Lumber markets remained flat this week as vacation time, industry gatherings, sweltering heat and general economic uncertainty contributed to sluggish sales.

Minimal immediate needs limited replenishment purchases to modest volumes while a lack of clarity regarding near-term prospects stifled speculative trading across North American framing lumber markets. 2×4 led gains in many species, but the increases were modest.

Seasonal factors, including unusually heavy rainfall and normal summer heat, contributed to the ongoing sluggish pace across the South. Mills worked hard to capture modest premiums.

The coming hike in duties on Canadian shipments to the US did little to alter the ongoing lack of urgency among buyers. An industry gathering in Florida was expected to distract trading next week.

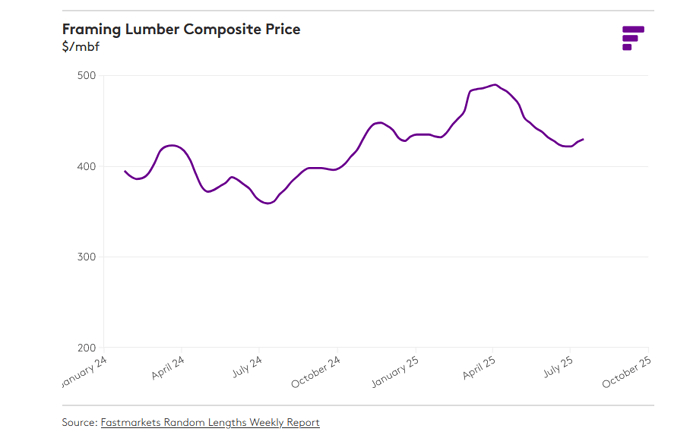

Fastmarkets Framing Lumber Composite shows small uptick

Sales of Western S-P-F were governed by tepid demand and uncertainty regarding the timing and scope of higher duties and potential tariffs. Prices of 2×4 continued to edge up on limited sales. Some insurance purchasing was evident ahead of the increased duty rates.

The July lumber futures contract expired Tuesday at a modest discount to the cash market in most species. The September contract, meanwhile, traded at a sizable premium to deliverable species. Total estimated volumes were light on Wednesday and Thursday.

Sales in the Coast region were lukewarm with most lumber markets trends holding, but some prices softening. Hem-Fir #2&Btr 2×6 and 2×10 and Douglas Fir 2&Btr 2×6 all declined on oversupply. Meanwhile, preferred tallies were difficult to come by in 2×4, firming up prices and leading to slight increases in Douglas Fir.

In the Inland market, 2×4 was the strongest width across grades from Std&Btr on up. The modest gains were in stark contrast to 2×6, which marked time across grades and species.

The difference was especially evident in MSR, as 2×4 trims gained $10-15 while 2×6 2400f fell $10. Most price adjustments in board markets were downward.