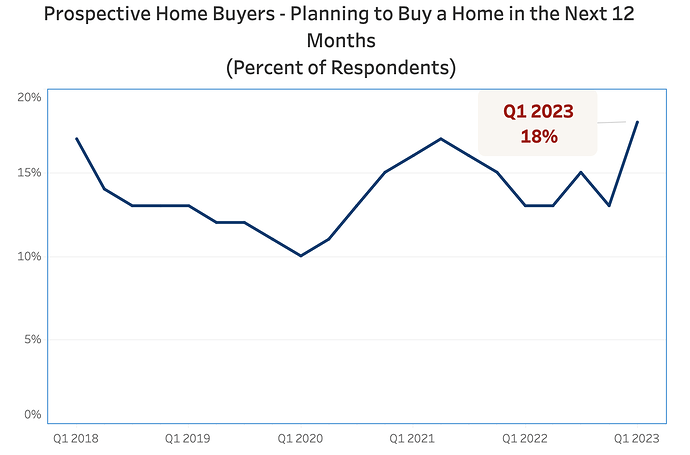

The retreat in mortgage interest rates during the first quarter of 2023 (from the 20-year peak reached in the fall of 2022) led a record share of adults in the US – 18 percent – to declare having plans to buy a home within a year – the largest share since the inception of this series in 2018. The finding also means the share of prospective buyers jumped 5 points in a single quarter, rising from 13 percent in the final quarter of 2022.

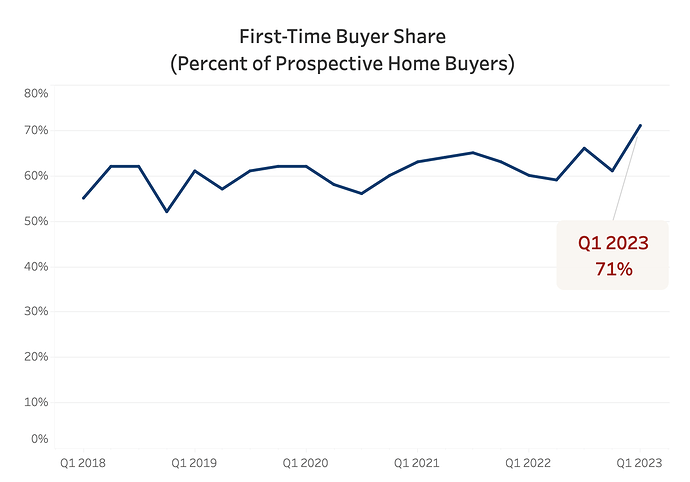

Relatively lower interest rates in the first quarter of 2023 also pushed more 1st-time home buyers to enter the market: 71% of all prospective buyers (a series-high) reported this would be their first time buying a home, up from 61% in the final quarter of 2022.

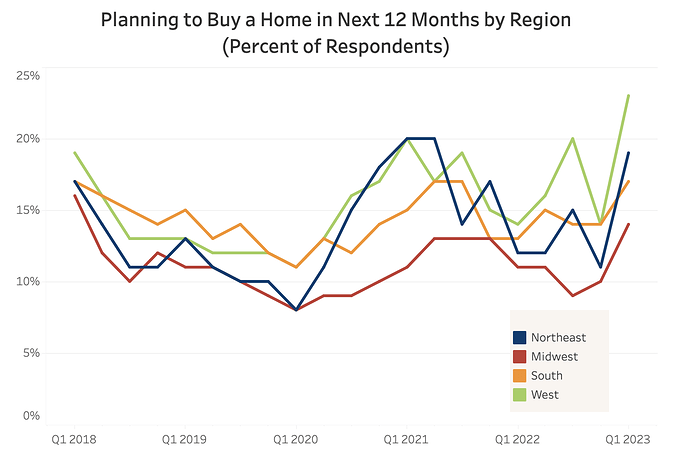

The share of adults with plans to buy a home in the next 12 months rose in all regions of the country between the final quarter of 2022 and the first quarter of 2023: Northeast (11% to 19%), Midwest (10% to 14%), South (14% to 17%), and West (14% to 23%).

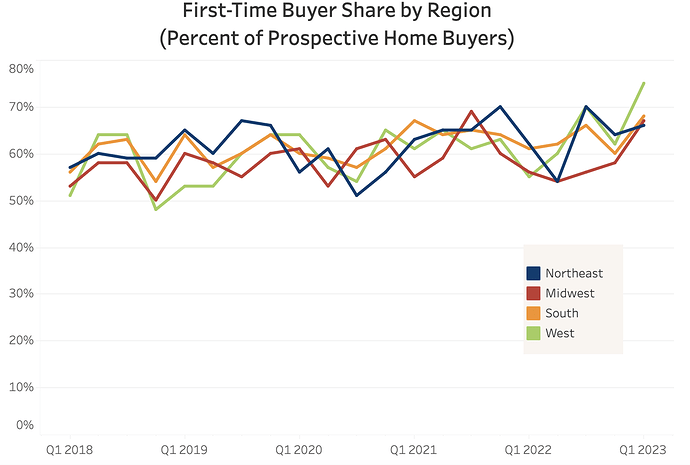

Similarly, the 1st-timer share gained ground in all four regions between the fourth quarter of 2022 and the first quarter of 2023: Northeast (64% to 66%), Midwest (58% to 67%), South (60% to 68%), and West (62% to 75%).