LUMBER PRICES COMING DOWN FROM PANDEMIC PEAK

Lumber prices coming down from pandemic peak, but high-interest rates offer buyers little relief

- Margaret Carmel BoiseDev

An increasing share of homes sold in Boise are new construction, one factor helping drive up the median home price.

- Don Day / BoiseDev

]

]

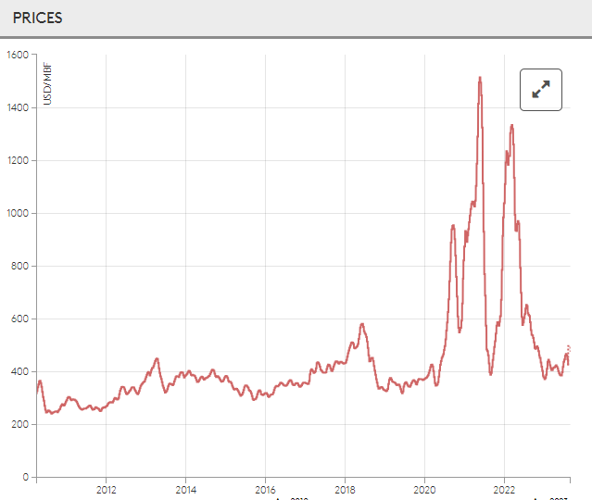

A graph from IdaPac showing the spike in lumber prices before, during and in the decline of the COVID-19 pandemic.

- Margaret Carmel / BoiseDev

Being a homebuilder is all about catching the big waves when they hit and knowing when to wait out the next great swell before you paddle out.

Like the rest of the country, the Treasure Valley’s real estate market surged and slowed in recent years based on a complicated set of factors, including housing demand, worker availability and interest rates. Cost for materials was a major driver of home costs skyrocketing during the height of the COVID-19 pandemic in 2020 and 2021, requiring builders to balance unprecedented demand for new homes while also struggling to find what they needed to finish projects under construction.

These materials prices, especially lumber, have now largely normalized back to near pre-pandemic levels from their sky-high rates, but now builders are having to navigate a new landscape where high-interest rates are adding tens of thousands to home prices. And as a result, potential buyers are waiting to see a change before they’re willing to put down a down payment.

These colliding market forces are likely fueling the return to typical market patterns in Treasure Valley real estate prices and the normalization of record building material costs that hit headlines two years ago. According to the latest MLS data available last month, the median price for a home in Ada County was $520,000 in August, down a typical 3% from seasonal summer price highs in July. It’s down year-over-year 8% from last August.

Data from the National Association of Home Builders shows housing starts in the Western region of the United States are down from 352,000 homes last August to 281,000 in August 2023.

‘IT WAS NEVER GOING TO STAY IN THOSE RANGES’

When the country started sending workers to their home offices and shutting down non-essential businesses, it wasn’t clear what would happen to the country’s economy.

But, instead of cratering, the move fueled a massive investment in real estate as city dwellers sought greener, suburban pastures and people took their new remote work status as a sign to leave more strict states for the wide open conservative spaces of Idaho. That, plus shortages in skilled workers, a deadly deep freeze in Texas putting a damper on wood panel production and wildfires in the Pacific Northwest further drove prices up.

Before the pandemic, $600 per thousand board feet was expensive for lumber. Prices jumped up to well over $1,200 per thousand board feet last year, which Idaho Pacific Lumber Company’s Vice President of Purchasing and Sales Scott Sunday says was driven by 2021’s “shock to the system.”

“It was never going to stay in those ranges, although you had some producers that were thinking it would trade that way forever, but it never does,” he said. “It always works its way up and down. It had to adjust.”

Now, the average price on the latest IdaPac market report for the end of September shows the average price per thousand board feet is down to $633. Sunday said this decrease in prices back to near-normal ranges was driven by supply chain issues resolving themselves and supply once again matching demand. Plus, he said the high-interest rates for home loans, which the U.S. Federal Reserve enacted to slow the overheated economy and drive down inflation, helped bring prices back to normal levels.

“There was fear in the market place and it went extreme,” Sunday said. “That normalized as supplies got better and as demand came back a little bit and as interest rates have started to rise you’ve got interest rates now we’re over 7% and that means that it’s that much more for new homes. That’s thrown a little bit of a blanket on things and beaten things back.”

BUILDERS STILL FACING AN UPHILL BATTLE

Gene Harding stopped building for six months while interest rates climbed, even as material prices started dropping.

His company, Harding Homes, is now paying tens of thousands of dollars less for lumber than he was at the height of the market last year, but high-interest rates are forcing him to switch up his strategy to keep selling homes. A house at the high point in the lumber market would cost $70,000 in materials and now is down to $30,000, plus framers cut their rates in half as they try to dig up business in a slowing market.

These material cost cuts help Harding’s bottom line, but he said interest rates mean buyers who could afford a $600,000 home of his a few years ago are now limited to $450,000 because of the extra cost of interest. This means for him to stay in business he’s been having to change the type of product he’s building to keep customers coming for the prices he offers.

“The payments are really close to the same and what we did is took out a little more bells and whistles to get the houses to be more competitive,” he said. “Our sales are pretty vibrant. Not flying off the shelves, but I don’t think that was a healthy market for a buyer back when the market was so crazy because we would sell our inventory out before we finished.”

Cody Weight, with Solitude Homes, said he’s fighting high prices for lumber and framing and things haven’t normalized on his balance sheet. It might be down from the high of the pandemic, but it’s still climbing on his bottom line since last year. He said costs for his lumber to frame his homes have tripled since last August, despite other builders in the market seeing a move toward calmer waters.

“We’re talking about land price hasn’t gone down, materials haven’t gone down, labor has gone down and interest rates are high,” he said. “It’s really hard to define one area as a big pain point because they work together up and down and not one dropped significantly more than the other.”