Lumber Demand Remains Unseasonably Soft

EVEN IN THE MIDDLE OF MAY THE USUAL SPRING HOME CONSTRUCTION DID NOT MATERIALIZE.

The harsh winter was a distant memory as normal seasonal weather was upon North America, yet building activity did not increase. Whether it was concerns over macroeconomic conditions, questions about potentially low new home sales, or simply uncertainty in general; most players were staying on the sidelines with their lumber purchases. It seemed like everyone was waiting to see what everyone else would do.

Meanwhile, the wildfires in Alberta were somewhat reduced however still very serious.

It turns out that about half those forest fires were caused by human activity, which is incredibly disappointing; specifically because those could have been avoided.

At this time in mid-May those fires burned almost 900,000 hectares of Alberta forests.

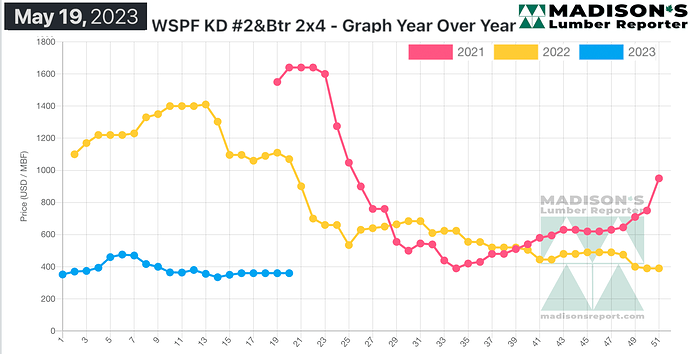

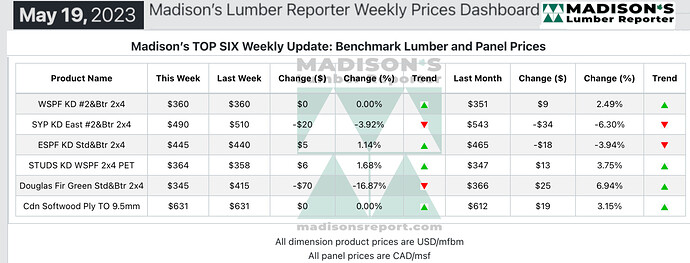

In the week ending May 19, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$360 mfbm, which is flat from the previous week, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$9, or +2%, from one month ago when it was $351.

Buyers were still extremely hesitant to take long positions and instead kept to short-covering, leading to perpetually-low field inventories.

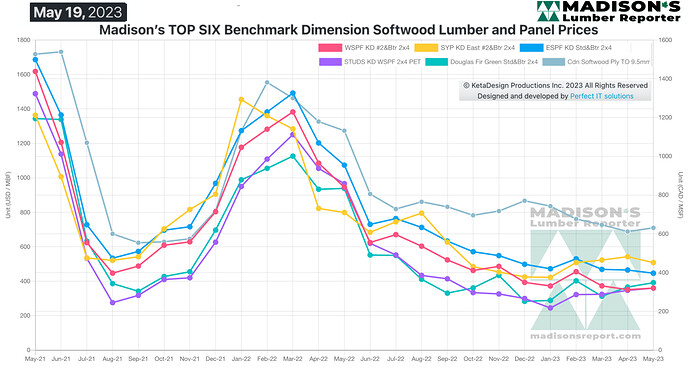

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY AVERAGES

COMPARED TO THE SAME WEEK LAST YEAR, WHEN IT WAS US$1,070 MFBM, THE PRICE OF WESTERN SPRUCE-PINE-FIR 2×4 #2&BTR KD (RL) FOR THE WEEK ENDING MAY 19, 2023 WAS DOWN BY -$710, OR -66%.

COMPARED TO TWO YEARS AGO WHEN IT WAS $1,640, THAT WEEK’S PRICE IS DOWN BY -$1,280, OR -78%.

To read the full report go to: madisonsreport.com