We are coming up on the first anniversary of the all-time peak in the lumber futures arena. In May 2021, the price traded to $1711.20 per 1,000 board feet, an amazing level considering the all-time high before 2018 was $493.50. Supply chain bottlenecks, slowdowns at mills, wildfires in the US and Canada, and rising inflation put upward pressure on wood’s price over the past years. Moreover, a boom in new home construction caused the demand to surge. The trend is always your best friend in markets, and lumber has shifted from bull to bear over the past weeks. However, even though interest rates are rising, the prospects for new home construction remains bullish.

Lumber futures reach a lower high and fail

Over the past year, lumber futures traded from high to low that is wider than the current price. Meanwhile, nearby May futures were near the $1,000 level on March 30.

The chart shows the rise to $1711.20 in May 2021 and declined to $448 per 1,000 board feet three months later in August, a decline of $1,263.20. After rallying back to a high of $1,477.40 during the week of February 28, 2022, the price turned lower and was sitting at just under $1,000 per 1,000 board feet on March 30.

Searching for a bottom as the knife falls

Over the past year, lumber has gone from a shooting star to a falling knife and back and forth again. The illiquid nature of the lumber futures arena makes it virtually impossible to trade. When the price is rallying, limit-up sessions do not allow buyers to participate in the market, and limit-down periods do the same for sellers.

As of the end of March 2022, the lumber price was in implosive mode as the wood market searches for a bottom. While the nearby price has declined by over $480 per 1,000 board feet over the past month, it remains near $1,000, double the pre-2017 all-time high.

The backwardation in the lumber market makes nearby futures more expensive than deferred futures contracts.

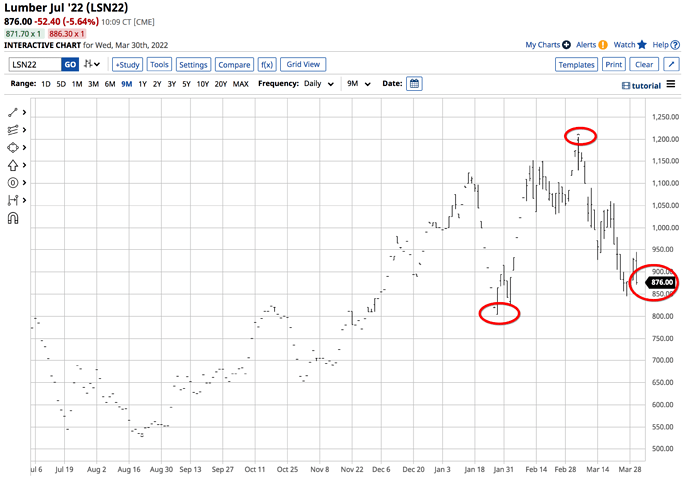

The chart of the July lumber futures contract shows the price reached a high of $1,204.70 on March 4. With the price at the $876 level on March 30, the first technical support level stands at the January 27 $804 low.

Interest rates are rising- Inflation is soaring

At the March FOMC meeting, the US central bank increased the short-term Fed Funds Rate by 25 basis points, lifting off from a zero percent environment. The Fed told markets they would likely raise 25 basis points at each meeting for the rest of 2022, pushing the rate to 1.75%. Moreover, the central bank will move to shrink its balance sheet, which provides additional tightening further out along the yield curve.

The Fed is addressing inflation, but the economic condition has increased to a level where the central bank remains far behind the curve. February CPI rose to 7.9%, the highest level in over four decades. Real interest rates will remain in negative territory at a nearly eight percent inflation rate for far as far as the eye can see, given the most recent Fed guidance. While some voting FOMC members have hinted they would support a 50-basis point rate hike, it will not scratch the surface of addressing inflationary pressures. March CPI is likely to be far higher as Russia’s invasion of Ukraine and sanctions pushed energy and food prices to lofty levels in March.

Rising inflation, a continuation of supply chain bottlenecks, wildfires in the US and Canada, and other factors remain bullish for lumber despite the current correction. Moreover, Russia is a significant lumber producer, and the war could curtain supplies from a global perspective.

New home supplies remain low

The demand for new homes in the US remains robust, even though mortgage rates are rising. The prospects for even higher mortgage rates over the coming months and years are causing a stampede in the housing market.

One of the most significant problems for the housing market is a lack of supply. Steady demand has overwhelmed supplies in many areas, pushing real estate prices higher and encouraging builders to increase new home construction. More new homes increase lumber demand. The migration from high tax states such as California and New York to lower tax states like Nevada, Florida, Texas, and others, is causing booming new home construction in the low tax states.

Meanwhile, US infrastructure rebuilding will also underpin lumber demand over the coming months and years.

Another higher low on the horizon in the lumber futures arena

After the wild volatility of the past year, I expect lumber to settle into an inside range over the coming months. While I do not expect a higher all-time high in 2022, I expect a higher low. I expect lumber prices to gravitate towards the midpoint of the May 2021 high and August 2021 low, which is around the $1,080 per 1,000 board feet level.

The chart shows the odds favor a consolidation range from $800 to $1200 per 1,000 board feet.

After elevator rides higher and lower throughout 2021 and the first three months of 2022, the lumber futures market needs to settle into a trading range where the consolidation would likely be around the $1,000 level.