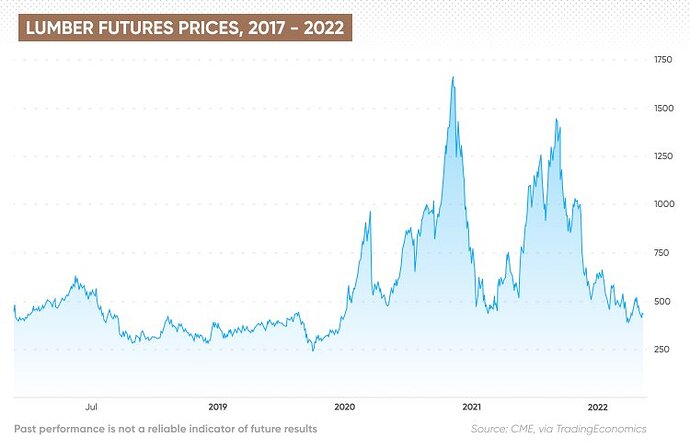

US lumber futures continued to fall over the past few months as weakening housing markets in major economies amid rising interest rates pressured raw material prices.

Lumber is a key construction material for houses. The slowdown in the property market amid rising mortgage rates has cut demand for lumber.

The November random length lumber contract traded on the Chicago Mercantile Exchange (CME) settled at $451.10 per thousand board feet (bft) on 8 November, up 0.2% from the previous month and a fall of 27.5% year-on-year.

Although lumber prices have fallen over the past year, it remained above the average level in 2019 and the first half of 2020, where lumber was trading below $450/bft.

What’s next for the lumber futures market? Here we take a look at what factors are shaping lumber futures price prediction and outlook.

What are lumber futures?

Lumber futures are derivatives with wooden timbers as the underlying assets. They are traded on the Chicago Mercantile Exchange (CME).

Lumber futures traded in CME are denominated in US dollars and cents. The minimum contract size is 110,000 board feet (260 cubic metres) of random length lumber. The monthly listed contracts are January, March, May, July, September and November. Contracts are settled by physical delivery.

According to trade data provider OEC, the top five importers of sawn wood by value in 2020 are the US ($8.33bn), China ($6.91bn), UK ($2.01bn), Japan ($1.61bn) and Germany ($1.51bn). OEC’s definition of sawn woods includes the lumber of different tree species. Timber from felled trees has to be processed by sawmills into various lengths before sale.

Meanwhile, the top exporters by value were Canada ($7.69bn), Russia ($4.23bn), Sweden ($3.7bn), United States ($2.55bn) and Germany ($2.55bn).

Lumber futures market overview

Lumber futures prices have been falling since March 2022 as rising interest rates across major economies and looming recession slowed house sales and building. The property crisis in China, the world’s largest lumber importer and second largest economy, further sparked concern of a spill-over effect on the global economy.

Since the end of Covid-19 restrictions in much of the world in 2021, pent-up demand for properties has pushed lumber futures higher. According to lumber futures history data, the price of lumber hit an all-time high at $1,670.50/bft in May 2021.

The lumber market was partly supported by reduced supply as logging activities in Canada, the world’s biggest supplier country, were disrupted by record rainfall in British Columbia in November last year.

Prices were below $1,000 for most of the second half of 2021. They climbed back to $1,000 in December and started 2022 at $1,227.90/bft.

At the beginning of this year, the post-Covid economic recovery and property demand were pushing lumber futures prices to a six-month high of $1,464.40/bft on 3 March 2022. Meanwhile, at the end of the first quarter, lumber futures started to fall amid a growing recession fear as the US and many other developed economies continued to hike interest rates to combat the effect of inflation.

In the latest lumber futures news, the fear of contagion from the Chinese property sector further weighed on the lumber futures market this year. China’s second largest and most indebted property developer, Evergrande (3333), failed to meet its debt liabilities, sparking concern that the country’s property market may collapse.

Beijing’s zero-Covid policy has also slowed economic growth in China, further impeding recovery in the country’s real estate sector.

Market wary of China’s property market crisis

The housing market crisis in China has intensified in the third quarter this year as the number of properties sold continued to fall. According to Chinese government data released on 24 October, the total property sales value fell by 26.3% year-on-year to CNY 9.938bn.

The continuing [Evergrande debt crisis has led to a credit crunch for other property developers, leading to construction projects being abandoned. Bank of China said in its Q4 China’s Economic and Financial Outlook:

“In Q3, the incidents related to ‘incomplete buildings’ went rampant across the country, undercutting the already-teetering confidence in the property market. On the whole, the real estate market is still in the bottom.”

In response to the house market crisis, the Chinese government has implemented a series of support measures to stabilise the property sector and encourage buying activities. In September, China’s central bank the People’s Bank of China (PBOC) cut the base mortgage rate by 15 basis points and temporarily lowered the mortgage rate in the fourth quarter. First home buyers in selected cities with falling prices in June-August 2022 were offered reduced mortgage rates and tax exemptions.

The Bank of China (BOC) added that real estate policies should aim at helping both home buyers and developers. In addition to the policies supporting home buyers, BOC suggested that property developers should be offered stronger credit support to ease liquidity issues, which allowed rollover of bank loans from eligible borrowers. In addition, China should improve its risk management mechanism to deal with problem developers in a category-specific manner.

However, rating agency Fitch Ratings said in 24 October note that “China’s latest support measures aimed at stabilising the property sector and restoring homebuyers’ confidence are probably insufficient to boost housing demand”, adding:

“The uncertainty around whether developers can deliver good quality homes on schedule remains the primary concern that dissuades homebuyers from purchasing pre-sold units. The potential savings on mortgage interest costs and tax expenses are also immaterial relative to housing prices and are likely to have only marginal impact on new home sales, in our view.”

Fitch Ratings expected limited policy room for mortgage rates to drop further in China from the existing lowered level, as banks already face rising pressure on net interest margins.

US new home sales fall in September

In the US, house sales have been falling for the past few months as rising interest rates hit demand. Sales of new single-family houses in September fell to an annual rate of 603,000, down 10.9% from the revised rate of 677,000 in August, data from the US Census Bureau and the Department of Housing and Urban Development showed.

The seasonally adjusted September house sale rate was 7.5% below the 732,000 in the same month last year, suggesting that the rising mortgage rate is reducing demand amid higher borrowing costs.

Lumber futures forecast

Analysts were mixed about the outlook for lumber futures in the next one to five years. Given the negative sentiment in the housing market, algorithm-based financial data provider Trading Economics, as of 9 November, expected lumber futures to trade at $434.02/bft by the end of the fourth quarter, falling to $367.45 in the next 12 months.

In contrast, algorithm-based forecasting website Wallet Investor, as of 9 November, predicted the average lumber prices to rise to $577.511 in the next 12 months and double to $1,122.83 in five years’ time.

Another forecasting website, Gov.capital had the most bullish lumber futures forecast, predicting prices to jump to $989.60/bft in a year’s time, surging to $4,083.95 by 2027.

Note that algorithm-based and analysts’ predictions can be wrong. You should not use them to substitute your own research. Always conduct your own due diligence before trading, looking at the latest news, technical and fundamental analysis and a wide range of expert commentary. Remember, past performance does not guarantee future returns. And never trade money you cannot afford to lose.