Lumber Is Sending A Signal We Should Not Ignore

Andrew Hecht - Barchart - Mon Jul 11, 9:31AM CDT

Lumber is a highly illiquid futures market, making trading, investing, and hedging challenging. The lack of volume and open interest causes offers to sell to disappear during rallies and bids to buy to evaporate when the price declines, exacerbating price variance. Therefore, the lumber futures market is best utilized as a benchmark for market participants to keep track of price trends.

Lumber has a habit of leading the commodity sector as the price tends to decline before other more liquid raw material futures markets. A bottom in lumber often leads to lows in other commodities.

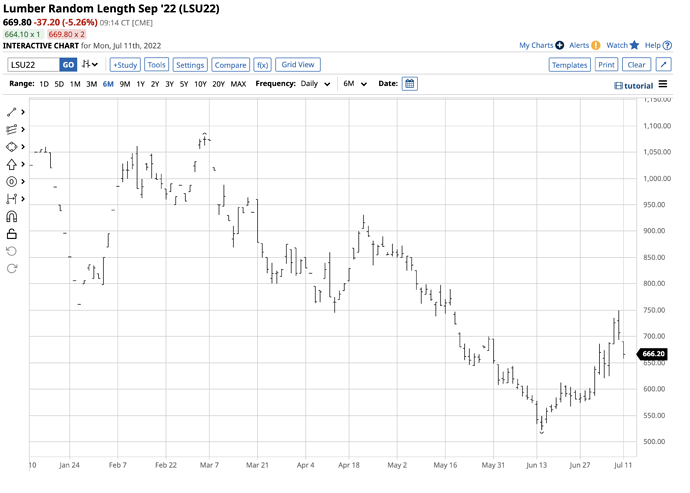

Lumber futures became a falling knife after reaching a lower high in March 2022 and appears to have bottomed in June, which could signal that significant bottoms for the commodities asset class are on the horizon after the recent downside corrections.

A substantial three-month decline in lumber prices

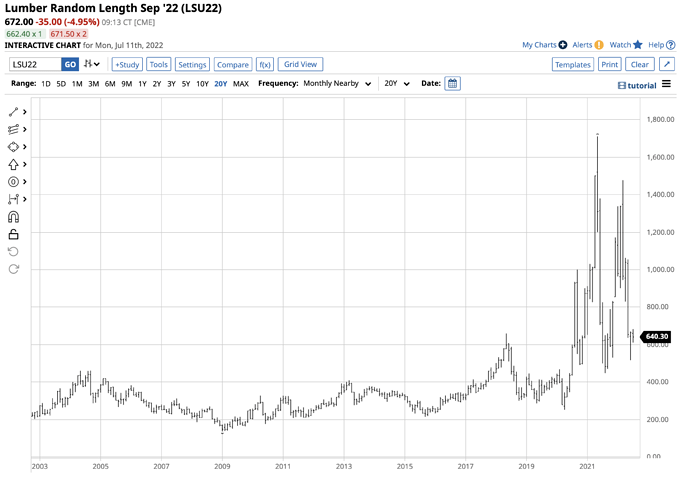

Lumber futures reached an all-time high in May 2021 when the price traded to $1711.20 per 1,000 board feet.

The chart shows the decline that took lumber to a low of $448 in August 2021, five months after the record peak. Before 2018, the all-time high was $493.50 in 1993. Lumber not only recovered from the August 2021 low, but the price soared, reaching $1477.40 in March 2022 as many commodities exploded to the upside. Copper and gold futures traded to record levels in March 2022, and crude oil and natural gas futures moved to the highest prices since 2008 in March and the following months.

Lumber was in backwardation, with nearby prices at a premium to prices for deferred delivery months.

While the nearby contract traded to nearly $1480, the September 2022 lumber chart shows a high of $1079.80 on March 4 and a decline to a low of $522.60 on June 14. The July contract low was at $517 per 1,000 board feet.

History shows that lumber sends signals for the commodities asset class

Lumber’s price dropped before most other commodities corrected and became falling knives in late Q2.

Lumber had already found a bottom in mid-June, while other raw material prices continued to decline. Over the past years, lumber had reached highs and lows before other commodity futures markets. In a June 16 article on Barchart, I pointed out that lumber had made a higher low, writing, “Meanwhile, at over $500, lumber remains at a price above the pre-2018 all-time peak.”

On Monday, July 11, the September lumber futures price was sitting at around the $666 per 1,000 board feet level, around $150 above the mid-June low. If history repeats, lumber’s recovery could signify that other commodities have or will fund bottoms and recover over the coming weeks.

Rising interest rates have weighed on wood’s price

The Fed increased the short-term Fed Funds interest rate by 75 basis points at the June FOMC meeting to 1.50%-1.75%, the most aggressive tightening in years. All signs point to another 75-basis point hike this month, boosting the rate to 2.25%-2.50%. The Fed is taking on inflation at the risk of igniting a recession, with hopes of a soft landing in US economic conditions. The central bank is also reducing its swollen balance sheet, allowing previous debt purchases to roll off at maturity, pushing rates higher further out along the yield curve.

Thirty-year fixed-rate conventional mortgage rates recently moved from below 3% at the end of 2021 to the 6% level before moderating. The rise in mortgage rates puts downside pressure on home prices and chokes the demand for new homes as high prices and rising rates have become roadblocks for many buyers. As the demand for new dwellings declines, lumber requirements fall.

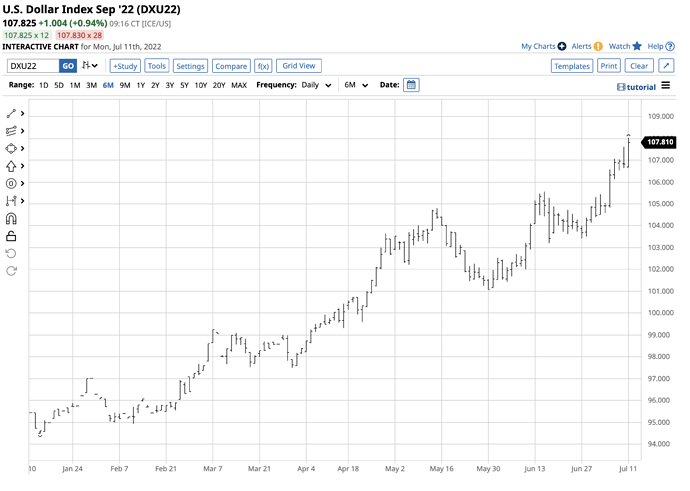

A strong dollar has been bearish

Higher rates have also put upward pressure on the US dollar versus other world reserve currencies. The war in Europe weighs on the euro versus the dollar foreign exchange relationship. The euro accounts for 57.6% of the dollar index, and the European currency has been on a path to parity against the US dollar.

The chart of the US dollar index highlights the new high of 108.015 on Monday, July 11. The dollar is at its highest level against other reserve currencies in two decades, since 2002.

A strong dollar and rising interest rates are a potent bearish cocktail for raw material prices. While lumber prices had dropped while the rates and dollar increased, they seem to have found at least a temporary bottom in mid-June, despite the continuation of Fed hikes and a rising greenback.

Lumber looks like it found a low- Watch for crude oil, copper, and other industrial commodities to follow

Lumber is a wild and volatile futures market that takes no prisoners when it trends higher or lower. The latest decline that took the continuous contract from $1477.40 to $517 found a lower high and a higher low compared to the 2021 levels. Meanwhile, the bounce to the $700 level last week could increase the odds that gold, copper, crude oil, and many other commodity markets have or will find significant bottoms and will begin recovering.

Lumber is a bellwether market better suited for watching than trading and investing.

Keep an eye on the lumber market. A continuation of higher prices could ignite rallies in the more liquidly traded commodities futures markets. Lumber may be a dangerous market, but it has consistently provided clues for the path of least resistance of the raw materials asset class over the past years.

Meanwhile, lumber futures getting a remake thanks to the CME. The exchange is rolling out a new lumber futures contract to boost the trade in two-by-four derivatives. The specifications will allow for eastern species of spruce, pine, and fir, instead of only varieties that grow in the West. Time will tell if the new lumber futures will attract volume and open interest levels that would improve liquidity.