Annual Year-End Slowdown Keeps Lumber Prices Flat

IT IS NORMAL TOWARD THE END OF THE YEAR, AS CONSTRUCTION ACTIVITY REALLY SLOWS DOWN FOR WINTER, THAT LUMBER SALES AND LUMBER PRICES ALSO FLATTEN OUT.

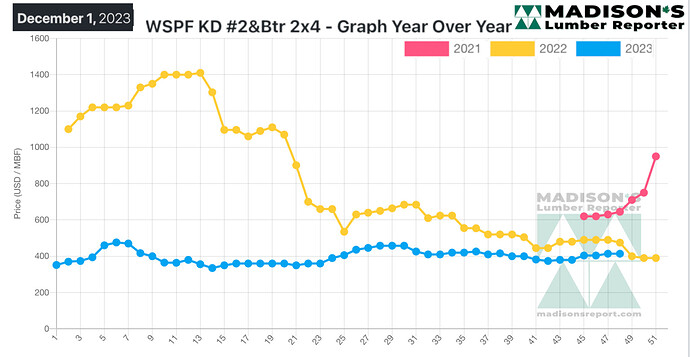

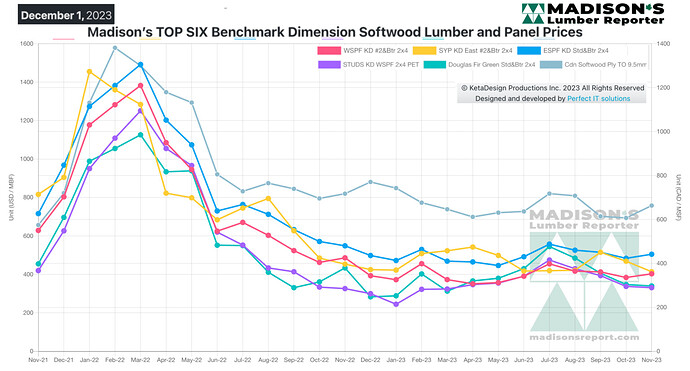

After three years of incredible volatility, 2023 annual lumber price cycle seems to have returned to historical norm. Over the course of this year the price swing between highest and lowest was approximately US$150, which is along the lines of the past. For example, the benchmark Western S-P-F 2×4 #2&btr reached a high of US$476 mfbm in mid-February 2023, and a low of $335 in late March. This kind of normal fluctuation makes it more possible for industry, both producers and customers alike, to plan. As we go forward into next year, the usual processes of running a sawmill: hiring loggers, contacting truckers, making a lumber production schedule, etc, will be less fraught with

uncertainty and confusion than it was during the past three years.

Producers in the Western United States kept their asking prices flat almost across the board, even as their log decks dwindled by the day – particularly in terms of large-diameter fibre.

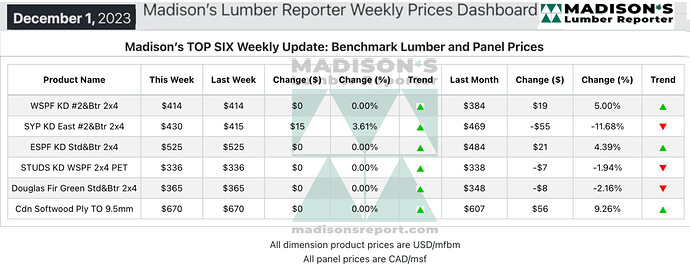

In the week ending December 1, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$414 mfbm, which is flat from the previous week, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. That week’s price is up by +$11, or +3%, from one month ago when it was $403.

Following a solid pre-Thanksgiving surge in sales early the previous week, as December dawned demand for Western S-P-F commodities in the US appeared to pull back noticeably. Supply of dimension items eight-inches and wider was already tightening up as buyers came out of the woodwork to short-cover. The ground wasn’t frozen enough yet to allow harvesting crews access to those large stems needed for wides. Many players used the old saw “sneaky strong” to describe the market; as supply and demand were in a deceptively balanced state.

Both demand and supply of Western S-P-F lumber seemed to sag in tandem, to hear Western Canadian players tell it.

Production volumes were waning for several weeks in a row. After an initial surge in buying in early November, most customers had covered their urgent needs and retreated to the sidelines for the remainder of the month. Sawmills meanwhile have maintained two- to three-week order files over that same period amid firm numbers. This with the help of quiet production curtailments and shift adjustments, according to scuttlebutt. There was a broad sentiment among players that, absent some exogenous factor that severely impacts the supply side, this market is basically bottomed out for the year. Buyers stuck to booking only small volumes of whatever prompt material they could get their hands on, lending a subdued tone to business.