North America Softwood Lumber Market Year-End Update: 2022

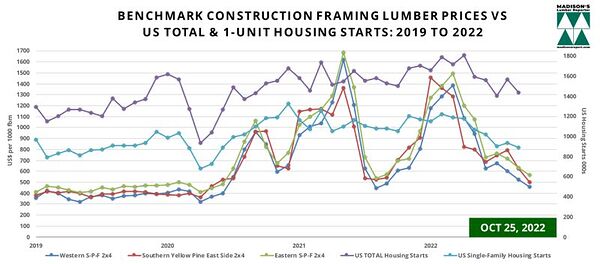

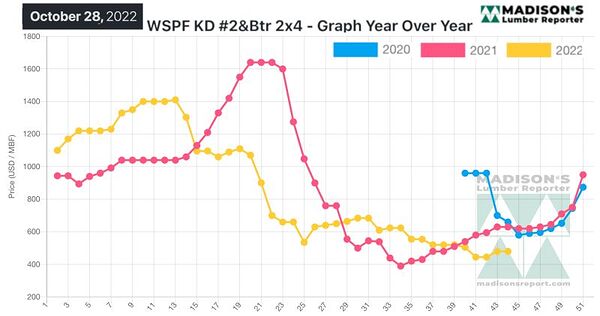

As the forest products industry matures into this post-Covid landscape, and the new realities of macroeconomic conditions become more clear, a better picture of cyclical lumber price trends is forming. In the past, solid wood manufacturers were able to rely on a relatively stable seasonal cycle; the beginning of slowdown after Labour Day, with lumber prices dropping until the end of the year. Then more buying in advance of the spring construction season, which brought higher prices usually by February.

For the past couple of years that historical annual cycle did not come into play. Even realtors noted that the traditional quiet time of less business did not come about. Historically, most people did not want to move over the Holidays, or in January, but since spring 2020 that changed.

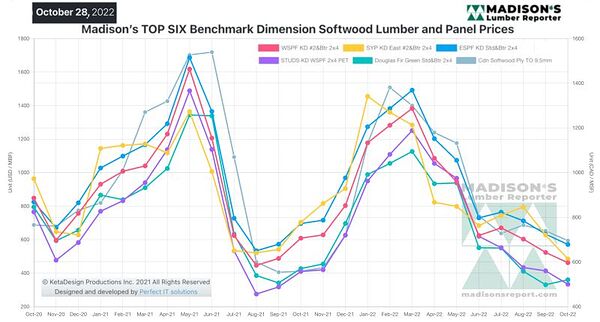

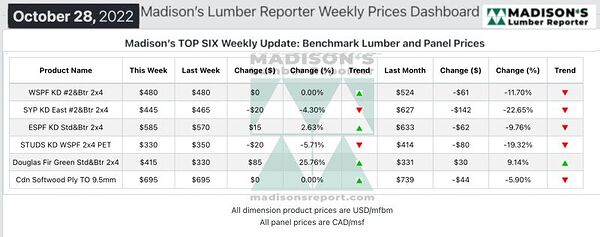

Now there appears to be a return of seasonal stability in home buying, in new housing construction, and thus for lumber demand as well. However, there are quite a few changes in comparison to the past. The most important for sawmills is that a new floor for dimension lumber prices has been established. As explained in Madison’s mid-year 2022 update for Canadian Forest Industries magazine; if the dramatic price increases seen since early 2020 had happened incrementally over the previous decade — for example, up 10% or 15% per year — no one would have thought it unusual.

Those price rises were so sharp and happened so suddenly, some people thought that levels must come back down.

The other main reason there is a new bottom for lumber prices is because the cost structure for producers has changed completely. Not just general inflation, but more fundamental – structural – changes to the forest industry and sawmilling which have increased operating costs significantly.