An increase in demand for lumber in the next few months follows seasonal increases in home buying in the spring.

Lumber was one of 2022’s worst commodity performers, and it has been volatile at the start of this year. But prices may gain on the back of a housing shortage.

An overall lack of confidence in U.S. housing amid the sharp rise in interest and mortgage rates led to lackluster lumber demand, contributing to the “precipitous” decline last year in U.S. lumber futures, says Walter Kunisch Jr., senior analyst at HTS Commodities. “Compressing” domestic demand and strong U.S. imports were also a “combustible cocktail” for prices, he says.

The Federal Reserve’s commitment to combat inflation, combined with tighter underwriting standards, is “scaring off many would-be home buyers and has them running for the…comfort of the rental market,” says Kunisch.

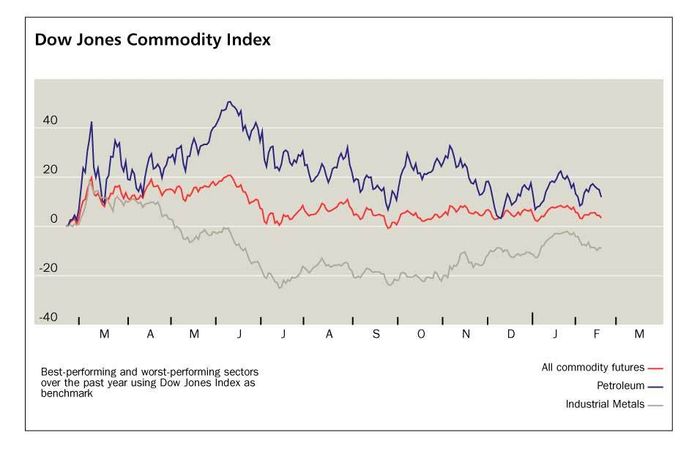

RELATED MARKET DATA

Random-length lumber futures lost 67% last year. For January, prices gained 40%—with the most-active contract subsequently losing over 20% in the first couple of weeks of February. They settled at $402.70 per 1,000 board feet on Feb. 14.

The volatility in the first half of February is “attributed to the limited interest in trading lumber futures,” says Kunisch. The CME is delisting random-length lumber futures after the May 2023 contract expires, so “open interest is falling, trading volume is low, and price volatility is rising.”

A new lumber futures contract, which launched in August 2022 and has a much smaller contract unit sizing, will replace the legacy contract. The new contract’s specifications don’t seem to have “mitigated the market’s concerns to generate increased liquidity,” says Kunisch.

Still, the price uptick early this year came on the heels of a January rise in the National Association of Home Builders’ monthly confidence index, after 12 months of straight drops in builder sentiment. That indicated that “market participants see potential for increased demand in the next few months, which would follow typical seasonal increases in home buying in the spring months and could bode well for builders,” says Scott Reaves, director of forecast operations at Domain Timber Advisors.

The U.S. housing market may see slow lumber demand if the Fed remains committed to “containing and combating domestic inflationary pressures,” says Kunisch. The central bank, however, has signaled that it will take a more “tactical and subdued approach to managing monetary policy.” If buyers increase demand for new-home construction as the Fed slows or stops raising the overnight lending rate, it’s plausible to see an increase in lumber demand, he says. The Fed announced a quarter-percentage-point interest-rate hike on Feb. 1, the smallest in a year.

There are lots of “variables at play” for lumber’s U.S. price trajectory, says Kunisch. It will “largely be determined by margins at the U.S. and Canadian mills,” with margin structure impacting supplies, he says. And, to a certain degree, “consumer confidence, the health of domestic equity markets, and the path of the Fed will influence demand.”

Similarly, Reaves says it’s too early to tell the “true trajectory” for lumber, but “we expect continued volatility…based on a variety of factors, such as the builder and buyer confidence and normal supply-and-demand dynamics.”

Long-term fundamentals “remain strong for housing demand,” Reaves says. A key long-term driver is “population demographics,” with the millennial generation “firmly moving into home-buying age,” and some estimates putting the current housing shortage in the four million units range.

“This creates a real push for construction and need for sustainably sourced raw materials” like wood products from U.S. forests certified by the Sustainable Forestry Initiative, Forest Stewardship Council, and American Tree Farm System, says Reaves.