands to show products’ carbon stocks.

The products, which show the carbon stocks this time, are called “Communication Tough Ⅱ DW” and show about 12 kg of CO2 per square meter. There are a lot of inquiries about the products because consumers can place a special order for the products. Other products, such as single doors, show about 39 kg of CO2. It would be about 2,372 kg of CO2 if Daiken’s products were used for a house.

Abbreviations

- LM: Loyale Merchant, a grade of log parcel

- Cu.m: Cubic Meter

- QS: Qualite Superieure

- Koku: 0.278 Cu.m or 120BF

- CI: Choix Industriel

- FFR: French Franc

- CE: Choix Economique

- SQ: Sawmill Quality

- CS: Choix Supplimentaire

- SSQ: Select Sawmill Quality

- FOB: Free-on-Board

- FAS: Sawnwood Grade First and Second

- KD: Kiln Dry

- AD: Air Dry

- WBP: Water and Boil Proof

- Boule: A Log Sawn Through and Through the boards from one log are bundled together

- pc: per piece

- ea: each

- BB/CC: Plywood grades. Letter(s) on the left indicate face veneer(s), those on the right backing veneer(s). Veneer grade decreases in order B, BB, C, CC, etc.

- MBF: 1000 Board Feet

- MDF: Medium Density Fibreboard

- BF: Board Foot

- Sq.Ft: Square Foot

- F.CFA: CFA Franc

- PHND: Pin hole no defect grade

- Hoppus ton: 1.8 cubic meters

Source: ITTO Tropical Timber Market Report