Lumber is an industrial commodity that is essential for construction and homebuilding. In 2020, nearby lumber futures traded in a range from $251.50 to $1,000 per 1,000 board feet as lumber rose to a new all-time high as the pandemic gripped markets and caused supply chain bottlenecks and disruptions at mills. In 2021, the volatility continued, with lumber rising into the stratosphere, reaching $1711.20 in May before falling off the side of a bearish cliff to a low of $448 per 1,000 board feet in August. Lumber declined by an incredible 73.8%. So far in 2022, the range has been from $900.90 to a high of $1338.20, with the futures market routinely moving up or down the daily trading limit.

The latest price variance occurred as Canada, the country to the north of the US that exports wood to US home builders and construction businesses, experienced a trucker strike that clogged the supply chain.

Inflation continues to rise

Lumber and many other commodity prices have been rising as inflationary pressures have mounted since the Fed unleashed a tidal wave of liquidity and a tsunami of government stimulus hit the financial system during the global COVID-19 pandemic. Supply chain bottlenecks only exacerbated rising prices as scarcity created an almost perfect bullish environment for commodities.

The January 2022 consumer price index rose by 7.5%, with core CPI, excluding food and energy, up 6%. The producer price index increased by 9.7%. The inflation indicators are at the highest level in over four decades.

You do not be an economist to realize prices are rising. Homebuyers, shoppers, drivers, and other individuals and businesses have seen prices soar over the past months, and the trend remains higher.

After months of attributing rising inflation to “transitory,” pandemic-inspired reasons, the US central bank realized that the economic condition was more structural than temporary in late 2021.

The US Fed is way behind the inflationary curve

The Fed’s quantitative easing program that puts downward pressure on interest rates further out along the yield curve will end in early March, setting the stage for liftoff from a zero percent Fed Funds rate. Last week’s Fed minutes revealed the committee discussed trimming the central bank’s swollen $9 trillion balance sheet but allowing debt securities to roll off at maturity.

At the December FOMC meeting, the Fed economists projected the Fed Funds Rate would rise to 0.90% in 2022 and 1.60% in 2023. Meanwhile, Bank of America and Goldman Sachs have forecast a 1.75% Fed Funds Rate by the end of 2022.

A growing number of market participants now believe the Fed will liftoff from zero with a 50-basis point hike at the March FOMC meeting. While the move would be double the typical central bank move, it falls far short of what is necessary to push interest rates out of negative territory. Pushing real interest rates to zero at current inflation levels would require twenty-four 25-basis point rate hikes based on the core inflation reading. If 7.5% inflation is more accurate, thirty 25-basis point rate hikes are necessary before rates move towards positive territory. The bottom line is the US Federal Reserve is far behind the inflationary curve, and negative real interest rates can keep the inflationary flames burning.

Rising mortgage rates could cause a scramble to build new homes in 2022- Infrastructure rebuilding will increase the demand

US 30-Year fixed-rate conventional mortgage rates were below 3% in 2021, and in 2022, tighter Fed policy will push rates higher. As interest rates are on an upward path, we could see a continuation of the scramble to buy new homes this year. When it comes to the lumber market, the recent jump in prices to over $1,300 per 1,000 board feet added over $18,600 to the cost of a newly built home. While home prices have exploded higher, the prospects for higher mortgage rates may keep the demand strong over the coming months, pushing real estate prices even higher.

Moreover, the cost of rebuilding the US infrastructure is rising with lumber and other construction costs.

Canadian exports have slowed as truckers take on their government

Canadian truckers have been protesting government policies, leading to increased bottlenecks for timber exports to the United States. In an almost perfect bullish storm for the lumber futures arena, tariffs on Canadian lumber imports and a brutal wildfire season in the American West and British Columbia, and torrential rains in BC last year are weighing on supplies.

Moreover, a shortage of workers moving lumber has exacerbated supply problems. Brian Leonard, a lumber analyst at RCM Alternatives, recently said, “The whole transportation sector, between rail and trucking, has slowed down.” The rains in British Columbia have devastated rail lines and highways, leading Mr. Leonard to call it a “logistical nightmare times two.”

Lumber liquidity in the futures market has worsened as limit moves prevent transactional activity

The lumber futures market is a benchmark, but the liquidity makes it virtually impossible for speculative participation.

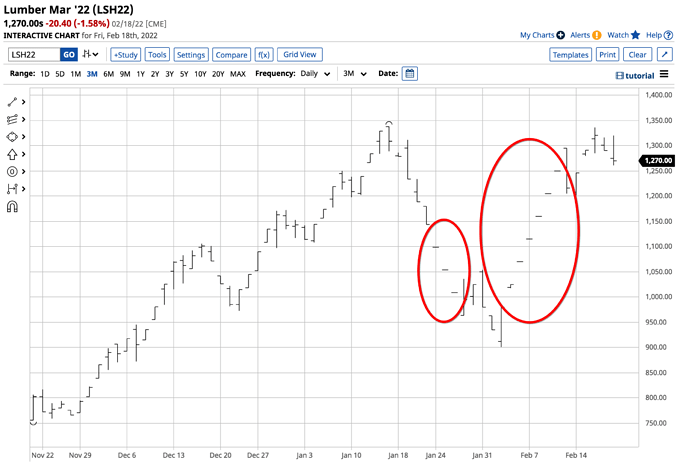

Source: Barchart

The dashes on the chart reflect limit-down and limit-up days. Market participants looking to sell on a limit-down day or buy on a limit-up day are out of luck and can find themselves stuck in risk positions that become financially disastrous. Hedgers face margin calls that tie up valuable capital. The lack of liquidity causes many problems for any market participants that dip a toe into the lumber futures arena.

Lumber futures are a benchmark. They tell us that inflationary pressures continue to be a clear and present danger to the economy. Inflation erodes money’s purchasing power. At face value, lumber and most commodity prices are rising, but the mirage is that it reflects the declining value of money.