Normal Seasonal Slowdown for Lumber Industry

Even while actual prices remained flat, there was a general sense of the usual seasonal slowdown coming for sawmills and the lumber industry. This is because the order files at producers have shrunk from a month to barely two weeks. Expectations are, that as construction activity drops off during the winter months, lumber demand will also fall thus prices will soften. However, there have been significant curtailment announcements at several of the largest operators, suggesting that if enough supply is taken offline into the end of December, prices might remain firm even as sales slow down.

It is important to remember that at this time last year there was devastating storm activity in British Columbia which destroyed the major highway in several places and also brought down the rail line. Should a similar weather emergency happen in the important timber supply or lumber manufacturing areas of the continent again this year, it might result in a sharp increase in prices.

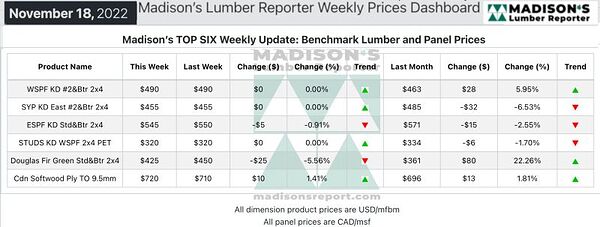

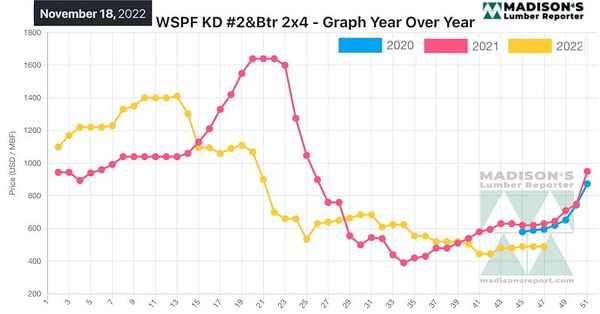

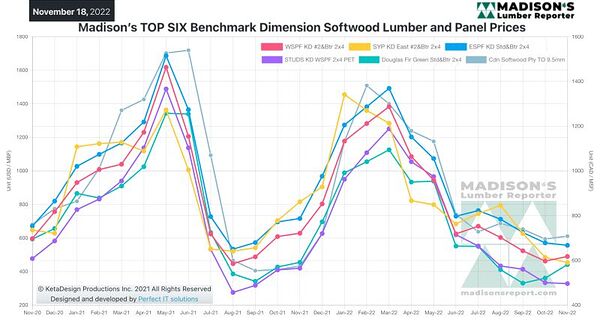

In the week ending November 18, 2022, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) was flat once more, at US$490 mfbm, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

This is up by +$28, or +6%, from one month ago when it was $463.

FULL STORY: LinkedIn