As 2021 comes to an end, lumber has been in the spotlight throughout the year. It began 2021 under $1000 per 1,000 board feet on the nearby futures contract. After a decline to $651.40 in January, the wood price took off on the upside in an explosive rally that took the price to a record high at $1711.20 in May. Lumber rose alongside copper and palladium, two other industrial commodities that moved to all-time highs in May. Lumber turned lower in May, and the price imploded, reaching a low of $448 in August, less than one-third the price at the high. The volatile lumber market then turned higher again, reaching over $1100 by December.

Lumber is a highly illiquid futures market, and the lack of volume and limited open interest magnifies price moves as it creates price gaps on the up and downside when bids and offers evaporate. As of the end of last week, it looks like we are going into 2022 with lumber futures at just over $1,000 per 1,000 board feet after a very volatile year.

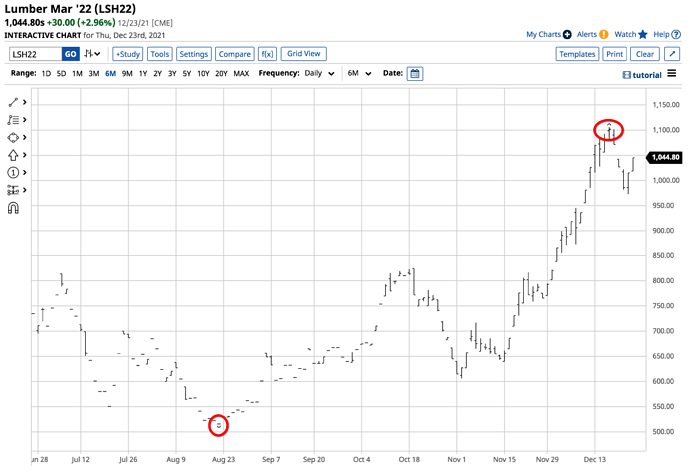

The recent lumber rally ran out of some upside steam at $1136.90

March lumber futures rallied from a low of $515.50 on August 20 to a high of $1,105.70 on December 16 as the price more than doubled. The expiring January contract hit a high of $1,136.90 per 1,000 board feet.

The chart highlights the rise over the past four months. The illiquid lumber futures price fell to an unsustainable level on the downside. Increasing inflationary pressures pushed production costs higher. Supply chain bottlenecks continue to plague the lumber market, and US protective tariffs on Canadian softwood producers continue to weigh on supplies. Moreover, strength in the US housing market continues to underpin demand.

Bull markets rarely move in straight lines

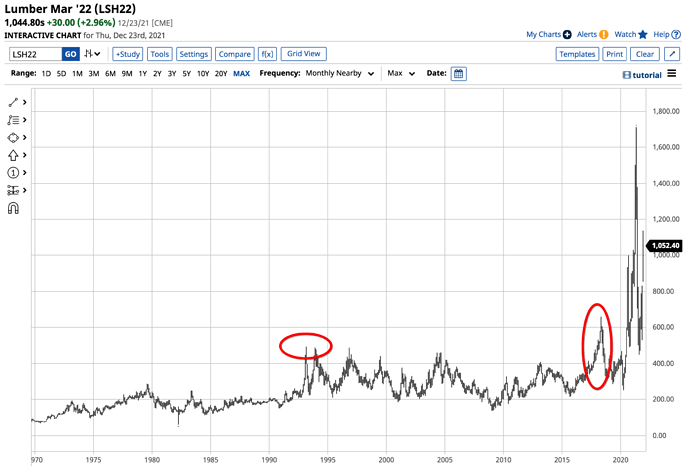

Bull markets tend to rise to levels that defy logic, reason, and rational analysis. When they finally run out of steam, corrections can be brutal. Markets that suffer from limited liquidity tend to experience magnified price action on then up and downside.

Lumber’s lack of critical mass when it comes to volume and open interest can cause selling to evaporate on the upside and buying to disappear when the price falls. Lumber’s price explosion from the October 2020 low below $500 per 1,000 board feet to the May high at over $1700 was, at least in part, a function of the illiquidity in the futures arena. While lumber futures fell to nearly one-quarter the price, at the high, it then doubled in four months. The liquidity pushed the price to extremes in 2021.

Lumber remains historically expensive

As we head into 2022, lumber is far from inexpensive.

The long-term chart shows that before 2017 the all-time peak in the lumber futures market was in 1993 at $493.50 per 1,000 board feet. At over the $1,000 level at the end of last week, wood’s price is over double the pre-2017 high.

Expect lots of volatility in the wood market in 2022

Four factors point to a continuation of extreme volatility in the lumber futures market in 2022:

- With interest rates set to rise over the coming years, we could see a rush for new home buying, increasing the demand for lumber in 2022.

- The US infrastructure rebuilding program will increase the demand for wood to rebuild and refresh roads, bridges, tunnels, airports, government buildings, and schools over the coming years.

- Inflationary pressures continue to rise, pushing production costs for all commodities higher, and lumber is no exception.

- As COVID-19 variants continue and trade issues between the US and Canada remain issues, supply chain bottlenecks could weigh on supplies.

While these issues continue to face the lumber market, the illiquidity promises to make price volatility the norm, not the exception in 2022.

Watch lumber’s price- It is a barometer for housing and inflation

Never trade lumber futures as it is a roach motel; you may get yourself into a risk position but getting out when the price moves in an unexpected direction will likely be a painful experience.

Meanwhile, watch the price of wood as it is a bellwether industrial commodity that can signal changes in other more liquid markets. Lumber is a market that tends to move higher or lower before the more liquid oil, copper, and other industrial commodities. Lumber’s price is likely to reflect inflationary pressures and real estate prices in 2022. At the December FOMC meeting, the US central bank forecasted the short-term Fed Funds rate at 0.90% in 2022 and 1.60% in 2023. With inflation running at much higher levels, real rates will remain in negative territory for the coming years. Negative real rates support commodity prices, which should underpin the volatile lumber futures market in 2022. Expect lots of volatility, and you will not be disappointed but watch those trends as they are a barometer of macro-economic factors and the sentiment that drives the commodities asset class higher or lower.