Lumber And The WOOD ETF

Andrew Hecht

Mar. 21, 2023 3:06 PM

Summary

- Lumber prices are stable - a new contract makes lumber hedging more versatile.

- Lumber remains highly illiquid, increasing the chances of explosive and implosive price action.

- Interest rates are critical for wood prices - new home building declined as interest rates rose and credit tightened.

- Migration from high to low tax states continues- infrastructure building will require lumber.

- WOOD, iShares S&P Global Timber & Forestry Index ETF, is an exchange-traded fund that offers liquidity and correlates with lumber prices.

Juanmonino

I have traded commodities since the early 1980s but have never bought or sold one lumber contract. The illiquidity makes lumber a roach motel, allowing market participants to enter risk positions with significant price slippage, but exiting when the market moves contrary to expectations is another story. Hedgers have avoided lumber futures because of liquidity issues.

While the new physical contract is smaller and allows for more flexibility for hedgers, it has yet to attain the critical mass in open interest and volume the Chicago Mercantile Exchange had hoped. Time will tell if it survives.

While I do not trade lumber, I watch the price like a hawk because it is a barometer that often signals price action in other industrial commodity markets.

Meanwhile, the iShares S&P Global Timber & Forestry Index ETF (NASDAQ:WOOD) product tends to correlate with lumber prices and is far more liquid than the wood futures market.

Lumber prices are stable

The Chicago Mercantile Exchange is phasing out its random-length lumber futures contract, with May the final month before it switches solely to the new physical contract. While the recent price action could reflect the change to the physical contract, May random-length lumber prices have been trending higher.

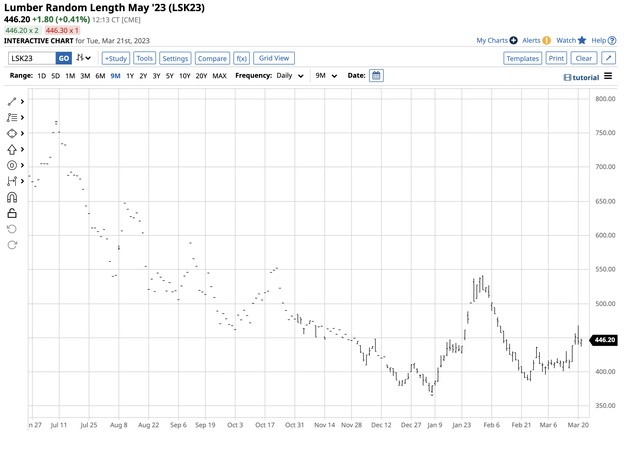

Short-Term Random-Length Lumber Futures Chart (Barchart)

The chart highlights the rise from $386.20 per 1,000 board feet on February 24 to $446.20 on March 21, a 15.5% increase.

The expiring contract contains 110,000 board feet, while the new physical contract is for 27,500 board feet with a broader range of delivery options.

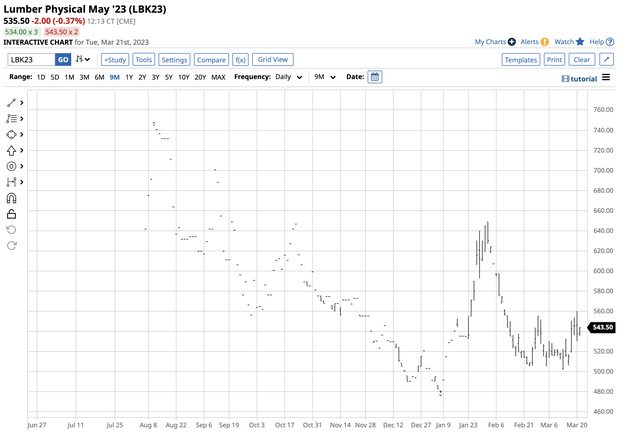

Short-Term Physical Lumber Futures Contract (Barchart)

The chart shows the physical contact for May delivery moved from $505 on February 23 to the $535.50 level on March 21, a 6% rise. While the expiration has likely caused more buying to cover short positions, both contracts have moved to the upside over the past weeks as lumber prices stabilized.

Lumber remains highly illiquid

Volume, or the total number of contracts traded, and open interest, the total number of open long and short positions in a futures market, are the metrics that illustrate liquidity.

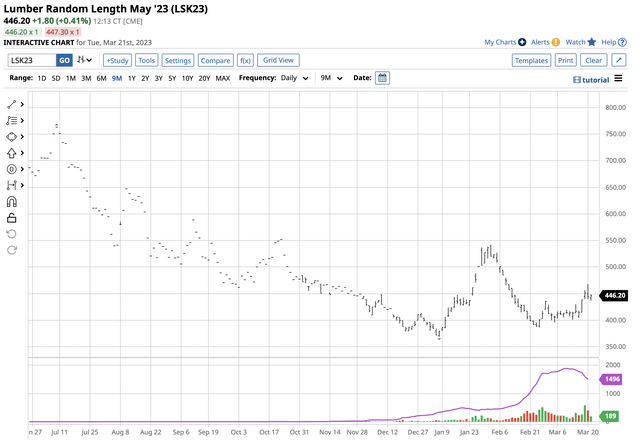

Volume and Open Interest in the Random-Length Lumber Futures Contract (Barchart)

The random-length lumber futures chart shows an open interest of 1,496 contracts, with daily volume running mostly below 500 contracts.

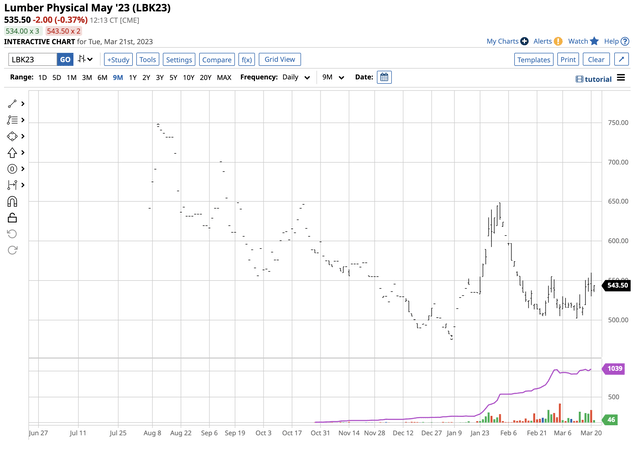

Volume and Open Interest in the Physical Lumber Futures Contract (Barchart)

The new and improved physical contract displays even lower liquidity, with an open interest of 1,039 contracts and daily volume running below 200 contracts.

Illiquid markets tend to experience far more volatility as bids to buy disappear when prices fall and offers to sell evaporate on rallies. So far, the CME’s new lumber contract has not improved liquidity in the futures arena, discouraging producer and consumer hedging.

Interest rates are critical for wood prices

Lumber prices continue to be a benchmark for the industrial commodity. The recent price action could signal that the trajectory of interest rate hikes will slow over the coming months.

In late 2021, thirty-year fixed-rate conventional mortgage rates were below 3%. The rate has increased to over 7%, meaning the monthly payment on a $400,000 conventional loan increased by more than $1,300. The rise in interest rates and tightening credit standards have excluded many potential home buyers. While housing prices have declined, price drops have not compensated for rising interest rates, impacting new home building. Lumber is one of the leading inputs in home construction, and the rate environment and slowdown in the housing sector have weighed on lumber demand and prices.

The recent price action in the lumber futures arena could be the result of these factors:

-

The switch from random-length to physical contracts could be distorting wood prices.

-

Lumber’s seasonality tends to lead to price strength during the spring and weakness during winter.

-

The recent rise in lumber prices could signal the market believes that the trajectory of rate hikes will slow over the coming months.

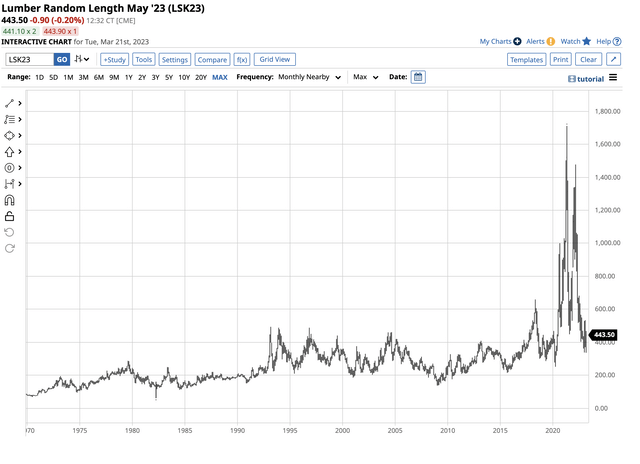

Long-Term Random-Length Lumber Chart (Barchart)

The chart shows the highs in 1993, 2004, 2018, 2021, and 2022 that occurred in March or May.

Migration and infrastructure building

Two issues may also be impacting lumber prices in March 2023. While the housing market has cooled and prices have declined, the migration from high U.S. tax states to low states continues. The flight from California, New York, Illinois, and other high-tax states to Florida, Texas, Nevada, and other low-tax states has been significant over the past years. Migration has increased the demand for new homes in the low-tax states as some cash buyers are immune from rate hikes and are taking advantage of lower new home prices.

Meanwhile, the November 6, 2021, U.S. Infrastructure Investment and Jobs Act invests $17 billion in port infrastructure and waterways and $25 billion in airports. Some of these and the other construction expenditures will increase lumber demand as wood is an essential construction input.

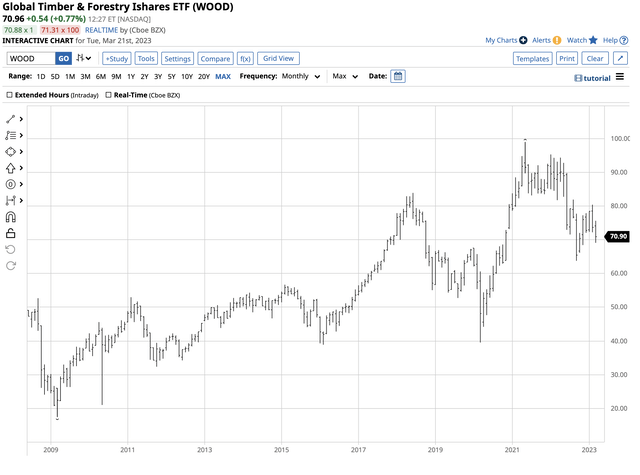

WOOD is an ETF that correlates with lumber

In May 2021, nearby lumber futures rose to $1,711.20, and in March 2022, a lower peak at $1,477.40 per 1,000 board feet. At the $465 level on the expiring contract and $555 on the new physical contract, wood prices are a fraction of the 2021 and 2022 highs.

While the price remains near the pre-2018 $493.50 record peak, slowing the trajectory of rate hikes, migration to low tax states, U.S. infrastructure rebuilding, and inflation that pushes production and transportation costs higher will likely keep a bid under the lumber market.

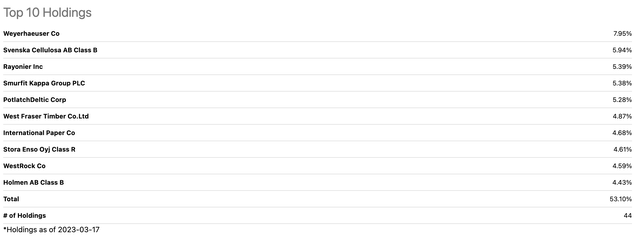

I will continue to avoid the futures market until it can demonstrate the critical mass necessary to provide significant liquidity. Meanwhile, the iShares S&P Global Timber & Forestry Index ETF product holds a portfolio of companies that tend to rise and fall with lumber prices. The most recent top holdings include:

Top Holdings of the WOOD ETF Product (Seeking Alpha)

Weyerhaeuser (WY), the top holding, operates as a real estate investment trust in the lumber market. As a real estate investment trust (“REIT”) with a call option on lumber attached, WY and the other WOOD holdings tend to correlate with lumber prices and can be a proxy for the futures arena.

Long-Term Chart of the WOOD ETF Product (Barchart)

The chart shows WOOD reached a record high in March 2021 at $98.98 per share when lumber futures peaked at $1,711.20. WOOD fell to $63.78 in September 2022 due to weak lumber prices and selling in the U.S. stock market. At just under the $71 per share level on March 21, WOOD recovered but remained much closer to the late 2022 low than the March 2021 high.

At $70.96, WOOD had over $207 million in assets under management. WOOD trades an average of 8,060 shares daily and charges a 0.40% management fee. Meanwhile, WOOD pays shareholders a blended $1.64 annual dividend, translating to a 2.31% yield.

I view lumber as a barometer for all industrial commodities. The illiquidity tends to cause wood’s price to move first, with other raw materials often following lumber on the up and downside. The recent rally in lumber could mean oil, copper, and other industrial commodities that have declined will find bottoms sooner rather than later. Meanwhile, iShares S&P Global Timber & Forestry Index ETF is a far more liquid product than lumber futures for those looking to participate in a continuing price recovery in the critical construction input.