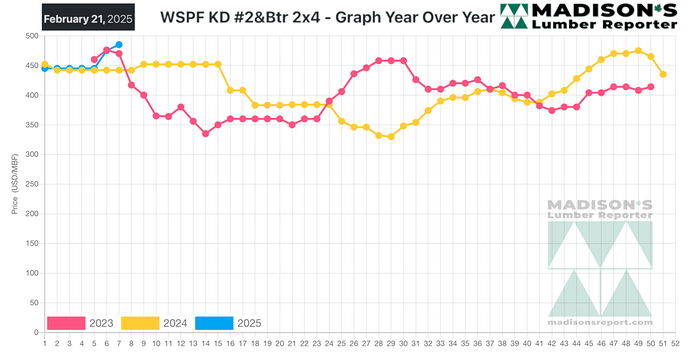

As noted last week by Madison’s Lumber Reporter, the price trend line for softwood lumber prices in the past two years has stabilized.

The market has been muted as home buyers held off until interest rates stopped going up. So while the traditional annual seasonal change of prices up and down by US$150 mfbm has returned, the manufacturing volumes have been lower than optimal.

In response to the muted demand, sawmills across the US, and especially in Canada, took significant amounts of production offline to prevent the price from falling too low. The tactic since mid-2023 was to keep supply in line with demand. This year, the harsh winter weather did nothing to boost construction activity.

As spring weather approaches, North American lumber manufacturers are ready to increase manufacturing to meet jump in demand.

In the week ending February 21, 2025, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$485 mfbm. This is up by +$10, or +2%, from the previous week when it was $475, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$40, or +9%, from one month ago when it was $445.

Toward the end of February, cold weather, looming tariffs, and holiday Mondays on both sides of the border kept the North American lumber market quiet.

Madison’s Lumber Reporter