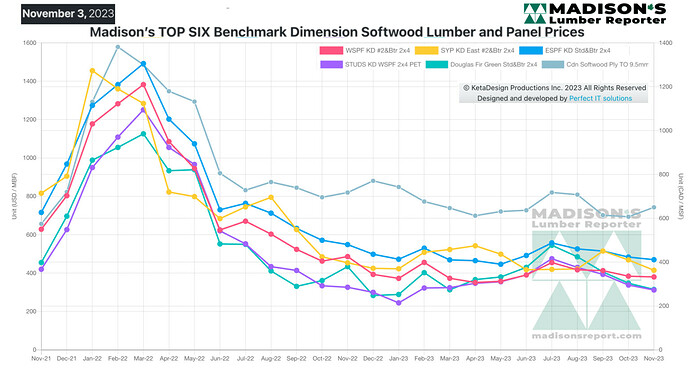

Lumber Prices Rise on Supply Constraints

THE ONGOING STRATEGY OF NORTH AMERICAN SAWMILLS REDUCING PRODUCTION AND CURTAILING MANUFACTURING VOLUMES SUCCEEDED IN REVERSING THE USUAL SEASONAL DROP OF LUMBER PRICES.

As November dawned, the supply-demand balance was such that lumber sellers were able to actually increase prices somewhat. Customers have been running on lean inventories for most of this year, as macroeconomic uncertainty made for quite cautious business decisions. Most lumber buyers have been making purchases for immediate needs only, not keeping any additional inventory on hand, in the thought that lumber prices might drop further. At the same time, lumber producers have been keeping production volumes low so as to not oversupply the market and thus drive prices lower. These circumstances collided at the

beginning of November, bringing prices up higher as customers needed to keep ordering wood for ongoing building projects. Scuttlebutt continued to indicate that sawmills were adjusting their production schedules to bring supply more in line with persistently dull demand.

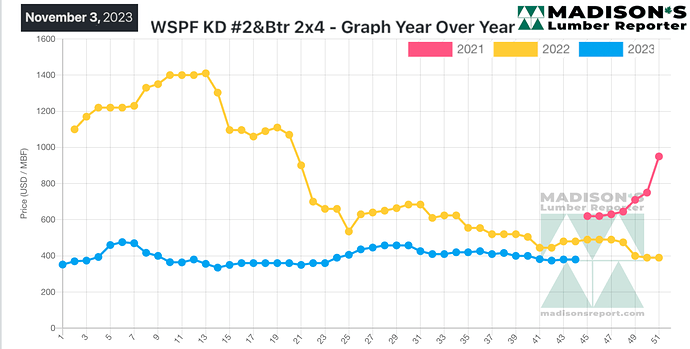

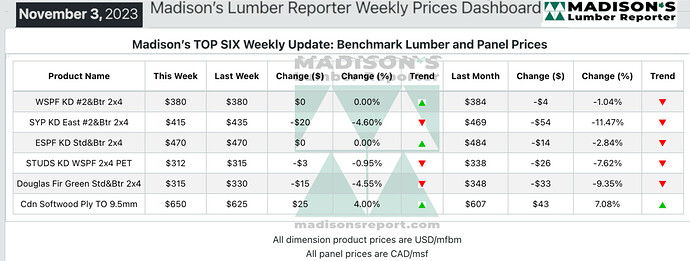

In the week ending November 3, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$380 mfbm, which is flat from the previous week, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down by -$4, or -1%, from one month ago when it was $384.

Western S-P-F traders in the United States had a slightly busier start to November than they saw throughout most of the previous month. It was still tough to get orders, but an increasing number of buyers found their inventories lacking and current prices amenable.

There were multiple accounts of rail car buyers stepping in to cover near-term needs.

The tightest-availability items were again 2×4-9’ studs and 2×4-16’ straight lengths. On the other end, prices of 2×6-8’s and 2×6-16’s remained sloppy and undervalued according to players.

Western Canadian suppliers of Western S-P-F lumber reported a much more balanced market as November kicked off. Aside from some modest gains in high-grade 2×6 and 2×10, most dimensional prices were flat from the previous week’s levels. Demand wasn’t much different, though there did seem to be a growing number of buyers who saw firming prices and decided to cover some of their short-term needs.

Secondary suppliers continued to service customers with highly mixed truckloads and LTL orders, often sending one load to multiple buyers. Transportation continued to run largely uninhibited, even as the snow started to fly in many regions.