Late-Season Pop in Sales Boosts Lumber Prices

AS HOME BUILDING AND CONSTRUCTION ACTIVITY ACROSS NORTH AMERICA SLOWS DOWN INTO WINTER, AND DEMAND FOR SOLID WOOD MATERIALS ALSO SLOWS, LUMBER PRICES USUALLY START TO DROP.

Sometimes, if there is a boost in building, there might be a late-season pop in lumber prices. That happened this year at the end of October. This is likely due more to end-users having kept their inventory levels very low for most of the past year, than to any true increase in construction.

Those customers who are now finishing their projects but got caught short of the wood they need to complete, had to go back to suppliers to make more purchases. As such, sellers were able to increase prices slightly to account for this rush of demand.

Prompt material was subject to modest discounts, while orders with delivery a couple weeks out held firmer numbers.

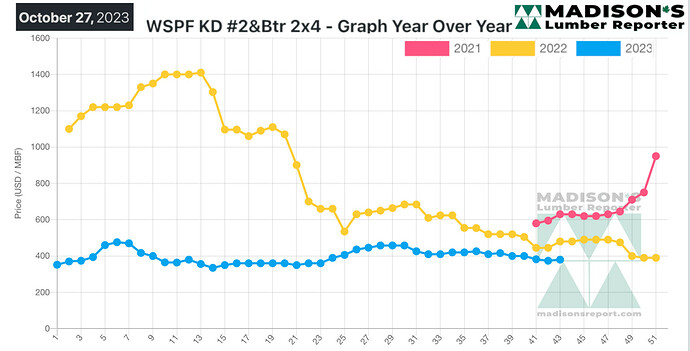

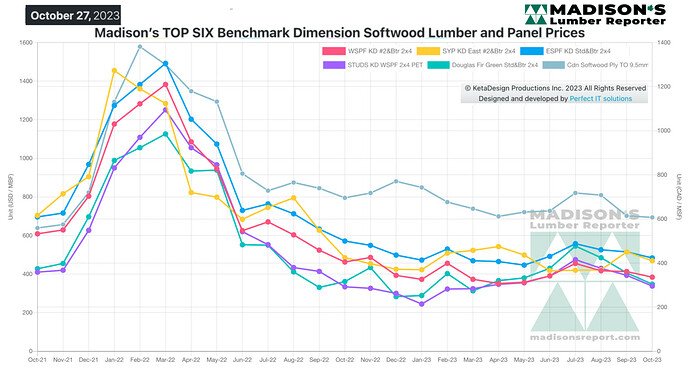

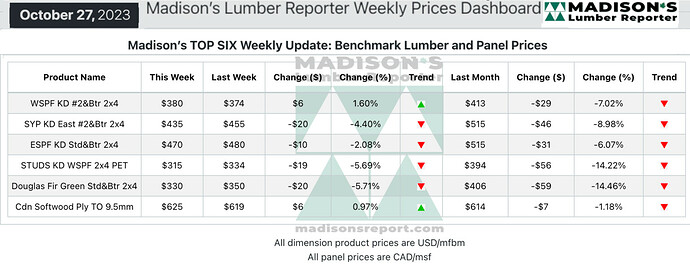

In the week ending October 27, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$380 mfbm, which is up by +$6, or +2%, from the previous week when it was $374, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down by -$33, or -8%, from one month ago when it was $413.

Mixed signals permeated the Western S-P-F market according to suppliers in the United States. The tone among customers was still resoundingly cautious, but a decent number of car buyers came off the fence to cover burgeoning demand from recently-active jobsites. Prices of studs took a tumble, with most trims still in search of stable trading levels.

Meanwhile, buyers remained confused by a host of broader economic issues.

It was another uncertain week for Canadian Western S-P-F suppliers as prices eroded further on standard- and high-grade dimension lumber. Caution continued to rule the mindsets of buyers, who kept their forays mostly confined to the distribution network.

Sawmills showed more and more availability on their lists as they endeavoured to find effective trading levels amid subpar demand. Field inventories remained extremely thin, and buyers felt zero pressure to shore up their positions.